What KPIs Are Used on a Fund Management Company's Dashboard?

Monitoring and assessing performance is crucial for a fund manager. Fund management organizations (hedge funds, pension funds, trust funds, mutual funds, and corporate funds) significantly depend on Key Performance Indicators (KPIs) to gauge performance, spot trends, and make defensible judgments about the assets they are tasked with managing on behalf of customers.

The key performance indicators (KPIs) that make up a fund management company's dashboard are examined in this article, giving light on how these measurements guide investment strategies and promote financial success.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

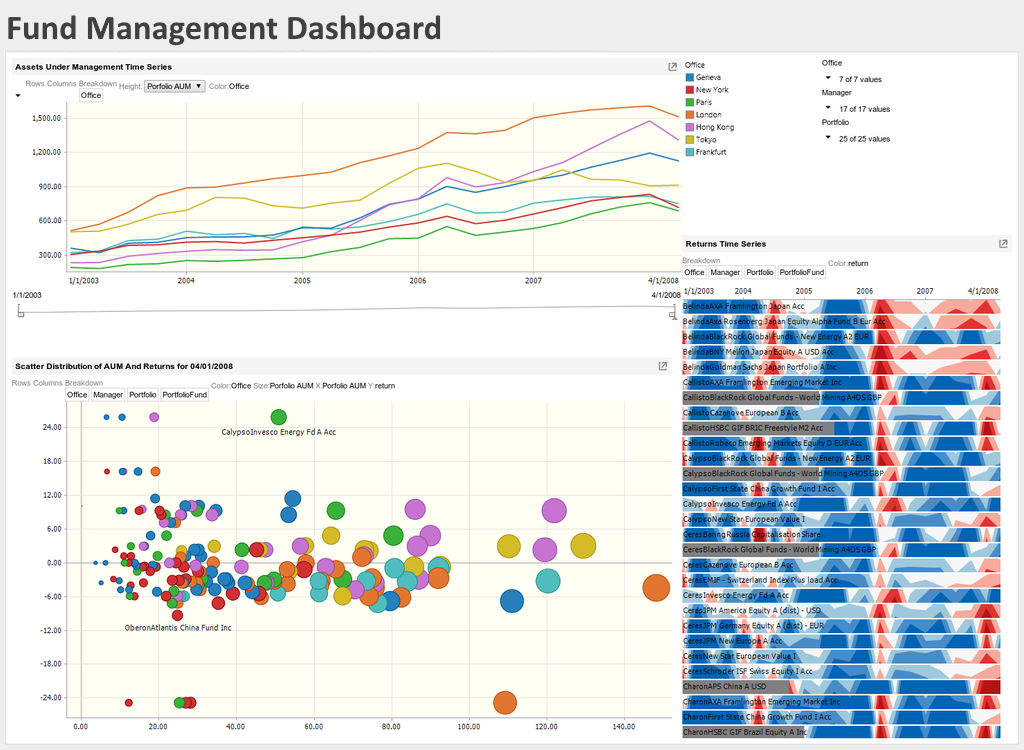

Asset Under Management (AUM) Growth

Asset Under Management (AUM), a key performance indicator (KPI), measures the total amount of money that a firm manages. Monitoring AUM growth gives the business information about how well it can draw in new customers and keep existing ones, as well as how well-liked its investment options are.

Information Ratio

The information ratio evaluates a fund manager's capacity to provide above-average returns in relation to the assumed risk. It takes into account the manager's aptitude for actively managing risk when choosing investments.

Return on Investment (ROI)

ROI is a crucial KPI that gauges the success of investment choices. It illustrates the company's capacity to provide returns for customers by comparing the profit from an investment to its cost. ROIs that are positive signify successful investment plans, whereas ROIs that are negative signal the need to reassess techniques.

Risk-Adjusted Returns

Assessing risk in relation to returns is necessary to comprehend investment performance. Fund managers may determine if the returns produced effectively offset the risks incurred with the use of the Sharpe Ratio and other risk-adjusted return indicators. This KPI makes ensuring that investment choices are made in a balanced manner.

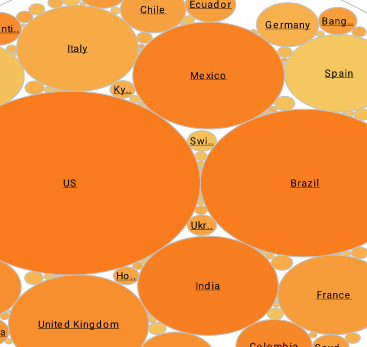

Portfolio Diversification

By distributing assets across several asset classes, a well-diversified portfolio reduces risk. This KPI evaluates the distribution of assets and makes sure the business doesn't specialize too much on one industry, minimizing the effect of market volatility on performance as a whole.

Expense Ratio

The expense ratio shows what percentage of a fund's assets are used for operational costs. A reduced expenditure ratio indicates effective cost control, which encourages investor confidence and might result in better net returns.

Active Share

The amount to which a portfolio's holdings deviate from its benchmark is measured by its active share. A high active share denotes an active management style and that the fund's portfolio differs considerably from the benchmark.

Alpha and Beta

The risk-adjusted performance of a fund in comparison to a market index is measured by alpha. Positive alpha denotes performance above average, whilst negative alpha denotes performance below average. A fund's susceptibility to market changes is measured by beta. Understanding how a fund reacts to market situations is made easier by both KPIs.

|

Learn about the top 10 features of embedded business intelligence. |

Liquidity Ratios

A company's capacity to satisfy short-term financial commitments is evaluated using liquidity measures like the current ratio and quick ratio. Companies that manage funds must have enough liquidity to fulfill redemption requests and take advantage of investing possibilities.

Client Retention Rate

Investor happiness and confidence in the company's skills are shown by a strong customer retention rate. Fund management firms may modify their strategy to fulfill customer expectations and create enduring partnerships by keeping an eye on this KPI.

Benchmark Performance

Insights regarding the success of the company's investments in relation to industry norms are provided by comparing fund performance against relevant benchmarks. This KPI supports the efficacy of the selected investing methods.

Tracking Error

The amount by which a fund's returns depart from its benchmark index is measured as tracking error. While a larger score denotes more divergence from the benchmark, a low tracking error value signifies that the fund closely tracks the benchmark.

Turnover Ratio

The turnover ratio measures the frequency of purchases and sales of a fund's holdings over a certain time frame. Increased transaction expenses and significant return ramifications might result from a high turnover percentage. Monitoring this KPI enhances trading effectiveness.

|

Learn the advantages of InetSoft's small footprint BI platform. |

Net Asset Value (NAV)

NAV is calculated by dividing the total value of a fund's assets by the total value of its liabilities. This KPI enables comparisons between other funds and gives investors an overview of a fund's value per share.

Yield

Investment income is measured by yield, which is often represented as a percentage of the market value of the investment. For income-focused funds, this KPI is essential since it enables investors to gauge the fund's potential for income.

Volatility

The degree of price variability in a fund's returns is reflected in volatility, which is often calculated using standard deviation. Investors that are risk-averse may choose low volatility, while those looking for better returns may favor high volatility.

Redemption Rate

The frequency and size of investor withdrawals are monitored by the redemption rate. This KPI is crucial for making sure there is enough liquidity to fulfill redemption requests quickly and keep the fund operating steadily.

Sharpe Ratio

The extra return produced per unit of risk taken is taken into account when calculating the Sharpe Ratio, which assesses a fund's risk-adjusted returns. This KPI assists in comparing the performances of various funds and evaluating their risk profiles.

Read what InetSoft customers and partners have said about their selection of Style Report as their production reporting tool. |

Tax Efficiency

Tax implications on investor returns are reduced by tax-efficient fund management. This KPI includes tactics like employing tax-advantaged investment instruments and timing investments optimally.

Market Share

Market share is how much of the total assets managed in a certain market sector a fund management business has authority over. In order to evaluate the company's competitive position and industry development potential, market share is monitored.

Client Acquisition Cost

The cost of acquiring a new customer is determined by the client acquisition cost. Using this KPI, fund management organizations may assess how well their marketing and sales initiatives are doing in proportion to the amount of new business they are bringing in.

|

Read how InetSoft was rated as a top BI vendor in G2 Crowd's user survey-based index. |

Fund Flow

The net amount of money entering or leaving a fund is measured as fund flow. While a negative fund flow could imply withdrawals owing to subpar performance or unpredictability in the market, a positive fund flow demonstrates investor interest and confidence.

Drift

The degree to which a fund's holdings deviate from its declared investing philosophy or mission is measured by style drift. By keeping an eye on this KPI, the fund may avoid unintentionally deviating from its planned strategy and staying faithful to it.

Upside and Downside Capture

While downside capture analyzes the fund's relative performance during adverse market phases, upside capture examines how well a fund performs in relation to a benchmark during positive market phases. These KPIs provide light on a fund's capacity for risk management.

|

View the gallery of examples of dashboards and visualizations. |

Regulatory Compliance

Companies that handle funds must adhere to industry standards. Monitoring regulatory compliance KPIs makes ensuring the business stays out of trouble with the law, maintains transparency, and retains investor confidence.

ESG Metrics

Ethical and sustainability standards are used to evaluate a fund's performance using environmental, social, and governance (ESG) measures. Following these KPIs shows a dedication to ethical investment and is in line with investor preferences.

Active vs. Passive Investments

The performance of actively managed funds and passive index funds is contrasted in this KPI. It assists fund management organizations in determining if the increased fees imposed relative to passive alternatives are justified by their active management tactics.

|

Learn about the top 10 features of embedded business intelligence. |

Duration

The sensitivity of a fixed-income investment to interest rate fluctuations is measured by its duration. It supports informed decision-making based on market expectations and aids fund managers in managing interest rate risk within their portfolios.

Holding Concentration

The amount of the portfolio that is invested in a single asset or a small number of securities is known as holding concentration. Increased risk may result from high concentration if such securities perform poorly.

Dividend Yield

Dividend yield for income-oriented funds assesses the yearly dividends investors get in relation to the fund's price. Investors may assess the fund's revenue potential using this KPI.