InetSoft Webinar: How BI Systems Relate to Finance

This is the continuation of the transcript of a Webinar hosted by InetSoft entitled "Business Intelligence in the Finance Department." The speaker is Mark Flaherty, CMO at InetSoft.

We’re switching gears now. That was our background on business intelligence. Now we’re going to talk about BI systems and how they relate to finance. It’s my attempt to depict what I think people in finance departments do as their finance system or the BI systems that they tend to interact with on a daily or weekly basis starting with operational systems.

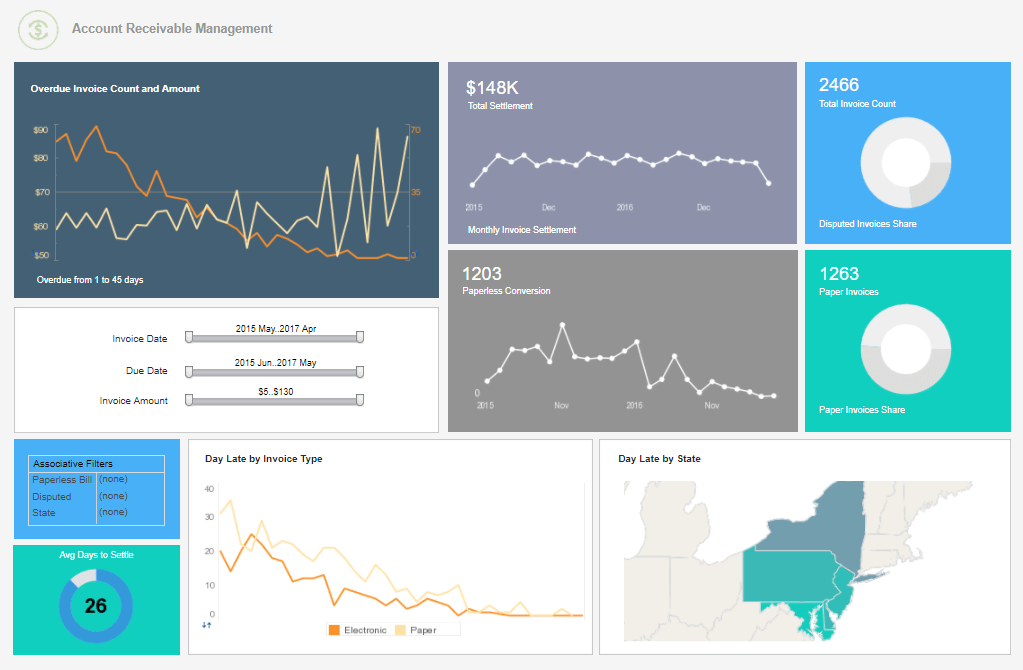

Those are the systems that run the business on a day to day basis, be it general ledger, your accounts payable, accounts receivable, sales, invoicing, things like that. Operational reporting is a confusing term. It means different things to different people and can be actually implemented in many different ways. But at a high level it’s about running reports off of individual operating system.

We have business intelligence which is all about generating reports off of a data warehouse or a data mart. It’s obviously a little more than that, but that captures its essence in terms of the strategies and benefits of BI. And then there are other systems: the planning, the budgeting, the forecasting and the consolidation systems that Finance uses.

Now, if I could draw a circle around the planning and budgeting square and the business intelligence square, I can’t do that on this Web conference system, but if I could, and pull those two systems together, you get something that vendors today are touting as performance management. And performance management is now making a big difference, perhaps even bigger than BI.

Depending on how you look at it. It’s been the reason for fifteen billion dollars of acquisitions in the last twelve months or less to be honest with you. What’s happened is the big software vendors out there have decided that performance management is a great way to get entry into the CFO’s office, into the office of Finance. And so they’ve purchased vendors that offer these capabilities. A lot of software vendors feel that the finance department is right territory for selling new services, new solutions and new software.

I think what we’ve seen happening, over the past ten years Finance is focused on the operational systems by implementing ERP systems and doing a lot of the back office cleanup and core finance, in order to get those efficiencies we were talking about earlier and to get process standardization and to really speed up the transactional part of Finance.

And now what we’re saying is, they’ve gotten a lot of that improved efficiency from those implementations. What they are now shifting their focus and energy towards is using intelligence and analytics to actually start becoming more effective. As the move happens in the marketplace now, the real opportunity is to analyze where spending is occurring and where the business is getting the value from is in the analytics and now applying new insights into that information to drive the business.

Now, we want to shift to talk a little about how these things interact, and there’s one thing that we have to talk about first which is how Finance manages the data for these core areas and what its data management foundation is like. I would have to say for most organizations that foundation is pretty weak.

It looks like this: spreadsheets. Spreadsheets rule in finance. Spreadsheets are essentially, for a lot of finance departments, they are the data management system. Now, there’s nothing wrong with spreadsheets. They’re incredibly powerful productivity tools. They have a lot of capabilities that business intelligence tools do not have.

The problem, however, and I think a lot of finance departments understand the problem with spreadsheets and data management systems, is that it undermines the information consistency of the enterprise. CFOs have recognized that this is certainly not a secure controllable environment for managing the financial information of the company.

Most have taken steps to secure this environment, to apply controls and perhaps to even get rid of spreadsheets all together especially for external and statutory reporting. However, I think they need to take the next step and remove spreadsheets all together as the data management system for collecting, gathering, integrating, and disseminating the rest of the information within the company.

That’s not to say that they should get rid of spreadsheets all together, but spreadsheets used as a data management system where every business analyst with a spreadsheet has a different view of the business, has defined the key terms and metrics in their own way so that none of this data can be integrated or aggregated.

Obviously when the CEO or CFO tries to get a consistent view of performance and productivity of the output of the company as a whole, and every department gives them different information that doesn’t add up, it’s quite infuriating. So many data warehouses have been implemented out of frustration by the CEO of not being able to get consistent information.