New Insurance Industry Analytics

This is an excerpt of a podcast interview about new insurance industry analytics. The speaker is Jessica Little, Marketing Manager at InetSoft.

Interviewer: Tell us about current generation claims analytics, and in your opinion, why they are not so good?

Little: Well, I think, unfortunately, in most claims departments, information is divided up into data silos, and that includes claims management systems that can only provide basic and limited reporting to separate litigation management systems as well as separate reinsurance systems and customer data repositories, just to name a few.

The problem with this is that fractured data leads to obviously a number of issues that impede success. So for instance, when a claims operation accesses data from multiple databases, there is no one single version of the truth or claim. So there is a greater likelihood that the claims adjuster may get multiple answers, right or wrong, from the data.

Further exacerbating to the claims handler is the fact that he or she may have to go to multiple source systems or people for an answer. So this is obviously very costly for a claims organization, especially since you consider that a lot of claims organizations are under a lot of cost takeout needs and controls right now.

Next Generation Claims Analytics

So this type of scenario can lead a claims organization to really be in a very reactive mode of operation because there is an incomplete picture of a class of claims, and it certainly limits the ability to do next generation types of claims analytics.

Interviewer: Okay, Jessica, and bring us up-to-date, tell us about the next generation claims analytics?

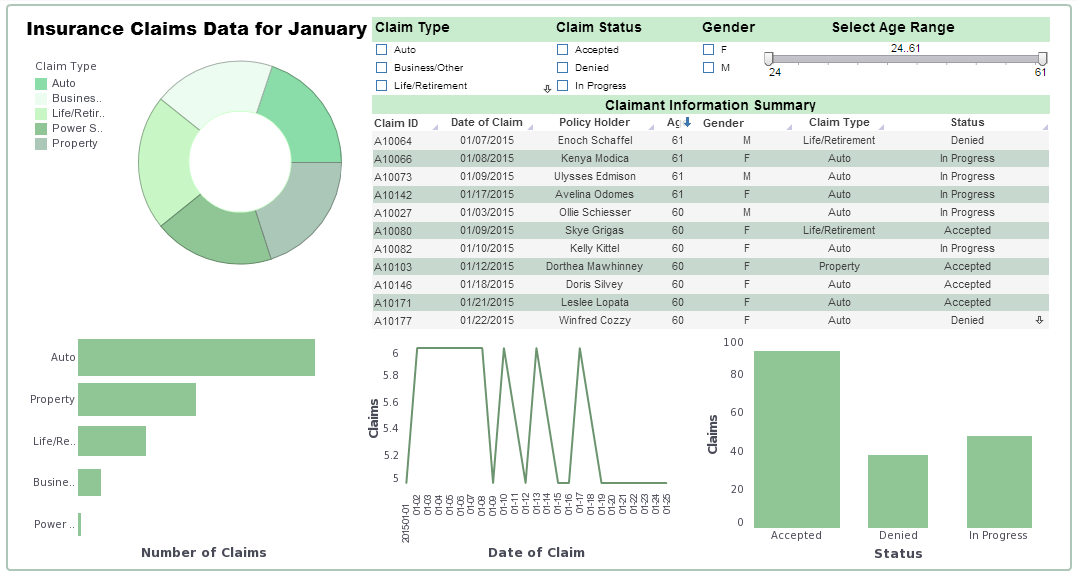

Little: Well, sure. An integrated claims data warehouse, and I am just focusing on claims, it allows really for one view of the claims business and provides an empowerment of claims end-users to access data via claims portals and analytic tools. So the manual searching for information is limited, and claims folks are better prepared to make decisions on claims because they are simply more empowered with data.

The integrated claims approach can quickly supplement information to the individual claims systems that current carriers have. So more importantly, or most importantly, an integrated claims data warehouse could provide one view of the claims business that can accurately and timely support our claims dashboarding connection with, say, a claims manager’s needs for an operation view of the department.

As more data is integrated, the claims’ business value compounds exponentially while the investment definitely increases incrementally. So carriers will find that as they add and integrate more claims data in the warehouse, they can answer more questions more quickly and deeply and enable predictive analytic applications to save money by reducing claims leakage and reducing inefficiency.

Total Cost of Ownership Declines

All this happens while their total cost of ownership of a dedicated claims warehouse really decreases. The combination of such an integrated claims foundation with predictive analytics and mining tools will enable claims organizations to achieve numerous benefits.

A lot of that comes down to the ability to be able to proactively use an ad hoc reporting tool and other types of automation including claims fast tracking, new claims triage, identifying fraudulent claims and potentially litigation early in the cycle, and again, this translates into reduced operational cost, allocated expense and loss for the company.

A Bloodstock Insurer Using StyleBI to Replace a Data Warehouse for Analytics

A bloodstock insurer faces unique challenges when it comes to managing and analyzing data. Unlike traditional insurers who deal with standardized actuarial models, a bloodstock insurer must incorporate highly varied data points, such as horse pedigrees, training regimens, breeding value, and global market fluctuations in equine sales. Historically, these insurers often relied on large, complex data warehouses to store and retrieve this information, but such systems tend to be expensive, rigid, and slow to adapt to the dynamic demands of the industry. This is where adopting StyleBI as an analytics platform becomes transformative.

By using StyleBI in place of a traditional data warehouse, the bloodstock insurer can integrate data from multiple sources—such as veterinary records, auction results, claims history, and customer contracts—into a single, flexible environment. Instead of waiting on IT teams to code and maintain warehouse structures, analysts and underwriters gain the ability to create mashups and transformations on the fly. This agility is critical when responding to new risks, like emerging equine diseases or sudden shifts in racing regulations, where the ability to quickly update models can directly impact profitability and risk exposure.

The adoption of StyleBI also improves the efficiency of reporting and visualization. Underwriters and executives can now view dashboards that track claims ratios, mortality trends, and premium income broken down by breed or region, all updated in real time. Instead of static warehouse reports, they benefit from interactive drill-down capabilities that allow them to explore outliers—such as why a particular stud farm has higher-than-average claims. These insights not only improve decision-making but also enhance client relationships by offering more transparent explanations of pricing and coverage.

Another key benefit is the reduced total cost of ownership. Data warehouses typically require significant infrastructure investments, licensing costs, and teams of administrators to manage data pipelines. StyleBI, being more lightweight and open-source, allows the bloodstock insurer to redirect resources toward developing innovative insurance products rather than maintaining backend systems. This cost efficiency is especially important for niche insurers, where profit margins can be tighter than in mainstream insurance sectors.

Ultimately, replacing a data warehouse with StyleBI enables the bloodstock insurer to be more agile, data-driven, and customer-focused. With faster access to integrated analytics, the insurer can refine risk models, respond quickly to market dynamics, and identify profitable growth opportunities. The combination of specialized domain knowledge with modern analytics tools positions the company to thrive in a competitive, high-stakes market where traditional systems would have slowed progress. For an industry built on assessing the future potential of prized animals, having equally forward-looking analytics capabilities is a strategic advantage.