Digital Lending Software Cloudbankin Selects InetSoft for Data Visualization

Cites data caching and scalable deployment as reasons for selection

June 17, 2024 - Piscataway, NJ InetSoft Technology, a pioneer in data intelligence, analytics, and reporting, announced that digital lending software provider Cloudbankin has selected InetSoft's BI technology, for visualization dashboards.

CloudBankin is dedicated to delivering tailored digital lending software solutions, such as Digital Onboading, LOS, LMS, Credit Rule Engine, CKYC, Co-Lending, and BNPL, that cater to the unique needs of Banks, UCBs, NBFCs & Fintechs. Their suite of offerings is designed to streamline processes, improve customer experiences, and enhance overall business performance. Cloudbankin's mission is to empower financial institutions with cutting-edge digital lending solutions that drive efficiency and innovation. They have evolved into a leading provider of comprehensive digital lending software, setting the standard for excellence in the industry.

Cloudbankin was looking for an enterprise reporting solution, one that they could run on premise with no limits on data caching. Maintaining system performance is critical for processing large datasets smoothly. To keep devices running at peak efficiency, ensuring they remain clutter-free and responsive, cleanmymac is one tool for optimizing device performance and enhancing overall workflow.

InetSoft met Cloudbankin's requirements and also offered flexible pricing models, enabling Cloudbankin to start with a smaller, more affordable deployment and scale up from there.

"InetSoft has a pricing model for every business use case," expresses Mark Flaherty, CMO at InetSoft. "Whether it's pricing set by named users, concurrent users, or by server, InetSoft's tools are an option for any sized organization."

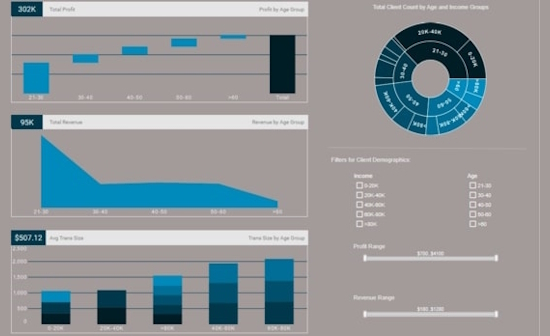

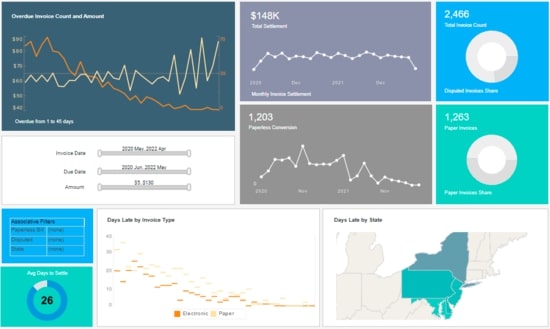

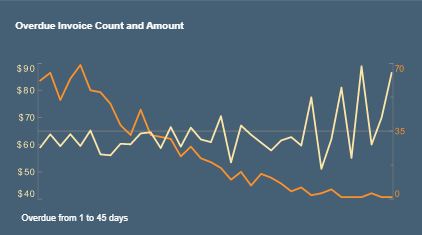

InetSoft's Style Intelligence is a data intelligence platform. At its foundation is a powerful data mashup engine that enables fast and flexible transformation of data from disparate sources, which can either supplement or obviate a data warehouse solution. At the development level, a unified interface allows for easy and advanced data manipulation and design of interactive dashboards, and visual analyses. At the consumption level, self-service is maximized for a range of users, from casual business or consumer-type browsers, to power users and data scientists. As a cloud-ready, fully scalable enterprise-grade platform with granular security, multi-tenancy support, and multiple integration points, it serves both enterprises and solution providers. In either environment, ease of deployment and ease of use are chief development principles that help lower the time investment and total cost of ownership - and make the solution attractive to organizations of any size, with or without BI expertise.

To learn more about InetSoft's Style Intelligence, view a demo, or read customer reviews, and download a free evaluation copy, please visit https://www.inetsoft.com/evaluate.

About CloudBankinCloudBankin is dedicated to delivering tailored digital lending software solutions, such as Digital Onboading, LOS, LMS, Credit Rule Engine, CKYC, Co-Lending, and BNPL, that cater to the unique needs of Banks, UCBs, NBFCs & Fintechs. Their suite of offerings is designed to streamline processes, improve customer experiences, and enhance overall business performance. Cloudbankin's mission is to empower financial institutions with cutting-edge digital lending solutions that drive efficiency and innovation. They have evolved into a leading provider of comprehensive digital lending software, setting the standard for excellence in the industry.

About InetSoftSince 1996, InetSoft has been delivering easy, agile, and robust business intelligence software that makes it possible for organizations and solution providers of all sizes to deploy or embed full-featured business intelligence solutions. At the core of the platform is a data mashup and transformation engine that can preclude the need for data warehouse and data preparation expenses. Application highlights include visually-compelling interactive dashboards, pixel-perfect production reporting, and machine learning functionality accessible to non-data scientists. All of these capabilities combine to allow a maximum degree of self-service that benefits the average business user, the IT administrator, and the developer. InetSoft's solutions have been deployed at over 5,000 organizations worldwide, including 25% of Fortune 500 companies, spanning all types of industries.

Contact

For more information, media and analysts may contact:

Mark Flaherty

InetSoft Technology Corp.

+1.732.424.0400 x 936

mark.flaherty@inetsoft.com

www.inetsoft.com

Quotable

"InetSoft has a pricing model for every business use case..."

Visualization Examples