What KPIs and Analytics Are Used on Revenue Cycle Management Dashboards?

A critical component of maintaining the financial stability of healthcare businesses is revenue cycle management, or RCM. Organizations use complicated dashboards with analytics and Key Performance Indicators (KPIs) to effectively manage the intricacies of revenue cycles.

These resources provide priceless insights into the organization's financial health and support decision-making by stakeholders.

This article examines Revenue Cycle Management dashboard KPIs and analytics and their use in financial process optimization.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

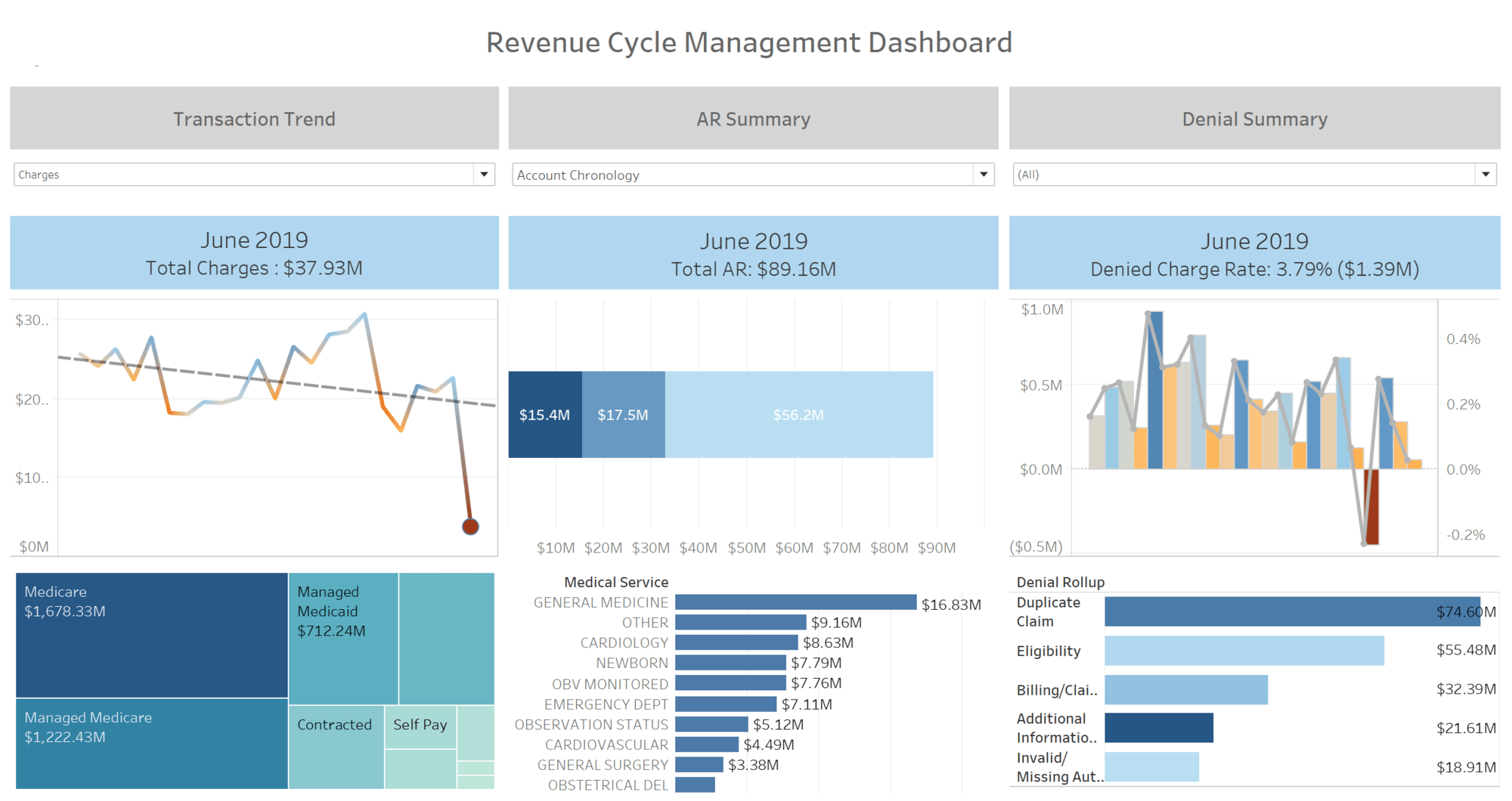

Days in Accounts Receivable (DAR)

Days in Accounts Receivable (DAR) is one of the core KPIs in dashboards for revenue cycle management. The average number of days it takes a healthcare company to be paid after rendering services is measured by this KPI. A lower DAR suggests that the company is collecting payments on time and has a more effective revenue cycle. If DAR is high, billing and collections concerns may be present, requiring firms to explore and fix inefficiencies to improve cash flow.

First Pass Acceptance Rate

The effectiveness of the billing process is evaluated by the First Pass Acceptance Rate, a crucial Key Performance Indicator. It shows the proportion of claims that payers approve without asking for more information or resubmissions. A better billing procedure is indicated by a greater first pass acceptance rate, which lowers the possibility of late payments and denied claims. Healthcare companies may reduce the risk of revenue loss from billing mistakes and increase revenue cycle efficiency by tracking and optimizing this statistic.

Denial Rate

A crucial metric for evaluating how well a healthcare company submits and processes claims is its denial rate. This measure indicates the proportion of claims that payers reject, suggesting possible problems with coding, paperwork, or other areas of the invoicing process. Monitoring the Denial Rate helps firms identify areas for improvement, take remedial action, and minimize refused claims, boosting income.

Net Collection Rate

A comprehensive measure that evaluates an organization's revenue cycle's efficacy from a financial standpoint is the net collection rate. The proportion of revenue collected is computed subsequent to the deduction of modifications, denials, and contractual allowances. A low Net Collection Rate may suggest billing, collections, or payer contract difficulties, whereas a high rate implies effective revenue cycle management. Organizations may find areas for improvement and put measures in place to optimize revenue collection by keeping an eye on this KPI.

Charge Entry Lag

Charge Entry Lag, the time it takes from healthcare service delivery to billing system entry, is a critical operational statistic. A shorter charge entry lag indicates a more efficient billing procedure, which lowers the possibility of late claim submission and maximizes revenue cycle effectiveness. Organizations may speed up the revenue cycle and enhance their financial performance by continuously monitoring and decreasing charge entry latency.

Accounts Receivable (AR) Aging

Accounts Receivable Aging is a detailed study that ranks outstanding receivables by length of time. This indicator shows how outstanding balances are distributed within several aging buckets, giving an overview of the organization's financial health. By assessing AR aging, healthcare companies may detect issues, prioritize collections, and minimize AR aging to improve cash flow.

Collection Effectiveness Index (CEI)

An organization's ability to collect effectively is measured by a performance statistic called the Collection Effectiveness Index (CEI). It calculates the proportion of charged amounts that are paid for within a certain period of time. A lower CEI might point to difficulties in collecting unpaid accounts, while a higher CEI suggests a successful and effective collections operation. Healthcare businesses may assess their collections techniques and make data-driven changes to improve financial performance by monitoring the CEI.

Patient Satisfaction Scores

Although conventional financial measurements remain crucial, in healthcare practices, patient happiness has become more and more important in recent years. Patient satisfaction scores, frequently determined by surveys, reveal the complete patient experience, including billing and financial procedures. Patients who are satisfied are more likely to pay their bills on time, which lowers the possibility of bad debt and strengthens the organization's finances. Financial performance and a good patient experience may be linked for businesses by integrating patient satisfaction ratings into revenue cycle management dashboards.

|

Learn about the top 10 features of embedded business intelligence. |

Clean Claim Rate

A crucial KPI called the Clean Claim Rate evaluates the proportion of claims that are sent to payers' error-free or with no inconsistencies. Reduced chances of claim rejections and delays are indicated by a high clean claim rate, which is a sign of an efficient billing process. This statistic helps firms optimize coding, documentation, and billing, expediting the revenue cycle and claims processing.

Average Reimbursement Time

Average Reimbursement Time is a significant indicator that shows how long payers often take to reimburse healthcare organizations after filing a claim. This KPI shows reimbursement efficiency and helps firms discover bottlenecks that cause delays. Organizations can maintain timely financial stability, boost liquidity, and speed cash flow by decreasing the average reimbursement time.

Payer Mix Analysis

Examining the patient and revenue distribution among various payers, including self-pay, government programs, and commercial insurance, is known as payer mix analysis. Revenue cycle managers must understand the payer mix to evaluate their dependency on individual payers and predict reimbursement rate changes. Through smart decision-making, companies may diversify their payer mix and reduce financial risks from reimbursement policy changes.

|

Learn the advantages of InetSoft's small footprint BI platform. |

Patient Financial Responsibility Ratio

Patient Financial accountability Ratio monitoring is essential as patient accountability for healthcare expenditures rises. This KPI calculates the portion of total income that is generated by patients directly, including amounts paid out of pocket as well as copayments and deductibles. A greater patient financial responsibility ratio might be a sign that better collections techniques or more patient education are required. Healthcare companies may modify their revenue cycle strategies to conform to changing patient payment dynamics by comprehending and controlling this ratio.

Registration Accuracy Rate

One KPI that assesses the accuracy of patient data gathered during the registration process is the Registration Accuracy Rate. The revenue cycle depends on accurate patient data since registration mistakes might result in claim rejections and payment delays. This measure evaluates the proportion of patient records that are error-free, guaranteeing that billing data is accurate from the start. Healthcare businesses may improve overall revenue cycle efficiency, decrease billing mistakes, and reduce rework by maintaining a high registration accuracy rate.

Appeals Success Rate

One important indicator for assessing how well an organization's appeals procedure overturns rejected claims is the Appeals Success Rate. Claim rejections may still happen even with the greatest of intentions, which is why the appeals procedure is an essential part of revenue cycle management. This KPI calculates the proportion of rejected claims that are successfully appealed and then paid back. High appeals success rates suggest a strong framework for disputing rejections, enabling firms to recover lost money. The performance of the revenue cycle as a whole may be greatly enhanced by tracking and optimizing this statistic.