Adding Contextual Information to Your Data Visualization Tool

Eric Kavanagh: That’s kind of interesting. So I can see how visualization could be very useful in systems management if you’re trying to understand how very complex systems are performing or not performing. I am guessing that's a pretty key area for data visualization.

We’ve all seen these kinds of systems management software. We see peaks in valleys and you can see kind of how their operations are running. What are some other interesting ways to visualize that stuff and get a better handle on things?

Dale Skeen: Well, I can give you an example. TXU is the largest retail energy provider in Texas. They want to visualize their customers’ transactions through their systems such as customers enrolling, reconnecting, disconnecting, or moving from one service provider to another one.

This is all automated in multiple systems so they can monitor just the lowest level of detail such as an action that took place on the SAP system. It doesn’t convey insight as to how well these processes are progressing, if problems are occurring, if the customers have been affected.

Process Discovery Tool

With our tool we were able to add contextual information -- the right context and the right visibility into what’s going on. The context we’re following is first used as a process discovery tool.Then, it visualizes how these actions are laid out sequentially thoroughly over time. And then just over several iterations you can discover what the underline accepted progress of a transaction should be.

That becomes a process now. And then as you start tracking the raw information and then present it in the context of this process, there is a process diagram.So all of a sudden they can start seeing progress of the individual transactions. The expected processors are tracked and you could overlay on top of that other things like judgment service level, KPI, and metrics.You can now see how well you’re doing in the context of the business object. So, that’s a great example of how we are using visualization and operational intelligence.

Eric Kavanagh: Yeah. That’s pretty cool stuff.

Driving the Business by Monitoring IT

Jim Ericson: It's very cool stuff. The lot of the early market on this was really coming to the log detail stuff. The IT churn and some companies have turned up just to serve that kind of stuff. Do you think there was kind of a launching pad? Or is it kind of the way you are describing it - all sort of business content for some good insight in terms of driving the business by monitoring IT activity?

Dale Skeen: Yeah. Well, one thing we want to make clear is that we are not just monitoring IT activities. Other types of activities, for example, would be social media activity. If you look at cost selling processes you all know what’s hot, what’s not, what people are dreaming about. So it's really being able to monitor all of this information.

To monitor in real time or do proactive monitoring of this you don't wait to question if something is wrong because that's usually too late to discover it. And, I think, the most important thing is cutting the business context to the process context, the operational context, the business goals to it, and framing it in terms of the business close and in terms of IT.

Jim Ericson: Yeah. Well, just the notion of overlaying regional customer churn over brown outs or local power outs or whatever you know is a compelling thought because you really are kind of mixing apples and oranges.

You are thinking operationally -- you know performance data of your business as its core competency and then matching that against what the customers are doing in different ways.

Dale Skeen: That's right. But it's not quite apples and oranges. In this case that’s the only correlation but they could be called validity associates.

Adding Context to Data Visualizations

Context turns numbers into meaning by answering why a reader should care. Without context a chart is an isolated fact; with context it becomes insight. The following practical techniques help viewers interpret patterns, judge significance, and make better decisions based on visualized data.

Reference Points and Benchmarks

Include baselines such as averages, targets, historical medians, or industry benchmarks. Displaying a horizontal line, shaded target band, or side-by-side comparator allows users to see whether a value is typical, below expectation, or exceptional. Clearly label what the reference is and when it applies so comparisons are unambiguous.

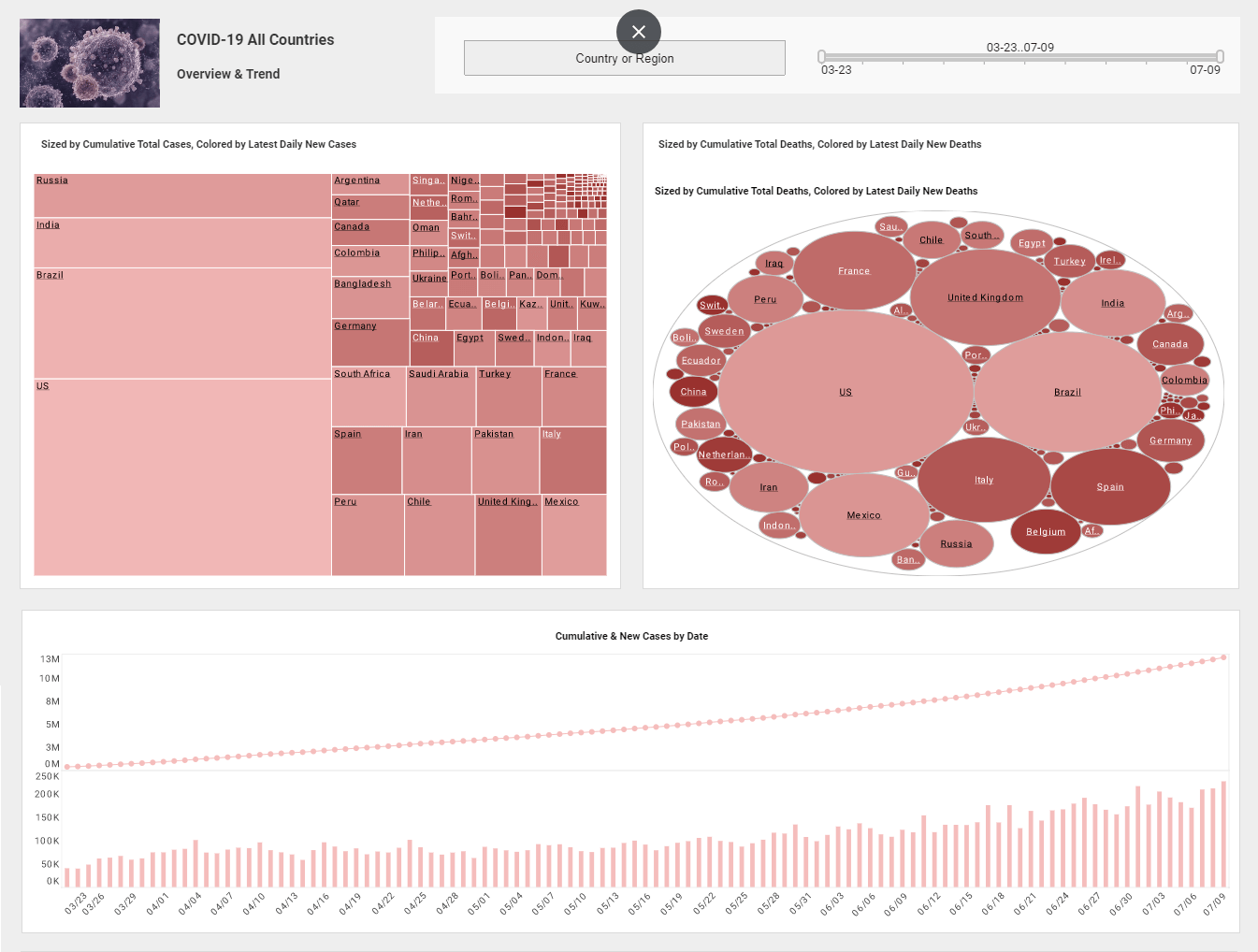

Time and Trend Context

Show trends rather than single snapshots whenever possible. Add previous-period comparisons, year-over-year change, or cumulative views to reveal momentum. Annotate key events on the timeline—product launches, policy changes, holidays—to explain sudden shifts and help users separate seasonality from structural change.

Annotations and Narrative Cues

Use brief annotations to call out important points: inflection points, outliers, or decisions that drove change. A concise caption or label next to a peak or dip gives immediate explanation without forcing the user to hunt for meaning. Combine annotations with a short headline that summarizes the takeaway in one sentence.

Axes, Scales, and Units

Make axes, units, and scales explicit. Use meaningful tick intervals, avoid truncated axes unless intentionally highlighting proportion, and state units clearly. When using logarithmic or indexed scales, include a note so readers understand how values relate. Consistent scales across related charts support accurate visual comparison.

Segmentation and Grouping

Break aggregates into segments to reveal variation hidden by averages. Segment by geography, customer cohort, product line, or demographic to show who or what drives the overall pattern. Use small multiples to present the same metric across comparable groups so differences stand out while layout stays consistent.

Comparative Context

Present comparative views such as ratios, normalized values, or relative ranking. Percent change, index values, and rank ordering often explain significance better than raw counts. When comparing entities of different scale, normalize per-capita or per-unit to prevent misleading impressions about size alone.

Uncertainty and Data Quality

Visualize confidence intervals, error bands, or sample sizes to communicate uncertainty. Flag missing or low-quality data and explain limitations in a short footnote. Being transparent about uncertainty increases trust and prevents overinterpretation of noisy signals.

Interactive and Layered Detail

Provide layered views so casual readers get the headline while analysts can drill into detail. Tooltips, drilldowns, and filters let users explore subsets, change time ranges, or reveal supporting numbers. Preserve the main insight while enabling deeper investigation for users who need it.

Design Signals and Microcopy

Use consistent color meaning, concise legends, and clear titles to reduce cognitive load. Add short microcopy below charts to state the key question the chart answers and any actions a viewer might take. Good microcopy or a one-line takeaway anchors interpretation and guides decision making.

Conclusion

Contextual elements—benchmarks, trends, annotations, segmentation, and transparency about uncertainty—transform visuals from pretty pictures into reliable evidence. Thoughtful context anticipates questions, prevents misreading, and makes visualized data useful for real decisions.