5 Reporting Software Comparisons

There are many sufficient reporting solutions on the market today, but InetSoft StyleBI stands out in some very key areas. The five featured vendor comparisons to InetSoft are:

- Tableau

- Qlik

- Cognos

- Business Objects

- Domo

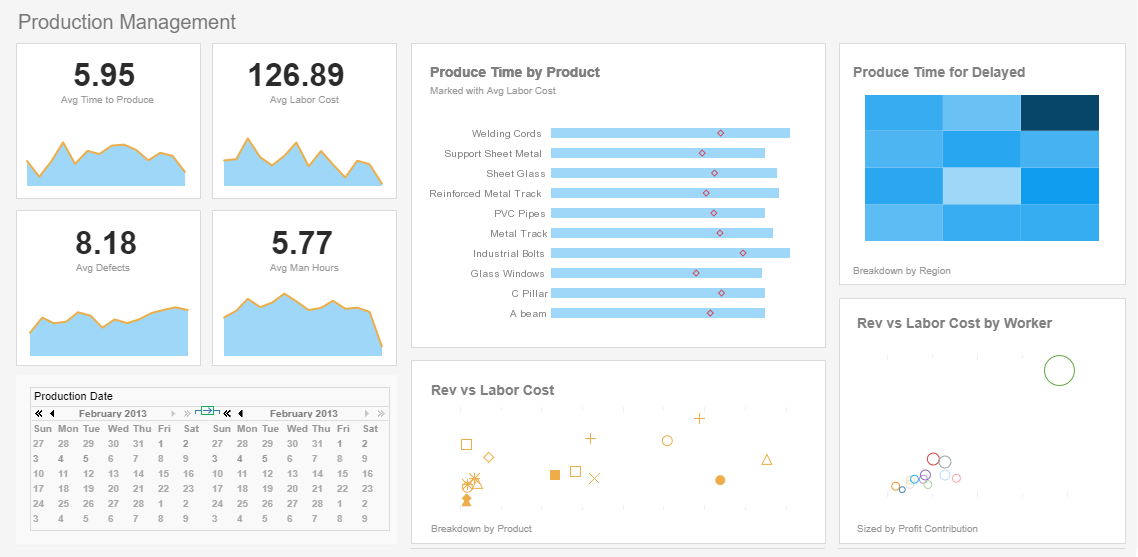

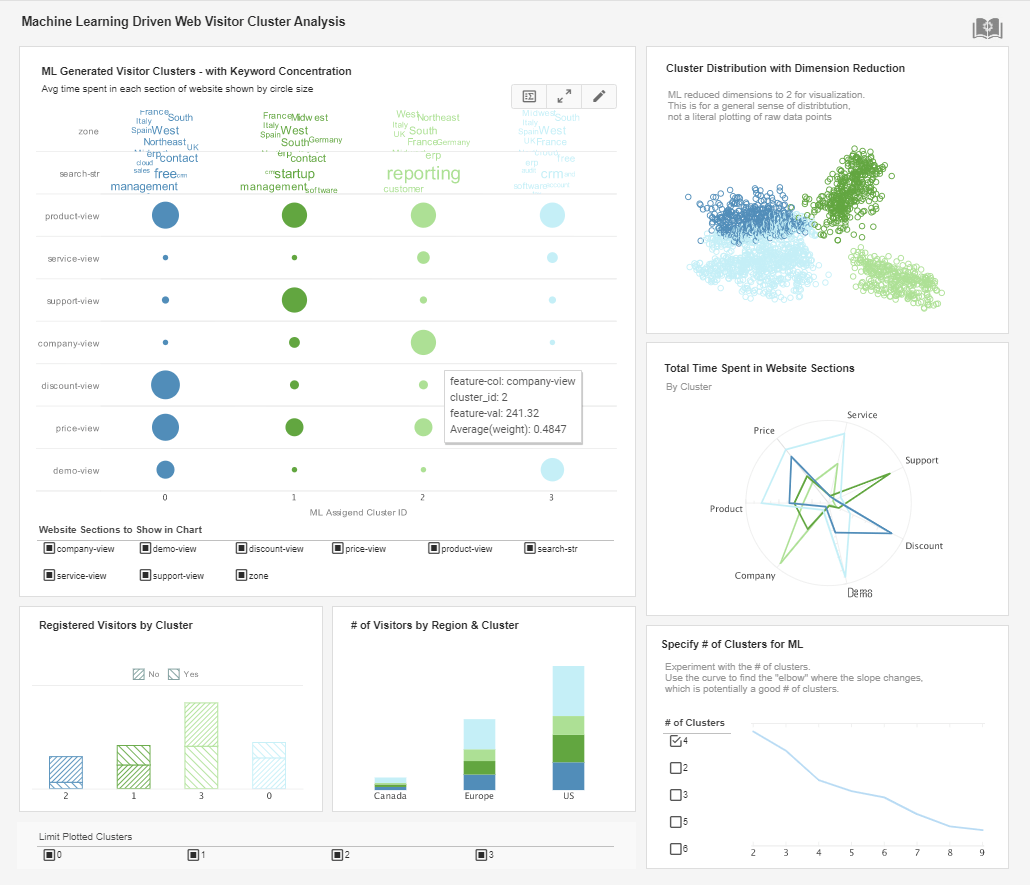

The main feature that helps InetSoft distinguish itself is the offering of both visual analytics and traditional reporting in one product. While visualization vendors such as Tableau, Domo, and Qlikview do not offer paginated reports, InetSoft's dashboarding capabilities are complemented by the ability to create pixel-perfect reports with impressive charts and graphics. InetSoft's reports can be made to be interactive, allowing users to drill down into raw data, links, and embedded dashboards.

When it comes to reporting or scorecarding, InetSoft has an upperhand over its counterparts such as Cognos and Business Objects. StyleBI is extremely agile and is able to mashup data from a multitude of disparate sources to produce its reports. These reporting capabilities are a big benefit to all kinds of businesses since they are no longer limited to producing different reports for different data sources. This flexibility has helped many to enhance their management and become more time efficient.

A Visual Reporting Solution

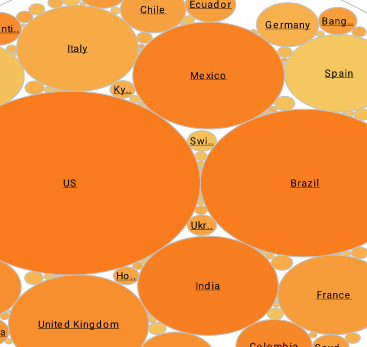

Visualization is an essential tool to that enables conditions to be communicated in a much more intuitive way. InetSoft's reporting application enables users to create meaningful reports that encompass all of an organizations data sources. Using the data mashup technology to integrate new data sources with an existing data warehouse allows users to see a complete picture of the state of an organization, in a single representation.

A good report includes insights that are beneficial to making improvements and enhancing the organization's goals. With most reporting solutions, users either get flexibility or ease of use. InetSoft's solution offers total flexibility in report design and generation, all while being easy and intuitive enough for non-technical users.

Comparison vs Smaller Competitors

InetSoft’s sweet spot is organizations that want a flexible, web-based BI/reporting platform with a data mashup engine: you can connect many sources, do transformations in the product, and produce interactive dashboards and embeddable analytics without building elaborate ETL. It’s particularly attractive when you need embedded analytics or custom report delivery rather than marketing-centric automation.

Tradeoffs: InetSoft is not purpose-built for marketing agencies (that’s Whatagraph’s lane) and doesn’t compete directly with search-first tools like ThoughtSpot that prioritize NLQ discovery. It’s also more of a traditional BI platform than a lightweight data sync tool like Coupler.io.

How it compares by dimension

1. Target user & use case

- InetSoft: BI developers, embedded analytics teams, IT-led dashboard programs who need mashup and ad hoc transformation features.

- Whatagraph: Marketers and agencies who want quick client reports and channel aggregation with minimal engineering.

- Sisense: Enterprise analytics and embedded analytics for product teams and ISVs with ambition to scale and white-label dashboards.

- ThoughtSpot: Business users who want search/AI-driven exploration and fast self-serve answers without deep model building.

- Zoho Analytics: SMB teams and departments seeking low-cost, solid BI with many prebuilt connectors and an easy learning curve.

- Coupler.io: Data operators who need reliable connectors and simple pipelines into Google Sheets, BigQuery, or BI tools — not a replacement for a BI visualization studio.

2. Data preparation & modeling

InetSoft’s data mashup engine sits between light ETL and full data-warehouse modeling — useful for fast joins and transformations inside the BI layer. If you need heavy transformation, you’ll still often pair it with an ETL/warehouse. Coupler.io is for the extraction/ingest piece rather than modeling inside a BI canvas. Zoho and Sisense offer a mix of modeling features; ThoughtSpot focuses on semantic modeling to enable NLQ. Whatagraph relies on connectors and template logic for sanitized marketing metrics.

3. Analytics style & discovery

ThoughtSpot is the obvious leader if you want NLQ and AI-first insight discovery; Sisense and Zoho have been adding conversational and generative features; InetSoft is more traditional (designer + interactive dashboards) but strong where you need custom embedded visuals and programmatic delivery. Whatagraph focuses on automated, templated reporting rather than exploratory analytics.

4. Deployment, embedding & extensibility

Sisense and InetSoft both emphasize embedded analytics for ISVs and product teams. Sisense often wins on scale and modern cloud features; InetSoft can be an easier fit when you need a web-based designer and fast mashups without a heavy cloud footprint. Zoho is easiest for organizations already inside the Zoho stack. Coupler.io is complementary because it feeds data to these platforms rather than replacing them.

5. Pricing & total cost of ownership

Expect different pricing models: Whatagraph and Zoho market lower entry costs for small teams; Sisense, ThoughtSpot, and InetSoft are typically licensed in enterprise/embedded models that vary by seats, cores, or embed volume. Coupler.io uses connector/volume pricing and can reduce engineering cost by removing custom connector work. If budget is a primary constraint, Zoho or Whatagraph will often be cheaper to get started.

Risks and operational notes

Security incidents and vendor stability matter. For example, Sisense was publicly associated with a data compromise in 2024, which is something buyers should factor into vendor risk assessments and contract negotiations (patch cadence, incident response and SLA details). For any vendor you consider, validate SOC/ISO evidence, upgrade cycles, and backup/DR procedures.

Which tool should you pick?

The right tool depends on the problem you’re solving:

- Embed analytics into a product or deliver flexible enterprise dashboards: evaluate InetSoft and Sisense; Favor InetSoft if you prioritize a powerful web designer and data-mashup flexibility with lighter engineering overhead.

- Fast marketing/client reporting with automation and templates: Whatagraph is optimized for agencies and multi-channel reporting.

- Search or AI-driven, self-serve exploration: ThoughtSpot leads for NLQ and conversational analytics experiences.

- Cost-sensitive SMB analytics inside an app ecosystem: Zoho Analytics is hard to beat on price/features if you’re already in Zoho or need low-cost, fast adoption.

- Need lots of connectors and simple ETL into sheets/warehouse/BIs: Coupler.io is a pragmatic addition to any stack — use it to feed Zoho, InetSoft, Sisense, or ThoughtSpot rather than replacing them.

Final practical advice

Don’t evaluate features in isolation. Run a small POC with the same dataset, try embedding scenarios if you plan to white-label, and measure time to first dashboard and time to production data sync. Combine a connector/ETL like Coupler.io for ingestion with a BI platform that matches your user persona (InetSoft for embedded/mashup, ThoughtSpot for NLQ, Whatagraph for marketing ops, Zoho for SMB budgets, Sisense for scale). If security posture or incident history is a high priority, include third-party security reports and ask direct questions on breach handling and forensics before committing.