Loss Run Dashboards and KPIs

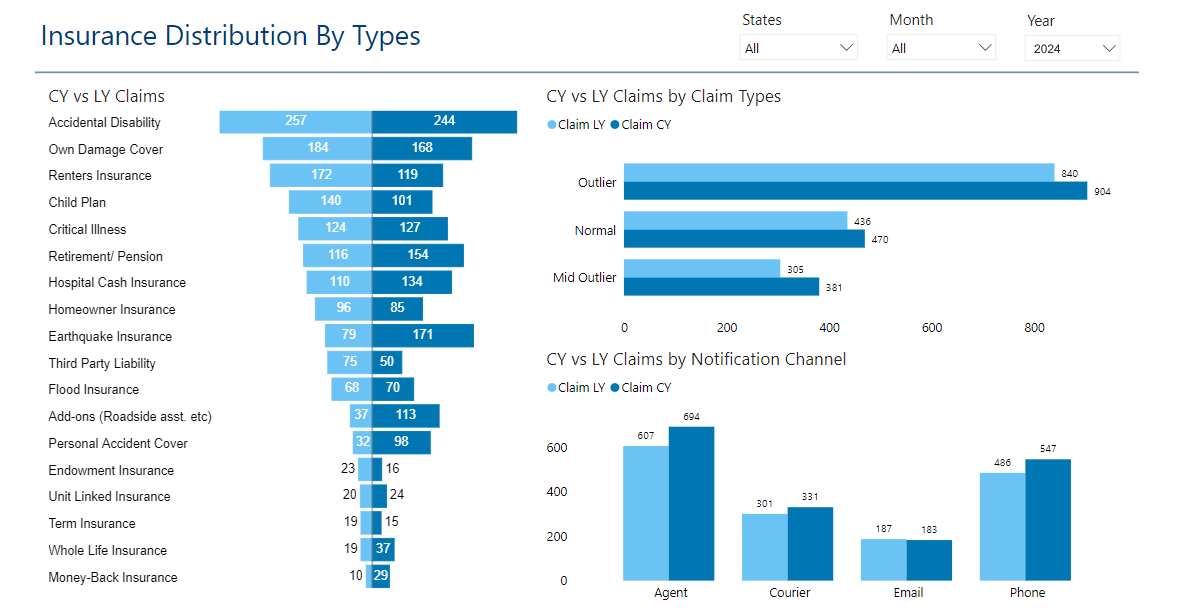

A loss run dashboard is a visual representation of an organization's insurance claims data, providing insights into trends, patterns, and the overall performance of insurance policies. It typically includes key metrics such as total number of claims, incurred losses, claim frequency, severity, and loss ratios.

Through graphs, charts, and tables, it enables stakeholders to quickly grasp the status of insurance claims, identify areas of concern, and make informed decisions regarding risk management strategies. This dashboard tool aids in assessing the effectiveness of insurance coverage, optimizing claims management processes, and ultimately mitigating financial losses for the organization.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

KPIs on a Loss Run Dashboard

A loss run dashboard is a powerful tool for monitoring and managing insurance claims data effectively. It provides stakeholders with valuable insights into the performance of insurance policies, helping them make informed decisions to mitigate risks and reduce financial losses. Key Performance Indicators (KPIs) play a crucial role in assessing the health of insurance claims portfolios and identifying areas for improvement. Below are some essential KPIs commonly included in a loss run dashboard along with explanations of their significance:

- Total Number of Claims:

- This KPI represents the total count of insurance claims filed within a specific period.

- Significance: It provides an overview of the volume of claims, indicating the frequency of incidents or losses experienced by the insured.

- Incurred Losses:

- Incurred losses refer to the total amount of money paid out by the insurance company for settled claims and claim reserves.

- Significance: It measures the financial impact of claims on the insurer, reflecting the severity of losses and the effectiveness of risk management strategies.

- Claim Frequency:

- Claim frequency measures the average number of claims filed per unit of exposure, such as per policy or per insured unit.

- Significance: It helps assess the likelihood of future claims and identify trends in claims occurrence, guiding insurers in setting premiums and managing risk.

- Claim Severity:

- Claim severity represents the average cost per claim, calculated by dividing the total incurred losses by the number of claims.

- Significance: It evaluates the financial impact of individual claims on the insurer and aids in assessing the adequacy of reserves and pricing strategies.

- Loss Ratio:

- The loss ratio is the ratio of incurred losses to earned premiums, expressed as a percentage.

- Significance: It indicates the profitability of insurance policies by comparing claims expenses to premium income, helping insurers evaluate underwriting performance and pricing adequacy.

- Average Time to Close Claims:

- This KPI measures the average duration from the date a claim is reported to the date it is closed or settled.

- Significance: It evaluates the efficiency of claims processing and customer service, influencing customer satisfaction and retention rates.

- Reserve Adequacy:

- Reserve adequacy assesses the sufficiency of funds set aside by the insurer to cover outstanding claims liabilities.

- Significance: It ensures that insurers have enough reserves to honor future claim payments, avoiding financial instability and regulatory compliance issues.

- Claims Leakage Rate:

- Claims leakage rate measures the percentage of claims payments that exceed the expected or budgeted amount.

- Significance: It identifies inefficiencies in claims handling processes, such as overpayments, fraud, or errors, enabling insurers to implement corrective measures and minimize financial losses.

- Claims Closure Rate:

- The claims closure rate calculates the percentage of claims that have been successfully closed or settled within a specific timeframe.

- Significance: It evaluates the efficiency of claims management operations and the effectiveness of strategies to expedite claim resolution, reducing backlogs and improving customer experience.

- Top Causes of Loss:

- This KPI categorizes claims by their primary cause, such as accidents, property damage, theft, or liability.

- Significance: It identifies common risk factors and loss drivers, enabling insurers to prioritize risk mitigation efforts, adjust underwriting guidelines, and develop targeted loss prevention initiatives.

- Recovery Rate:

- Recovery rate measures the percentage of claim payments recovered through subrogation, salvage, or other means.

- Significance: It assesses the effectiveness of recovery efforts in recovering funds from responsible parties or third-party sources, enhancing claim settlement outcomes and reducing net claim costs.

- Customer Satisfaction Score (CSS):

- CSS quantifies customer satisfaction with the claims handling process, typically obtained through surveys or feedback mechanisms.

- Significance: It gauges the quality of customer service, responsiveness, and communication during the claims experience, influencing customer loyalty, retention, and brand reputation.

- Loss Development:

- Loss development tracks changes in the estimated ultimate cost of claims over time, comparing initial reserve estimates to actual payments.

- Significance: It monitors the progression of claims reserves and identifies emerging trends or discrepancies, informing reserving practices and financial reporting accuracy.

- Claims Aging Analysis:

- Claims aging analysis categorizes outstanding claims by their age or duration since the date of loss or report.

- Significance: It helps prioritize claims handling based on urgency and identifies bottlenecks in the claims resolution process, facilitating timely action and reducing claims cycle times.

- Trend Analysis:

- Trend analysis examines historical patterns and emerging trends in claims frequency, severity, and other relevant metrics.

- Significance: It forecasts future claim experience, enabling insurers to anticipate changes in risk exposure, adjust pricing and underwriting strategies, and implement proactive risk management measures.

- Header: Includes the title "Loss Run Dashboard" and the date range for the data displayed.

- Key Performance Indicators (KPIs):

- Total Number of Claims: Displayed as a large numeric value with an accompanying icon.

- Incurred Losses: Presented as a bar chart showing the total incurred losses over time.

- Claim Frequency: Shown as a line chart illustrating the trend in claim frequency.

- Claim Severity: Visualized as a pie chart indicating the distribution of claim severity categories.

- Loss Ratio: Displayed as a gauge or dial showing the current loss ratio percentage.

- Claims Summary Table:

- Tabular representation of individual claims, including claim ID, date reported, type of claim, status, and amount paid.

- Graphical Representations:

- Graphs and charts depicting trends in key metrics such as average time to close claims, reserve adequacy, claims leakage rate, and recovery rate.

- Top Causes of Loss:

- A bar chart or pie chart showing the top causes of loss, with labels and percentages.

- Customer Satisfaction Score (CSS):

- A scorecard or gauge displaying the current CSS rating, accompanied by trend data.

- Additional Insights:

- Section for additional insights or commentary on notable trends, anomalies, or risk factors identified in the data.

- Use a clean and modern design with a professional color scheme, such as shades of blue and gray for a corporate look.

- Ensure clear and legible typography for all text elements.

- Employ intuitive icons and graphics to enhance understanding and navigation.

- Organize components logically with ample white space for readability.

- Include interactive elements for users to drill down into specific data points or adjust date ranges dynamically.

Steps to Designing a Loss Run Dashboard

Components:

Visual Design: