What KPIs and Analytics Does a Risk Operations Analyst Use?

In order to guarantee operational effectiveness and protect a company's reputation, risk management has become a critical component. Analysts of risk operations are essential in locating, evaluating, and minimizing possible hazards. They use a variety of key performance indicators (KPIs) and analytics to track and gauge the success of their risk management initiatives in order to achieve this.

In this article, we'll look at important KPIs and analytics that a risk operations analyst uses to make sure that risk management is done effectively.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

1. Incident Response Time

The risk operations team's reaction time to recognized risks or possible threats is gauged by incident response time. It shows how well the team's risk reduction procedures work. A quicker reaction time is often preferable since it reduces the possible effect of hazards and shows the team's capacity for quick crisis management.

2. Risk Detection Rate

This KPI evaluates how well the risk operations analyst can identify possible risks and hazards. A high-risk detection rate demonstrates a sharp eye for seeing new problems, enabling the team to handle them before they become major difficulties.

3. False Positives Percentage

False positives are instances that were first classified as dangers but were subsequently shown to be harmless. An excessive number of false positives suggests that the risk detection system is inefficient, which might cause the team to be overburdened with pointless inquiries. An effective risk detection system works to minimize false positives so the team may concentrate on real threats.

4. Risk Exposure Index (REI)

The Risk Exposure Index calculates the organization's potential exposure to recognized hazards. It aids in categorizing risks according to their seriousness and likely effects, enabling the risk operations team to properly deploy resources to deal with high-priority threats.

5. Resolution Efficiency

The success of the risk mitigation procedures adopted by the risk operations analyst is measured by resolution efficiency. In comparison to the overall number of recognized risks, it determines the proportion of risks that were effectively addressed. High resolution efficiency indicates that the team can successfully manage risks, reducing the total effect on the business.

6. Risk Trend Analysis

Analyzing risk trends entails monitoring risk occurrences over time. The risk operations analyst may acquire important insights into the organization's weaknesses and modify risk management strategies by seeing patterns and trends in risk data. Understanding risk patterns enables proactive threat management before minor problems turn into large ones.

|

Learn about the top 10 features of embedded business intelligence. |

7. Key Risk Indicators (KRIs)

Key Risk Indicators are unique parameters that are employed in real-time monitoring and risk prediction. KRIs function as early warning indicators that allow the risk operations analyst to take preventative action before hazards worsen. odd transaction volumes, abrupt changes in consumer behavior, or odd system access attempts are a few examples of KRIs.

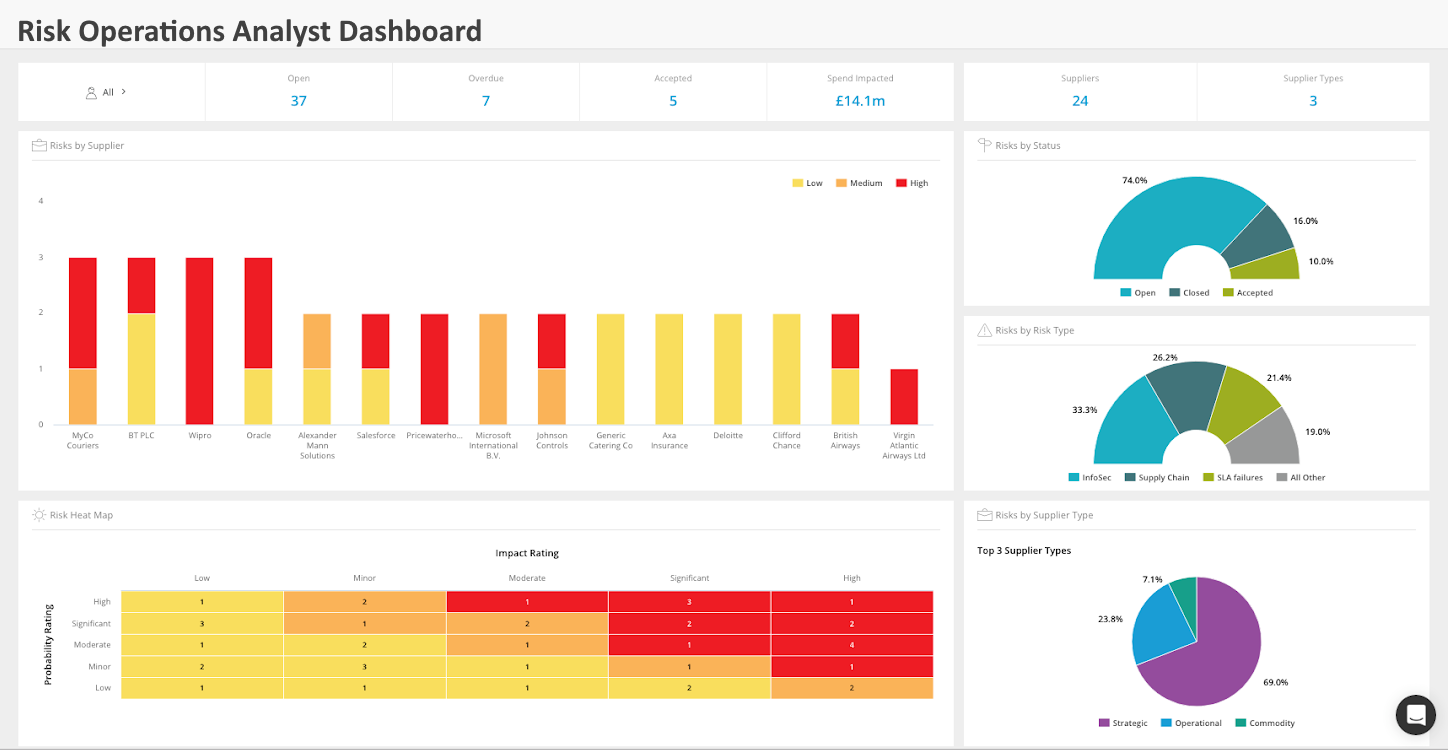

8. Risk Heat Maps

Risk heat maps provide the organization's risk landscape a visual depiction. They classify risks according to their seriousness and probability of occurring, enabling the risk operations analyst to properly prioritize mitigation actions. Decision-making is aided by heat maps, which show important regions that need rapid attention.

9. Root Cause Analysis (RCA)

Investigating the fundamental causes of hazards includes doing root cause analysis. The risk operations analyst may put into place specific solutions to address the core causes and stop similar risks from happening in the future. RCA aids in constructing a framework for risk management that is more durable.

10. Compliance and Regulatory Adherence

A critical component of risk management is ensuring compliance with all applicable rules and regulations. In order to minimize any legal ramifications and reputational harm, the risk operations analyst keeps an eye on the organization's adherence to compliance regulations and regulatory standards.

|

Learn the advantages of InetSoft's small footprint BI platform. |

11. Risk Mitigation Cost

Cost of Risk Mitigation evaluates the costs incurred to address and reduce recognized risks. This KPI aids the risk operations analyst in determining how cost-effective their risk management initiatives are. By keeping the expenses of mitigation under control, it is possible to manage risks effectively with the organization's budget intact.

12. Mean Time to Identify (MTTI) and Mean Time to Respond (MTTR)

The average time to detect a risk is measured by MTTI, but the average time to react and reduce the risk is measured by MTTR. These KPIs provide insightful data regarding how well the risk operations team responds to incidents. Rapider risk identification and resolution, which minimizes possible damages, is shown by lower MTTI and MTTR values.

13. Risk Culture Index

The organization's entire culture of risk awareness and risk management is evaluated by the Risk Culture Index. It entails polling stakeholders and workers to see how well they comprehend hazards and risk management techniques. Promoting risk-aware decision-making across the company depends on a healthy risk culture.

14. Customer Impact Rating

This KPI assesses how possible threats may affect consumers. The risk operations analyst may prioritize risk mitigation actions that have a direct influence on customer satisfaction and loyalty by understanding how risks might affect consumers.

Read what InetSoft customers and partners have said about their selection of Style Report as their production reporting tool. |

15. Vendor Risk Assessment

Vendor risk assessment examines possible dangers related to outside suppliers and vendors. To make sure that suppliers follow the organization's risk management criteria, risk operations analysts work with the procurement and vendor management teams. By assessing vendor risks, supply chain interruptions and data breaches may be avoided.

16. Risk Communication Effectiveness

In order to ensure that all pertinent stakeholders are aware of possible risks and comprehend the steps required to address them, effective risk communication is crucial. To promote a proactive risk-aware culture, the risk operations analyst keeps an eye on the clarity and timeliness of risk communications to stakeholders.

17. Residual Risk Evaluation

The amount of risk that remains after risk mitigation measures have been put in place is referred to as residual risk. The original risk level is contrasted with the residual risk by the risk operations analyst to determine the efficacy of these measures. This KPI assists in determining if more risk-reduction measures are required.

18. Loss Event Frequency (LEF) and Loss Event Severity (LES)

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

While LES calculates the magnitude of these losses, LEF evaluates how often risk-related losses occur. By combining these KPIs, it is possible to get a thorough picture of how risks could affect the organization's financial stability. Prioritizing risk mitigation efforts and maximizing risk financing solutions are made easier with the use of LEF and LES analysis.