Credit Card Analytics

Understanding who is applying for credit cards and what factors are affecting credit card approvals become increasingly crucial for many financial players in the industry.

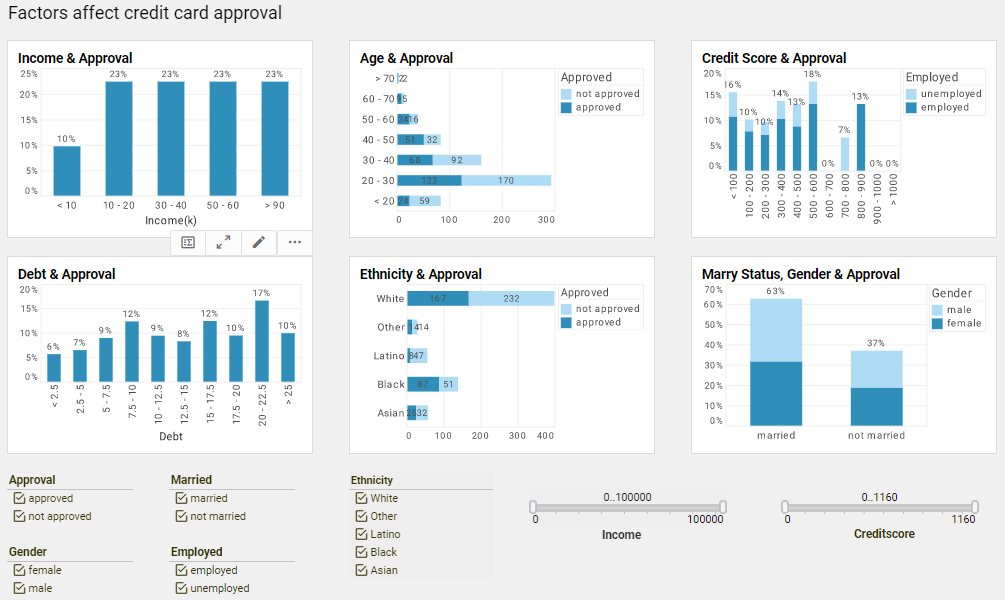

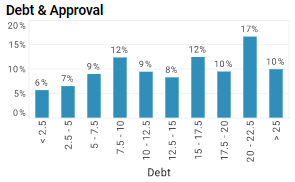

To this end, InetSoft has created a dashboard that investigates several factors associated with credit card approvals, including income, debt, age, ethnicity, credit score, marriage status, and gender. It not only allows financial users to visualize the relationship between a single factor and credit card approval rates at a glance, it also helps users slice and dice relationships easily between different variables with built-in checklists and sliders.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Credit Card Dashboard

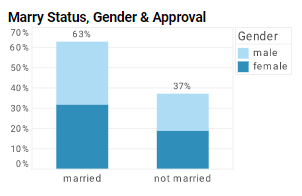

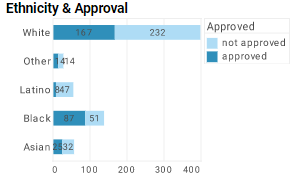

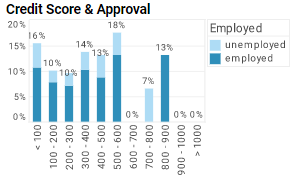

With built-in filtering components, financial professionals can easily slice and dice data with simple point-and-click methods to get various insights. They can investigate the relationship between approval rates and all other factors separately for males and females by filtering on gender. They can see how different demographic profiles affect credit card approvals by filtering on a combination of factors including age, ethnicity, income, employment, and marriage status. They can identify segments that are most preferable to credit card issuers by filtering on approved status.

Through the intuitive charts and filter functions on this credit card approval analytics dashboard, financial professionals can be more accurate in constructing credit card customer personas, understanding how different factors interact and affect the credit card approval rate.

Diverse Applications of InetSoft's Credit Card Approval Visualization

InetSoft's visualization dashboard web app is specifically designed to maximize business user self-service. With InetSoft's easy-to-use drag and drop design tools and a variety of charts and visualization types to choose from, financial industry players can easily cater the completed dashboard to specific needs and personalize the analytical views for accomplishing unique goals, such as:

- Potential cardholders can use the dashboard to assess the success rate of a possible credit card application.

- Financial analysts can investigate how different factors interact and affect approval rate, and generate insightful reports for publication.

- Commercial banks can use the dashboard to monitor credit card applications and gather instant insights on approved accounts, for risk assessment and management.

- Financial entrepreneurs can use the dashboard to identify credit card customer segments and discover new business opportunities.

|

View the gallery of examples of dashboards and visualizations. |

Achieving More with InetSoft StyleBI

The interactive credit card dashboard is one of the many visualizations created by InetSoft's Style Intelligence, a web-based application for mashup-driven dashboards and reports with machine learning intelligence.

InetSoft's data mashup capability is tightly coupled with visualization as one web app. While building visualization dashboards, the mashup engine enables finance professionals to quickly add data queries such as age and credit score blocks for insightful visual output without writing SQL. With powerful analysis methodologies and an easy-to-use interface, financial professionals can easily create interactive dashboards, perform ad hoc chart editing, and fully control how their visual dashboards will behave on different devices.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Furthermore, InetSoft's StyleBI allows finance professionals to drive machine learning processes directly through interactive dashboards. The combination of human-designed visualizations with machine-driven outputs not only saves finance professionals precious time but also enables them to uncover hidden insights out of abundant amounts of data.