What Is the Most Important Analysis to Do for a Salesforce That Most Sales Operations Teams Do Not Do?

One of the most valuable yet underutilized forms of analysis for a Salesforce is a comprehensive breakdown of sales cycle velocity by deal stage and buyer persona. Most sales operations teams track general metrics like win/loss rates, average deal size, and quota attainment. However, they often miss the opportunity to dissect how long prospects remain in each stage of the pipeline, especially when segmented by buyer roles, deal types, or industries. This level of granularity can yield transformative insights into the root causes of pipeline friction and lost opportunities.

For example, a sales team may see that deals involving procurement managers consistently stall in the negotiation phase, while deals with department heads get stuck earlier during the discovery process. Without this analysis, sales enablement efforts may be misaligned—focusing on general objections rather than role-specific concerns. By identifying where delays occur and which personas are involved, operations leaders can fine-tune the sales process with tailored content, coaching, or automated nudges at the right moments.

Furthermore, velocity analysis allows organizations to identify and emulate top-performing reps who close certain types of deals faster. This insight is especially valuable when launching new products or expanding into new segments. Sales leaders can optimize forecasting accuracy, resource allocation, and even territory planning by understanding the variable pace of different types of deals.

Most importantly, this analysis shifts the conversation from vague pipeline health to actionable intelligence. It enables the team to address specific slowdowns with data-driven solutions, boosting revenue predictability and improving the buyer experience. In a high-stakes sales environment where every delay translates to lost revenue or missed targets, understanding and accelerating stage-specific sales velocity is a strategic advantage that too few teams leverage.

15 Most Common Salesforce Analyses

The most common Salesforce analyses are designed to track pipeline health, sales performance, conversion rates, customer behavior, and forecasting accuracy. These analyses help teams understand what is working, where opportunities lie, and how to streamline sales processes. Below is a breakdown of the most widely used Salesforce analyses and their strategic value to organizations.

1. Pipeline Analysis

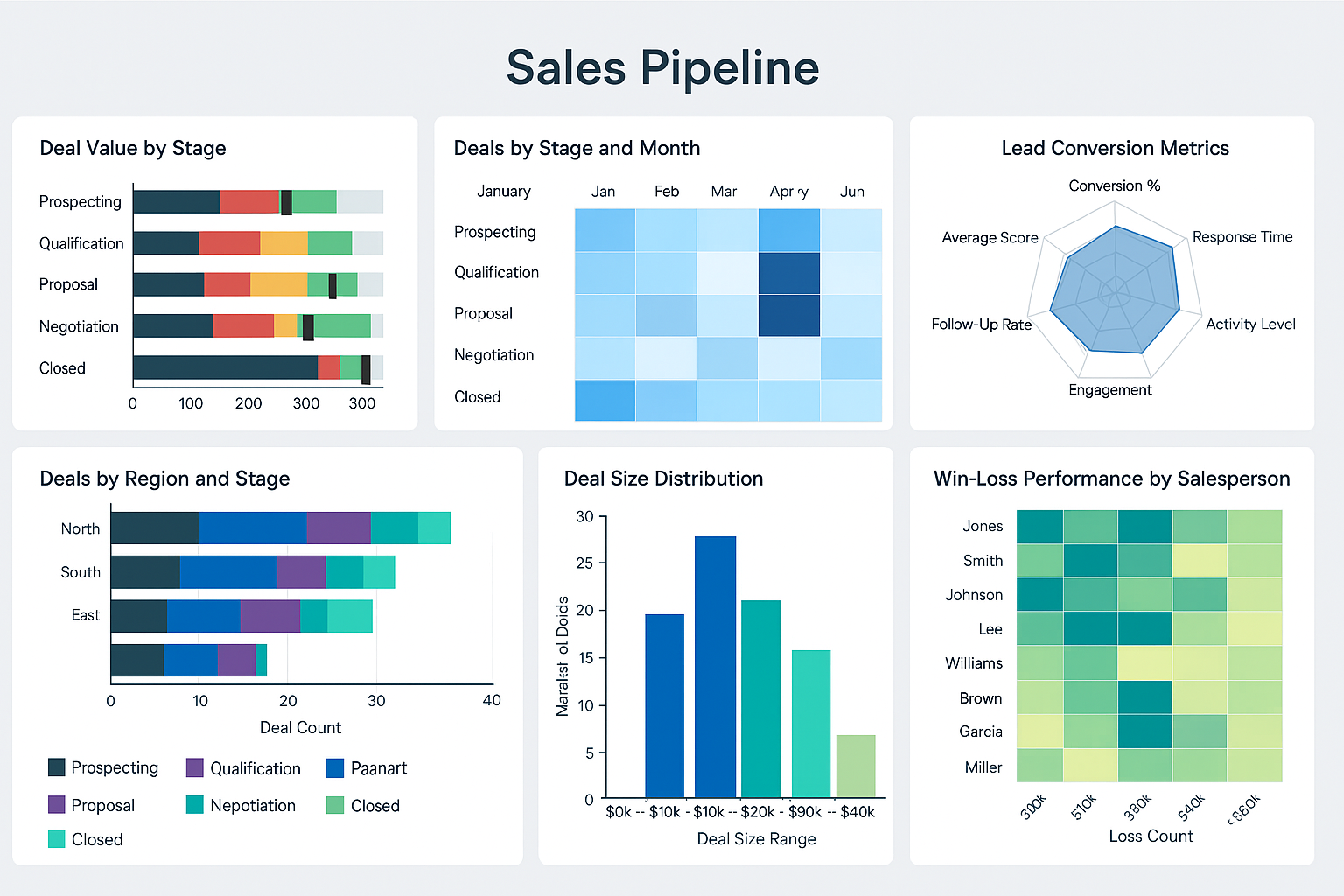

Pipeline analysis is one of the most fundamental and frequently used Salesforce reports. It provides a snapshot of all open opportunities, segmented by stage, deal size, close date, or sales rep. This analysis helps sales managers monitor pipeline coverage, determine if quotas are achievable, and identify where deals are getting stuck. It’s particularly useful for spotting gaps in the pipeline early and for ensuring a balanced distribution of opportunities across different stages of the sales cycle.

2. Win/Loss Analysis

This analysis examines the ratio of won deals versus lost deals over a defined period. By looking into why deals are won or lost, sales leaders can uncover patterns such as pricing objections, lack of product fit, or poor sales qualification. Win/loss data can be further enriched by filtering for competitor involvement, buyer personas, and deal types. This provides powerful insight into what tactics lead to success and where improvement is needed.

3. Lead Conversion Rate

Lead conversion analysis tracks how many leads move through the funnel—from being a raw lead to a qualified opportunity, and finally to a closed deal. This metric is critical for evaluating marketing effectiveness, sales readiness, and lead quality. Sales teams can use this information to identify high-performing lead sources, optimize lead scoring models, and improve collaboration with marketing teams to drive better MQL-to-SQL conversion rates.

4. Sales Activity Analysis

Salesforce can track all activities related to each opportunity, including calls, emails, meetings, and follow-ups. Activity analysis helps assess whether reps are putting in the necessary effort to close deals. It also shows what types of engagement are most successful for moving deals forward. Managers use this data to identify underperforming reps, coach on outreach strategy, and benchmark productivity across the team.

5. Forecast Accuracy Analysis

Forecasting analysis compares predicted revenues to actual closed deals. High forecast accuracy is crucial for operational planning, resource allocation, and investor communication. Salesforce allows organizations to view forecast trends over time, segment by region or rep, and measure how well reps are estimating deal close probabilities. Discrepancies between expected and actual results can point to issues with pipeline qualification or sales optimism bias.

6. Deal Velocity and Stage Duration

Sales velocity measures how quickly deals move through the pipeline, while stage duration analysis shows how long opportunities spend in each phase of the sales cycle. Together, these metrics help diagnose inefficiencies in the sales process. For example, if deals are consistently stalling in the proposal stage, it might indicate issues with pricing, approval workflows, or customer readiness. Shortening cycle times increases win rates and improves cash flow predictability.

7. Top-Performing Rep Analysis

Identifying who the top sales performers are—and understanding why they succeed—is a cornerstone of sales analytics. Salesforce dashboards can compare reps by quota attainment, win rate, average deal size, sales cycle length, and number of closed deals. These comparisons help managers replicate successful behaviors through coaching, playbooks, or automated workflows. It also helps with compensation planning and team resource alignment.

8. Customer Segmentation and Account Penetration

Segmenting accounts by industry, company size, region, or buying behavior allows teams to tailor their messaging and sales approach. Penetration analysis looks at how deeply a team has engaged a given account—whether through product cross-sell, multi-contact outreach, or expansion deals. Salesforce’s account-level reporting tools can reveal white space opportunities, upsell potential, and key stakeholders that haven’t yet been touched by the sales team.

9. Churn and Renewal Analysis

While often the domain of customer success teams, Salesforce can be used to track churn patterns and analyze renewal trends. Sales teams can review contract data, usage reports, and previous interactions to identify at-risk accounts and create proactive strategies to retain customers. This analysis is especially critical for SaaS businesses where recurring revenue and customer lifetime value are primary growth drivers.

10. Product and Pricing Performance

By analyzing sales data by product or SKU, teams can see which offerings are driving revenue, which are underperforming, and how pricing strategies impact conversion. Salesforce reports can track bundles, discounts, and margin erosion to provide clear insights into how pricing decisions affect profitability. This allows companies to make smarter product roadmap and packaging decisions based on real sales performance.

11. Campaign Attribution and ROI

Salesforce's integration with marketing automation tools enables campaign attribution analysis. This tracks which campaigns generate pipeline, how much revenue each source contributes, and how long it takes for leads from each campaign to close. It’s vital for aligning sales and marketing and for making data-backed decisions on where to invest marketing budget for maximum return.

12. Territory Performance

Salesforce can provide insights into how different geographic or account-based territories are performing. Managers can compare regions based on revenue, pipeline size, deal velocity, and win rates. This analysis helps with territory realignment, resource distribution, and evaluating market penetration strategies.

13. Custom Funnel Analysis

Many companies customize their sales funnels to reflect their unique sales processes. Salesforce’s customizable reporting allows teams to define their own funnel stages and measure conversion rates at each step. This helps in identifying where drop-offs occur and which steps are the most critical to improve.

14. Quote-to-Cash Performance

This analysis tracks the end-to-end process from quote creation to deal closure and billing. It highlights where delays happen, such as in approval processes, contract negotiations, or invoicing. Optimizing this process improves customer experience and accelerates revenue recognition.

15. Competitive Deal Analysis

Tracking opportunities that involve known competitors helps teams understand where they win or lose relative to others in the market. Salesforce can log competitor presence and outcomes, allowing organizations to build strategies to counter competitive threats and refine their unique value proposition.