Financial Reporting for your Company

InetSoft Technology provides a unified view of your organization's budget and actuals across disparate ERP systems and operating divisions.

InetSoft's financial reporting solution is capable of consolidating data from multiple data source that would otherwise require expensive measures to complete.

StyleBI offers users:

- Tabular reports that can be manipulated in Excel

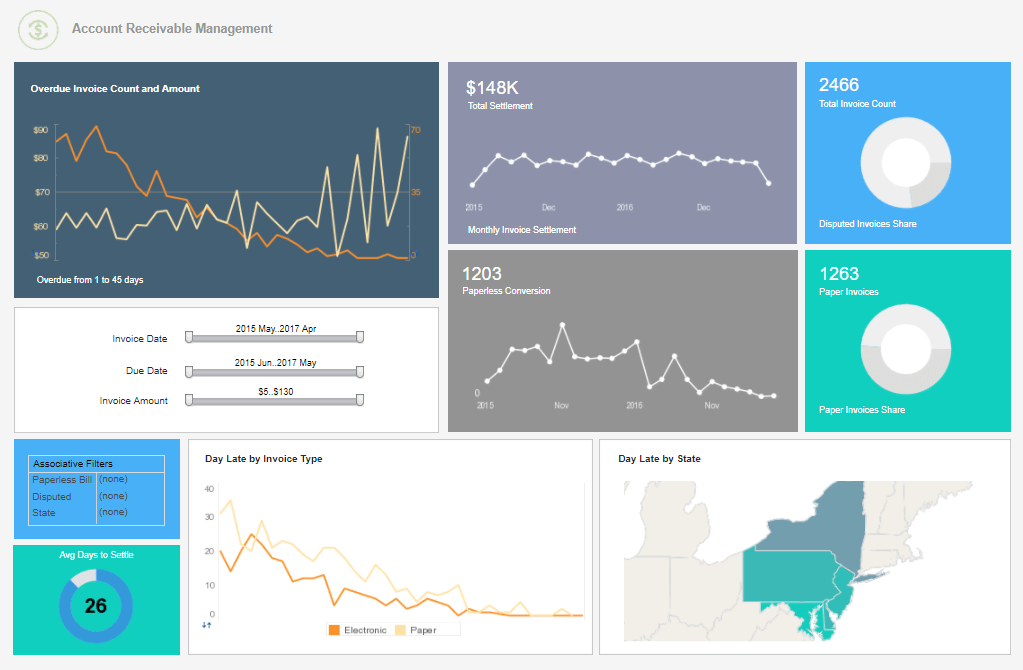

- Attractive visual dashboards and charts for executives and managers

- Automatically generated trend lines based on actual performance and variances

- Measurement of performance versus goals and commitments

- The ability to emphasize profit centers and accountability by entity

Custom Dashboard Design

Dashboards are generated through a small footprint application that can connect to any required ERP or financial systems. Operational data stores can be mashed up to create the desired unified view of corporate performance.

InetSoft dashboards offer point-and-click controls such as filter lists and range sliders allowing business users to intuitively explore and analyze large amounts of data. Dashboards are easily personalized, and can be saved as templates for quick retrieval.

Financial Data Mashup

Financial data pulled form operational system can be combined with almost any other data source found in your enterprise. StyleBI offers support for:

- • Relational databases (JDBC)

- • Oracle

- • Siebel CRM

- • JDE

- • PeopleSoft

- • SAP

- • Excel spreadsheets

- • OLAP cubes

- • Many more...

Financial Benefits

StyleBI allows your business to tighten its financial management, as well as:

- Address tax and compliance issues

- Add depth and insight to analyst and shareholder reports

- Reclaim time to pro-actively discover market trend

Why Is the Open Source StyleBI a Good Tool for a Company to Have for Doing Its Financial Reporting?

Financial reporting is one of those disciplines where the stakes are high and the details matter. Mistakes ripple into audits, investor relations, credit facilities, and executive decision-making. That’s exactly why an open source business intelligence platform like StyleBI is so compelling for finance teams. It combines the governance finance leaders demand with the flexibility technologists crave. In practice, that means faster close cycles, fewer spreadsheet acrobatics, and a reporting layer that can actually keep up with the business rather than slowing it down.

Ownership, Transparency, and Cost Control

First, the boring—but foundational—reasons: ownership and cost. Open source software gives finance and IT teams clear visibility into how the platform works. When you can inspect configuration and logic, you can trust it. That transparency also enables better controls: reviewers can see how a calculated metric was assembled, auditors can trace the steps, and you can lock down changes through version control. Cost-wise, open source avoids the trap of escalating per-seat fees that punish growth. A controller shouldn’t have to ration licenses to budget owners who simply need a monthly P&L. With StyleBI’s open source model, you keep TCO predictable while scaling adoption across the enterprise.

Data Pipeline Built for Finance Realities

Finance data is messy. General ledgers vary by subsidiary. ERP upgrades leave oddities in the chart of accounts. Bank feeds come in different formats. A key advantage of StyleBI is its data pipeline that can transform, combine, and script data before it ever touches a dashboard. You can normalize dimensions (e.g., aligning account hierarchies across entities), enforce standardized fiscal calendars, and map local currency ledgers into a consolidated reporting currency with transparent FX logic. Because those transformations are declared in an auditable pipeline, you get repeatability: close after close, quarter after quarter, the same steps run in the same order, and exceptions are easy to review.

Close Process Acceleration

The month-end close tends to bottleneck around manual reconciliations and ad hoc spreadsheets. StyleBI helps by automating the scheduled refresh of subledger data, maintaining reference tables (like cost center mappings), and publishing “workbench” dashboards for variance analysis the moment data lands. Controllers can drill from consolidated variance down to entity-account-transaction in a few clicks. That drill path—defined once—remains consistent across reports, which reduces the learning curve for new analysts and shortens the time from data availability to executive-ready results. The payoff is tangible: fewer late nights during close and faster delivery of the monthly reporting package.

Governed Metrics Without Sacrificing Flexibility

Finance thrives on consistent definitions: gross margin, EBITDA, free cash flow, ARR, and so on. StyleBI lets you centralize these calculations as governed measures, then reuse them everywhere. No more five versions of EBITDA fighting for truth. At the same time, analysts can fork a sandbox view to test alternative treatments—say, capitalizing certain costs or adjusting revenue recognition for a scenario—without contaminating the certified definition. Governance plus flexibility is the sweet spot; it keeps auditors happy while empowering analysts to explore.

Security That Matches Real-World Org Charts

Finance data is sensitive. StyleBI supports row-level and column-level security aligned to the organizational structure. A regional VP sees their region’s cost centers; the CFO sees everything; external auditors get read-only, time-bounded access to just the entities they’re sampling. Role-based access control, layered with data-level filters, gives you granular control without maintaining a labyrinth of report copies. This isn’t just convenience—it’s a control that reduces risk and simplifies compliance narratives.

Consolidations, Eliminations, and Multi-Entity Reporting

Many BI tools stumble when faced with multi-entity consolidations, intercompany eliminations, and mixed currencies. StyleBI’s pipeline logic lets you codify eliminations as rules, tag intercompany pairs, and apply period-specific exchange rates with clear lineage. For finance, that’s gold: you can show auditors exactly how elimination entries were generated, rerun them consistently, and expose reconciliation dashboards that highlight any dangling intercompany balances requiring manual review.

Excel Coexistence, Not Holy War

Let’s be honest—Excel isn’t going anywhere. The right strategy is coexistence. StyleBI publishes governed datasets that analysts can pull into Excel for modeling, while keeping the official numbers under control in the BI layer. Scheduled snapshots (e.g., “Post-Close Freeze”) protect the canonical record, and any Excel models can be re-pointed to that frozen dataset for audit-ready consistency. This reduces the classic “which file is final?” chaos without handcuffing power users.

Scenario Planning and What-Ifs

Finance is not just about reporting history—it’s about shaping the future. StyleBI supports parameterized dashboards and write-back patterns (when paired with a suitable database) to run scenarios like headcount plans, pricing changes, or CapEx timing shifts. Stakeholders can adjust drivers and instantly see the P&L, cash flow, and balance sheet impact. Because these assumptions live as structured parameters rather than buried in a spreadsheet cell, they’re easy to compare, roll back, and audit.

Compliance, Audit Trails, and Repeatability

Whether you’re navigating SOX controls, lender compliance, or nonprofit grant reporting, repeatability and traceability matter. StyleBI’s approach—pipelines, governed metrics, scheduled refreshes—creates a natural audit trail. You can document data sources, list transformations, and show the change history of key calculations. When auditors ask “how did this number get here?”, you can answer with a lineage view rather than a long email thread and screenshots.

Performance at Enterprise Scale

Finance queries are often spiky: heavy around close and board prep, lighter the rest of the month. StyleBI’s caching and query pushdown minimize database load while keeping reports snappy. You can design semantic layers that reflect the reporting grain you actually need—monthly for financial statements, daily for treasury and AR aging, transactional for audit drill-through—so you’re not overfetching data. The result is lower infrastructure cost and happier users who aren’t staring at loading spinners.

Integration Across the Finance Stack

A finance org rarely lives in a single system. You might have NetSuite for ERP, Workday for HCM, Salesforce for bookings, a data warehouse for history, and bank portals for cash. StyleBI’s connectors and scripting let you blend those sources into a coherent model. Want to tie headcount to OpEx by cost center and then overlay pipeline coverage ratios for planning? You can. Want to combine lease schedules with fixed-assets depreciation to forecast cash interest coverage? Also doable. This cross-system visibility is where a lot of ROI hides.

Developer-Friendly Without Alienating Finance

Some BI tools swing so far toward “no-code” that engineers avoid them, or so far toward “code-first” that finance avoids them. StyleBI strikes a practical balance. Finance users get drag-and-drop for common tasks and clear parameter forms. Engineers get scripting, APIs, and versioning to fold BI into CI/CD. That collaboration matters: you can operationalize financial reporting as productized artifacts rather than one-off heroics.

From KPIs to Board Books

The end product of all this plumbing is compelling output: monthly financials, variance bridges, cohort analyses, revenue waterfall, cash runway, DSO/DPO/CCC dashboards, and executive scorecards. StyleBI supports pixel-precise layouts for board-ready pages and interactive drill-down for operational teams. Distribute as web links, scheduled PDFs, or portal embeds. The important part is consistency: a single metric definition, many consumable formats, no rework each month.

If you believe finance should be a strategic engine rather than a historical archivist, an open source BI platform like StyleBI is a smart bet. It gives you the levers—governance, transparency, and automation—to convert financial data into decisions without burying the team in reconciliation chores. It respects the reality of mixed systems, honors the power of Excel without letting it run the company, and brings a software engineering mindset to a domain that needs it. In my view, that’s the right recipe for faster closes, tighter controls, and more insightful, less painful reporting.