What We Do with the Analytics Which Makes a Difference

Below is the continuation of the transcript of a Webinar hosted by InetSoft on the topic of Data Analytics in the Insurance Industry. The presenter is Christopher Wren, principal at TFI Consulting.

Moving on, what we recognize is that analytics is not a destination. It's really what we do with predictive analytics solutions which makes a difference. This slide indicates really that we can use analytics to ensure that the insurance company is meeting the strategy intended set out at the beginning, and if that strategy is being missed or diverted to make the right connection, analytics can help us in terms of the creation of new tactics to deliver on a strategic imperative, for example, or for the creation of best practices to modify our behaviors.

The analytics solution can fit in many part of the organization through distribution, through to sales, supply chain, operational management, marketing, and claims. We will be talking specifically about a couple of those areas a little later.

At the end of the day we're not doing this for the fun of it. It's around using analytics to change your behaviors and change our practices for an insurance company to obtain competitive advantage and to create a differentiated service and product, and ultimately to obtain profitable growth.

We are nowadays in what's described as the fourth age of analytics, and it might be helpful for you as individuals just to think about where you sit in this particular hierarchy of analytics. The foundational analytics is very much the description level, the use of BI tools for reporting to identify what has happened and what is currently happening.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Second Layer of Analytics

The second layer of analytics is in the area of prediction which is our focus today which helps us anticipate what may happen and perhaps raise alerts or forecast. The third age is what we call prescriptive where we align rule based technology into our predictive models to help us automate our decision.

The fourth age is what we called the cognitive age, which certainly some of the leading insurers are already beginning to think about. The cognitive, again the topic in its own right, some might argue that cognitive are not artificial intelligence but very closely aligned. The reality is that there is a subtle difference. We viewed cognitive analytics as being the use of analytics to help inform decision making, whereupon artificial intelligence is the ability to make decisions for the system to make decisions in its own right.

Actually an interesting and challenging conversation might raise a question at the end of the day. Maybe the key thing for you to take into account is what organizations like Gartner are suggesting. They're saying that 50% of all businesses will be making decisions using artificial intelligence and prediction.

The challenge really is if there's a roadmap towards that situation or maybe a little later than that, where are you on your roadmap? Certainly you won't be able to change overnight, but there can be steps you are taking today which help you compete in the world in height of 10 years time.

|

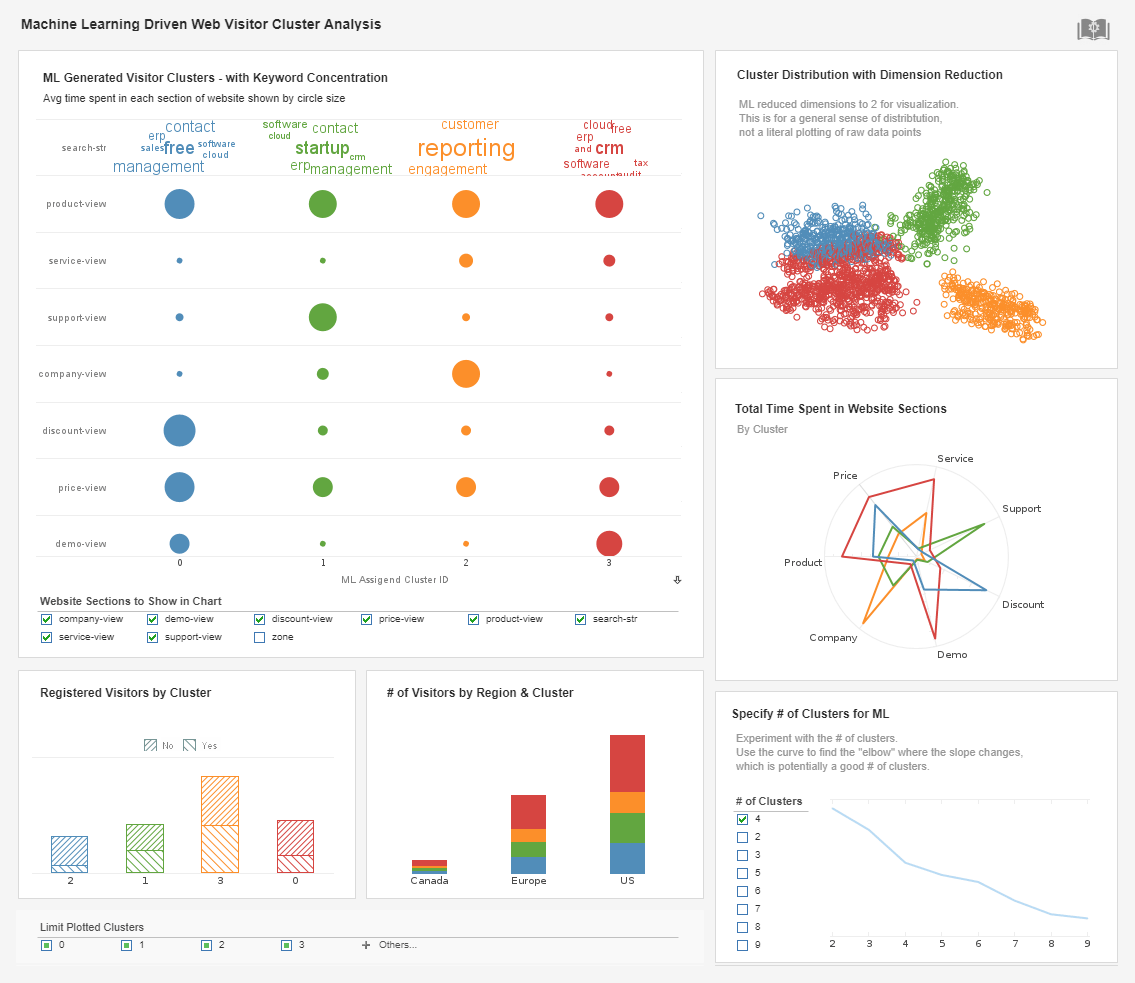

View live interactive examples in InetSoft's dashboard and visualization gallery. |

How Is Artificial Intelligence Used in Quantum Encryption?

Artificial intelligence (AI) is increasingly being integrated into various aspects of quantum encryption to enhance security, optimize performance, and mitigate vulnerabilities. Quantum encryption, also known as quantum key distribution (QKD), utilizes the principles of quantum mechanics to secure communication channels against eavesdropping and interception. Here's how AI is utilized in quantum encryption:

1. Quantum Key Distribution Optimization:

AI algorithms are employed to optimize the key distribution process in quantum encryption systems. These algorithms analyze various parameters such as channel characteristics, noise levels, and system settings to dynamically adjust encryption parameters and maximize key exchange efficiency. By leveraging machine learning techniques, quantum encryption systems can adapt to changing environmental conditions and optimize key distribution performance in real-time.

2. Quantum Key Management:

AI-powered quantum key management systems assist in generating, storing, and distributing cryptographic keys securely. These systems employ advanced encryption algorithms and AI-driven authentication mechanisms to safeguard quantum keys against unauthorized access and tampering. AI algorithms can also detect and mitigate potential security threats or anomalies in key management processes, enhancing overall system security.

3. Quantum Cryptanalysis Defense:

AI plays a crucial role in defending against quantum cryptanalysis attacks aimed at compromising quantum encryption systems. Quantum cryptanalysis involves leveraging quantum computing capabilities to break traditional cryptographic algorithms and compromise encrypted communication channels. AI-driven anomaly detection and pattern recognition techniques help identify suspicious activities or deviations from expected behavior, enabling proactive defense measures to thwart cryptanalysis attempts and safeguard encrypted data.

4. Quantum Random Number Generation:

AI algorithms contribute to enhancing the randomness and unpredictability of quantum random number generators (QRNGs) used in quantum encryption systems. Quantum randomness is essential for generating cryptographic keys that are resistant to cryptographic attacks and ensure the security of encrypted communication channels. AI techniques such as deep learning and neural networks are employed to analyze and enhance the randomness of quantum-generated random numbers, improving the overall security of quantum encryption systems.

5. Quantum Machine Learning for Security:

AI-driven quantum machine learning algorithms are utilized to detect and mitigate security threats in quantum encryption systems. These algorithms analyze network traffic patterns, communication protocols, and system behavior to identify potential vulnerabilities or malicious activities. By leveraging quantum computing capabilities, quantum machine learning algorithms can handle complex data sets and perform sophisticated security analysis tasks, enhancing the resilience of quantum encryption systems against emerging threats.

6. Quantum-Safe Cryptography:

AI contributes to the development and standardization of quantum-safe cryptographic algorithms that remain secure against quantum computing-based attacks. Quantum-safe cryptography aims to future-proof encryption systems against the anticipated threat posed by quantum computers to traditional cryptographic algorithms such as RSA and ECC. AI-driven research and development efforts facilitate the design and evaluation of quantum-resistant cryptographic primitives and protocols, ensuring the long-term security of encrypted communication in the post-quantum era.

| Previous: The Role of Analytics Is to Extract Value |