Distribution Channel Dashboard Example

As you can see, dashboards are powerful tools for doing just that. The sample dashboard provided tracks many key performance indicators in a highly visual and digestible manner.

The heat map on the top left emphasizes at a glance the important information of where in-stock levels are better and where they are worse. Continuing on, the heat map on the right illustrates weeks of supply which further isolates the most important markets to address.

The bottom bubble chart displays the forecasting accuracy by location which is often the root cause of the problems identified above.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

KPIs and Analytics for the Sanitary Gasket Distribution Industry

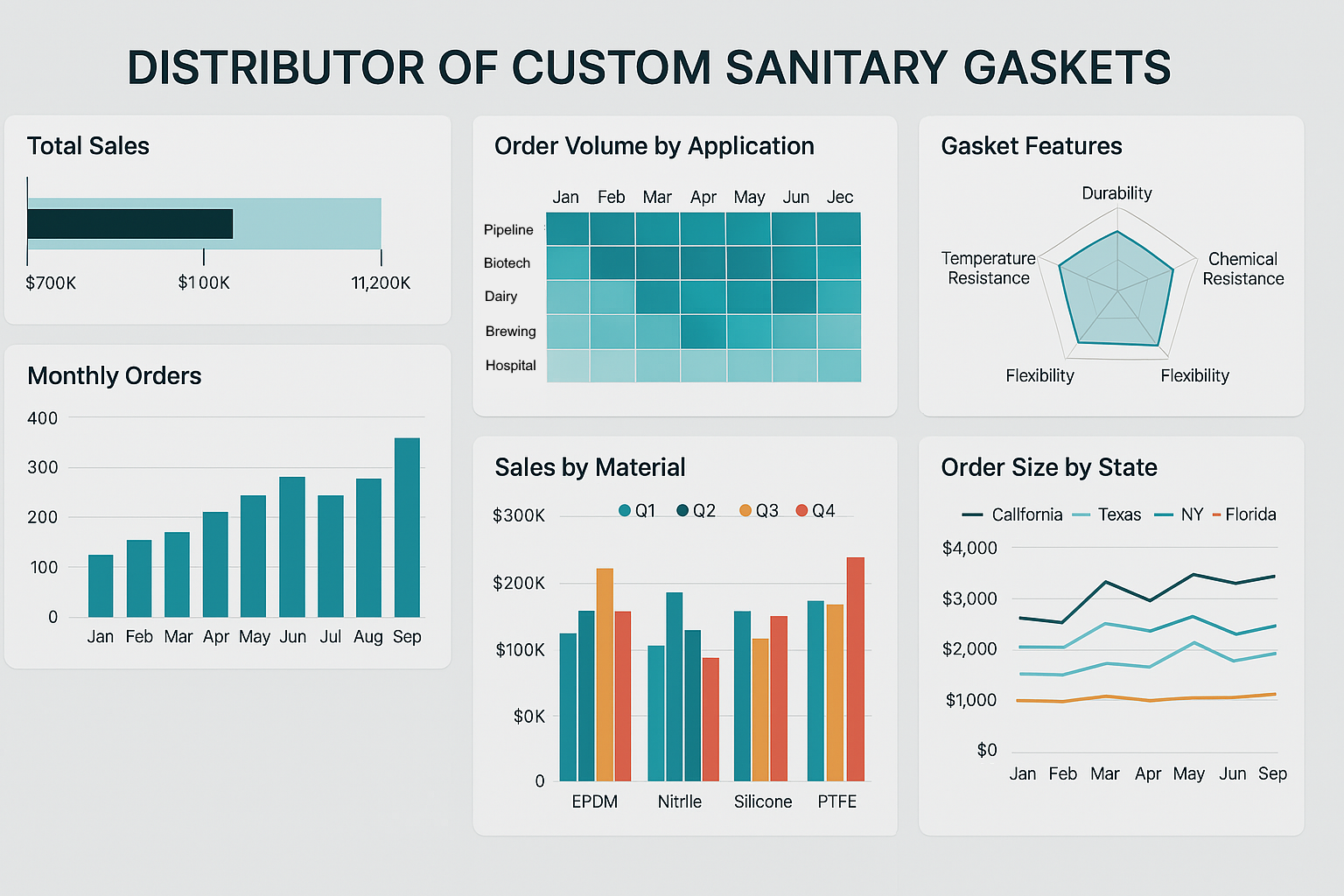

The custom full-screen dashboard designed for a sanitary gasket distributor operating in specialized sectors such as pipeline, biotech, dairy processing, and beer brewing provides a powerful lens through which operational performance can be monitored and optimized. The landscape-oriented 1600x1024 pixel layout accommodates six data-rich, advanced visualization charts, offering a cohesive view of mission-critical metrics. This article explores each KPI and chart in depth, explains how to interpret them, and offers tips for leveraging them to drive growth and efficiency.

1. Monthly Order Fulfillment Rate – Bullet Chart

The Monthly Order Fulfillment Rate chart displays percentage of customer orders delivered on time compared to company targets. Each bullet bar visualizes the actual performance against a target and includes performance thresholds (poor, average, excellent) as color-coded zones in the background.

- Primary KPI: Order Fulfillment Rate (%)

- Benchmark: 98% (target); 95–97% (acceptable); below 95% (needs improvement)

- Usage: Identify operational bottlenecks and logistics issues. Use this KPI to drive improvements in warehouse operations, inventory management, and transportation logistics.

2. Gasket Type Performance by Application – Radar Chart

The radar chart compares the relative performance of different gasket categories (e.g., tri-clamp, DIN, clamp-on) across key industrial applications. Spokes represent categories such as pressure resistance, durability in CIP systems, and microbial compliance.

- Primary KPI: Multivariate performance scoring (0–10 scale)

- Sectors: Biotech, Dairy, Brewing, Food Processing

- Usage: Sales teams and engineers can identify which product types excel in particular applications. Use to tailor marketing campaigns and customize solutions for strategic accounts.

3. Heatmap of Regional Sales Volume

A U.S. regional sales heatmap shows normalized sales intensity by state or territory. Warmer colors (red/orange) indicate higher volumes of gasket units sold, while cooler shades (blue/green) highlight underperforming regions.

- Primary KPI: Unit Sales by Region

- Secondary Metrics: Average Order Value, Key Client Presence

- Usage: Target sales reps and promotional budgets to underperforming markets. Monitor penetration of emerging sectors geographically. Useful in expansion planning.

4. Equipment Downtime by Production Line – Bar and Line Combo Chart

This dual-axis chart combines downtime hours (bars) with batch rejection rate (line) to uncover production challenges in gasket manufacturing. Lines represent production lines (e.g., Line A, B, C) and are color-coded.

- Primary KPI: Downtime per Line (hrs)

- Correlated KPI: Rejection Rate (%)

- Usage: Ideal for maintenance and quality assurance teams. Use to correlate equipment issues with quality problems, prioritize preventative maintenance, and refine manufacturing schedules.

5. Customer Segmentation Performance – Stacked Column Chart

This chart breaks down revenue from four customer segments—biotech, brewing, dairy, and OEM partners—by quarter. Each segment’s contribution is color-coded within each quarterly bar for comparison.

- Primary KPI: Quarterly Revenue by Segment ($)

- Trends: Seasonality in brewing demand; consistent biotech revenue

- Usage: Helps executives allocate resources, prioritize R&D, and monitor long-term client value. Segment-specific decline can trigger account recovery efforts.

6. Inventory Turnover and Stockout Rate – Dual Bullet Chart

Two bullet charts displayed side-by-side monitor operational efficiency in warehouse inventory. One displays Inventory Turnover Ratio (cost of goods sold / average inventory), and the other tracks Stockout Frequency per SKU.

- Primary KPIs: Inventory Turnover (target: 10x); Stockout Rate (target: <5%)

- Benchmarks: Poor turnover < 6x; Stockouts >10%

- Usage: Supply chain managers use this to balance overstock and understock risks. Predictive alerts can be tied to these metrics to trigger purchasing actions or vendor follow-ups.

Putting It All Together: Unified Insights

This dashboard is more than just a visual report. It acts as a control tower for sales, production, inventory, and client engagement. Interactivity (e.g., drill-downs, hover pop-ups) empowers users to filter by date ranges, specific SKUs, or distribution centers.

The use of advanced chart types such as bullet charts, heatmaps, and radar charts avoids clutter and provides layered insights that go beyond traditional pie charts or basic bars. Analysts, sales managers, and executives alike benefit from unified visibility and rapid insight-to-action translation.

From discovering new revenue opportunities in underperforming regions to isolating root causes of production inefficiencies, this dashboard equips stakeholders across the enterprise to act decisively.