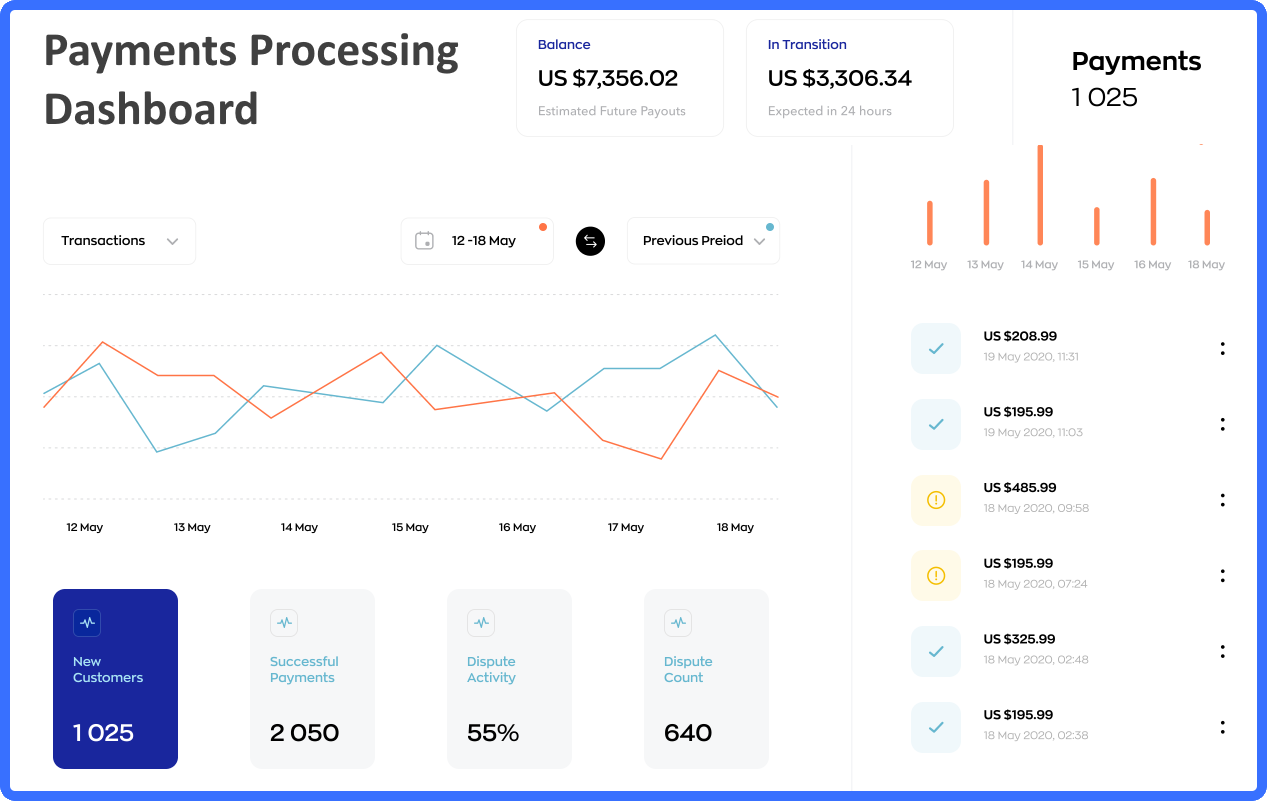

What KPIs and Analytics Are Used on InfinitePay Dashboards?

Effective decision-making in contemporary business is dependent on a thorough comprehension of a company's performance. A strong dashboard with KPIs and analytics is essential for financial transaction leader InfinitePay who enables payments to be made swiftly and securely, whether they are online, in-store, or even across borders

This article discusses income, sales, customer acquisition, and other key InfinitePay dashboard indicators.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Revenue

Any company dashboard's total revenue is its core component. This KPI shows the capacity of InfinitePay to produce revenue over a certain time period and gives a broad overview of the company's financial health. Revenue monitoring on a regular basis helps stakeholders see patterns, evaluate growth, and decide on future tactics.

Sales

The sales KPI deconstructs transactions in combination with total income, revealing the subtleties of product or service attractiveness. This measure offers detailed information that helps InfinitePay assess the performance of certain products and improve its sales tactics. It is possible to identify high-performing goods and services as well as potential problem areas by delving deeply into sales data.

Customer Acquisition Cost (CAC)

Comprehending the expenses linked to obtaining a new client is crucial for maintaining steady expansion. InfinitePay is able to evaluate the success of its marketing and sales initiatives thanks to the CAC KPI. The business may improve its acquisition methods and make sure that the cost of gaining a client is in line with the potential income they bring in by evaluating CAC against customer lifetime value (CLV).

Customer Lifetime Value (CLV)

CLV considers the whole client relationship, while CAC concentrates on the initial cost of gaining consumers. This KPI measures the overall amount of money a client brings in for InfinitePay throughout the course of their relationship. Strong client loyalty is indicated by a high customer lifetime value (CLV), which also reveals which customer categories are most important for long-term profitability.

Conversion Rate

Turning website visitors into paying clients is a crucial objective in the digital age. The proportion of visitors who complete a desired action—such as completing a purchase or signing up for services—is measured by the conversion rate KPI. With the use of this data, InfinitePay can optimize its sales and marketing funnels and pinpoint areas that could need improvement in order to raise conversion rates overall.

Churn Rate

Acquisition is important, but so is customer retention. The proportion of consumers that stop utilizing InfinitePay's services is shown by the churn rate KPI. A high percentage of client turnover indicates possible problems with competition or consumer happiness. Through proactive resolution of churn's underlying causes, InfinitePay may increase client retention and reduce revenue loss.

Average Order Value (AOV)

Customizing pricing and marketing techniques requires an understanding of consumer purchasing patterns. The average amount spent on each transaction, or AOV, gives InfinitePay important information. The business may maximize income from each customer encounter by identifying chances for upselling or cross-selling by evaluating AOV data.

Inventory Turns

Inventory control is a vital component of business operations for every organization that deals with tangible goods. The inventory turns KPI calculates how well InfinitePay sells and restocks its goods. It reduces holding costs and ensures a steady supply of items to fulfill consumer demand when inventory turnover is high.

|

Learn about the top 10 features of embedded business intelligence. |

Time-to-Resolution (TTR)

Customer happiness depends on effective problem resolution. TTR calculates how long it takes InfinitePay to respond to questions or concerns from customers. A short time to resolution ratio (TTR) denotes efficient customer service, which enhances customer satisfaction and lowers the possibility of customer attrition.

Mobile App Engagement Metrics

Measuring the performance of InfinitePay's mobile app is essential in this mobile-first age. User behavior may be inferred from metrics like feature use, app downloads, and user engagement. With the use of this data, InfinitePay is able to enhance its mobile app and provide users a smooth and convenient experience.

Compliance Adherence

The financial sector is governed by strict laws. InfinitePay has to keep an eye on compliance to prevent legal problems and brand harm. This KPI ensures the organization follows industry laws and maintains a trustworthy reputation in the market.

|

Learn the advantages of InetSoft's small footprint BI platform. |

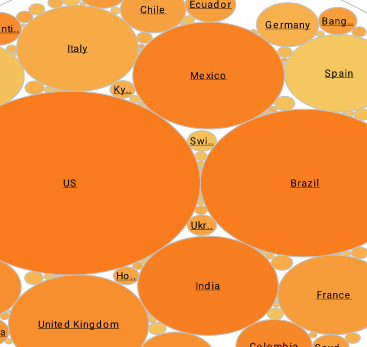

Social Media Engagement

A strong social media presence is essential for brand awareness and client interaction in the digital age. KPIs related to social media involvement include things like likes, shares, comments, and follower growth. These analytics help InfinitePay evaluate its social media efforts and build a community around its services.

Time on Platform/User Session Duration

Knowing how much time people spend using a platform like InfinitePay's services is essential. The length of a user session or time on platform indicates how long users typically spend engaging with InfinitePay. This KPI measures user engagement and may inform user interface, feature, and service changes to boost stickiness and satisfaction.