Business Intelligence for Insurance

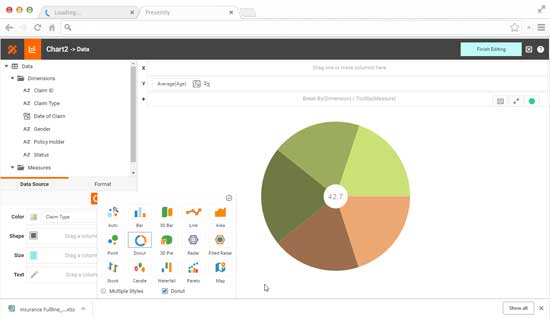

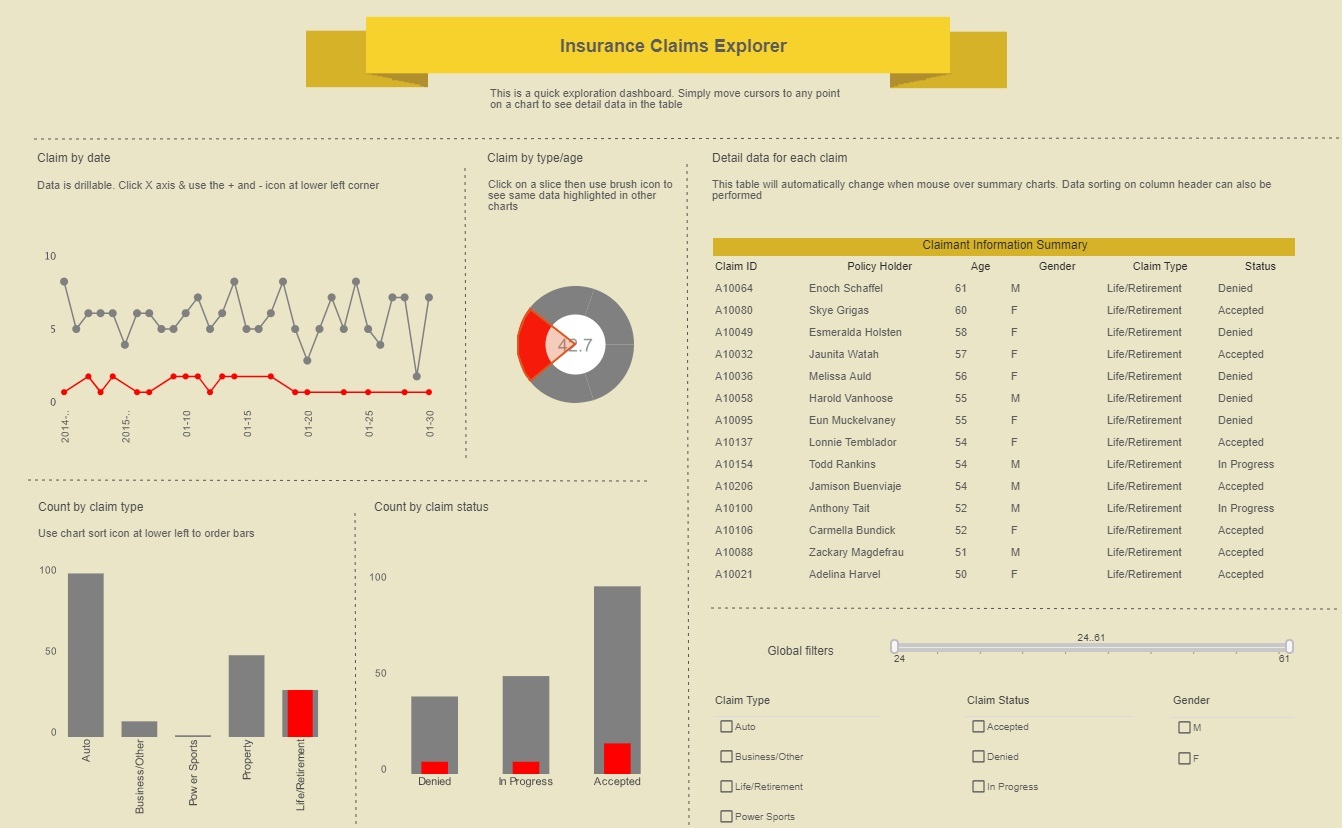

Automated parameterized reports keep managers in the know while a robust toolset allows users to weave quantitative analysis, qualitative alerts, and predictive insurance analytics into a seamless process that can effectively increase revenue, control costs, and help to manage risk.

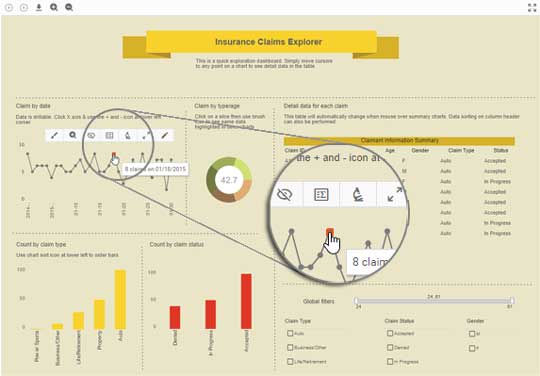

Custom dashboards accentuate metrics that must be improved upon in order to meet minimum standards set for key performance indicators like: number of days claims are open, claims where initial liability decision is not made within statutory time frame, and percentage of claims with missing documentation.