OLAP Database Definition

Short for Online Analytical Processing, an OLAP style database organizes data into cubes containing measures and dimensions, replacing the traditional tables. This allows for the ability to process complex queries, with the capability of accessing data through multiple dimensions. This approach to data access and storage increases the opportunity for discovering new insights.

OLAP tools are the finest in multidimensional data processing for businesses across the globe. InetSoft's StyleBI is an efficient OLAP tool that can pull data from OLAP databases as well as a wide variety of other sources, enabling users to analyze and gather insights from their data with just a web browser and a flash plug-in.

In addition to accessing OLAP for advanced dashboarding and analytics, InetSoft's powerful data mashup engine allows for the combining and manipulating of data from other types of datasources, including Hadoop/HIVE, Oracle Hyperion, SAP ERP, and more.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Using InetSoft for OLAP

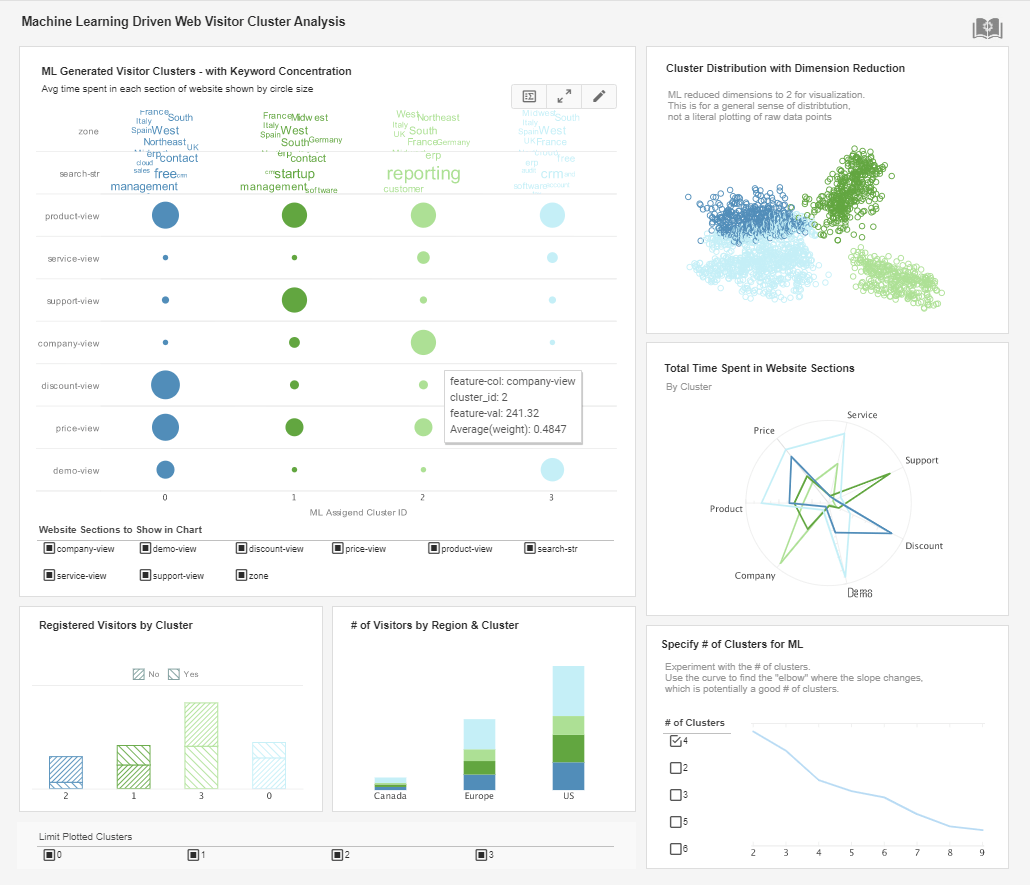

InetSoft's agile BI software is one of the few business intelligence applications that is powerful enough to run on OLAP cubes and operational databases. The capability to combine data fields from these sources with others provides greater potential for the discovery of valuable insights.

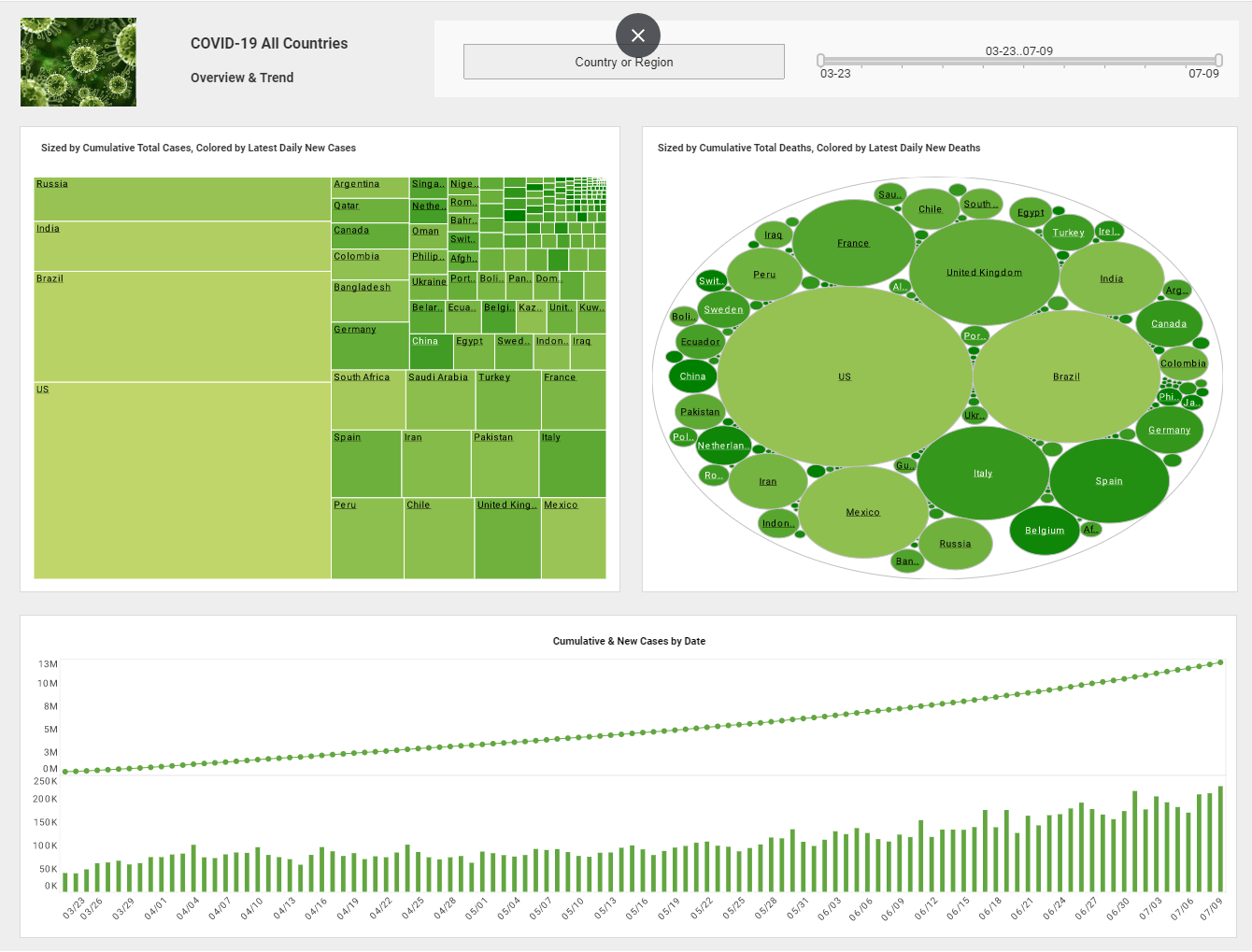

InetSoft's StyleBI comes complete with the capability to produce traditional reports, however, it is the visualization technology and ability to use OLAP databases that makes information consumption far more efficient. These new capabilites enable users and analysts to identify performance changes quickly, exploring the data with simple visual manipulations in order to uncover new information.

What Data Is Stored in the OLAP Database for a Forex Trading Firm?

In a Forex trading firm, an Online Analytical Processing (OLAP) database is crucial for storing and analyzing large volumes of data related to currency trading activities. This type of database is optimized for complex queries and multidimensional analysis, allowing traders, analysts, and decision-makers to gain insights into market trends, performance, risk exposure, and profitability. Here are some key types of data typically stored in an OLAP database for a Forex trading firm:

- Market Data:

- Currency Pair Prices: Historical and real-time data on currency exchange rates for various currency pairs, including bid and ask prices.

- Tick Data: Granular data capturing every price movement (ticks) for currency pairs, often used for high-frequency trading strategies.

- Volume Data: Trading volumes for currency pairs, indicating market liquidity and trading activity.

- Market Depth: Information on the supply and demand levels at different price levels for currency pairs.

- Trade Data:

- Trade Execution Details: Records of executed trades, including trade timestamps, prices, quantities, and execution venues.

- Order Book: Open orders placed by traders, including limit orders, stop-loss orders, and take-profit orders.

- Trade History: Historical data on trades executed by the firm, including profits, losses, and trade durations.

- Trade Positions: Current positions held by the firm for each currency pair, including open positions and unrealized profits/losses.

- Account and Portfolio Data:

- Account Balances: Balances and equity in trading accounts, including cash balances and margin requirements.

- Portfolio Holdings: Details of assets held in trading portfolios, including currency positions, equity positions, and derivative instruments.

- Margin Requirements: Information on margin utilization and margin calls for open positions.

- Risk Management Data:

- Exposure Analysis: Analysis of the firm's exposure to currency risk, including net positions, currency correlations, and delta hedging strategies.

- Value-at-Risk (VaR): Measurement of potential losses due to adverse market movements within a specified confidence interval and time horizon.

- Stress Testing Results: Results of stress tests simulating extreme market scenarios to assess the firm's resilience to market shocks.

- Client Data:

- Client Orders and Trades: Records of orders and trades placed by clients through the firm's trading platforms.

- Client Account Information: Details of client accounts, including account balances, trading history, and risk profiles.

- Client Profitability Analysis: Analysis of client trading activity and profitability, helping to identify high-value clients and trading patterns.

- Market News and Sentiment Data:

- News Feeds: Real-time and historical news articles, press releases, and economic indicators relevant to currency markets.

- Sentiment Analysis: Analysis of market sentiment based on news sentiment scores, social media feeds, and analyst reports.

- Reference Data:

- Currency Codes and Symbols: Reference data on currency codes, symbols, and exchange rates.

- Market Holidays: Information on market holidays and trading hours for different currency markets.

- Exchange Rate Conversions: Data for converting currency amounts between different currencies and exchange rates.

- Performance and Analytics Data:

- Performance Metrics: Key performance indicators (KPIs) and metrics related to trading performance, such as return on investment (ROI), Sharpe ratio, and maximum drawdown.

- Historical Analysis: Historical performance data for backtesting trading strategies and analyzing trading patterns.

- Benchmark Comparisons: Comparison of trading performance against industry benchmarks and peer firms.

- Compliance and Regulatory Data:

- Transaction Reporting: Records of transactions and trades for regulatory reporting purposes, including trade identifiers and timestamps.

- Regulatory Compliance Checks: Compliance checks and audit trails documenting adherence to regulatory requirements and internal policies.

- Anti-Money Laundering (AML) Data: Data related to AML checks and suspicious transaction monitoring.

- System and Log Data:

- System Logs: Logs of system activities, user interactions, and database transactions for troubleshooting and audit purposes.

- Performance Monitoring: Metrics and logs monitoring database performance, resource utilization, and system availability.

- Security Logs: Logs recording access attempts, authentication events, and security incidents.