Make InetSoft Your Insurance Industry BI Vendor

Are you in the insurance industry and looking for a BI vendor?

Founded in 1996 and headquartered in Piscataway, NJ, InetSoft Technology is the ideal BI vendor for the insurance industry in America, providing solutions which allow your business to easily analyze and interpret data, making day to day business activities run smoother.

American insurance companies are among the largest, diverse, and most complex of organizations. InetSoft's BI can save your company the chaos that often comes with trying to utilize mountains of data. InetSoft's data reporting software is ideal for insurance industry business intelligence activities, such as:

- Analyzing customers' behavior and relationships to discover new opportunities and cross-sell potential

- Monitoring insurance sales down to individual agent performance

- Discovering which strategies are beneficial and what practices need to be altered

- Optimizing claims processing and strengthening claims service levels

- Empowering underwriters with access to premium and loss ratios

- Watching for risk and policy portfolio exposures across products and lines of business

- Ensuring regulatory compliance and uncovering fraud through ad hoc investigation and reporting

- Optimizing operations, improve services, and streamlining IT

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Big Data Handled Securely

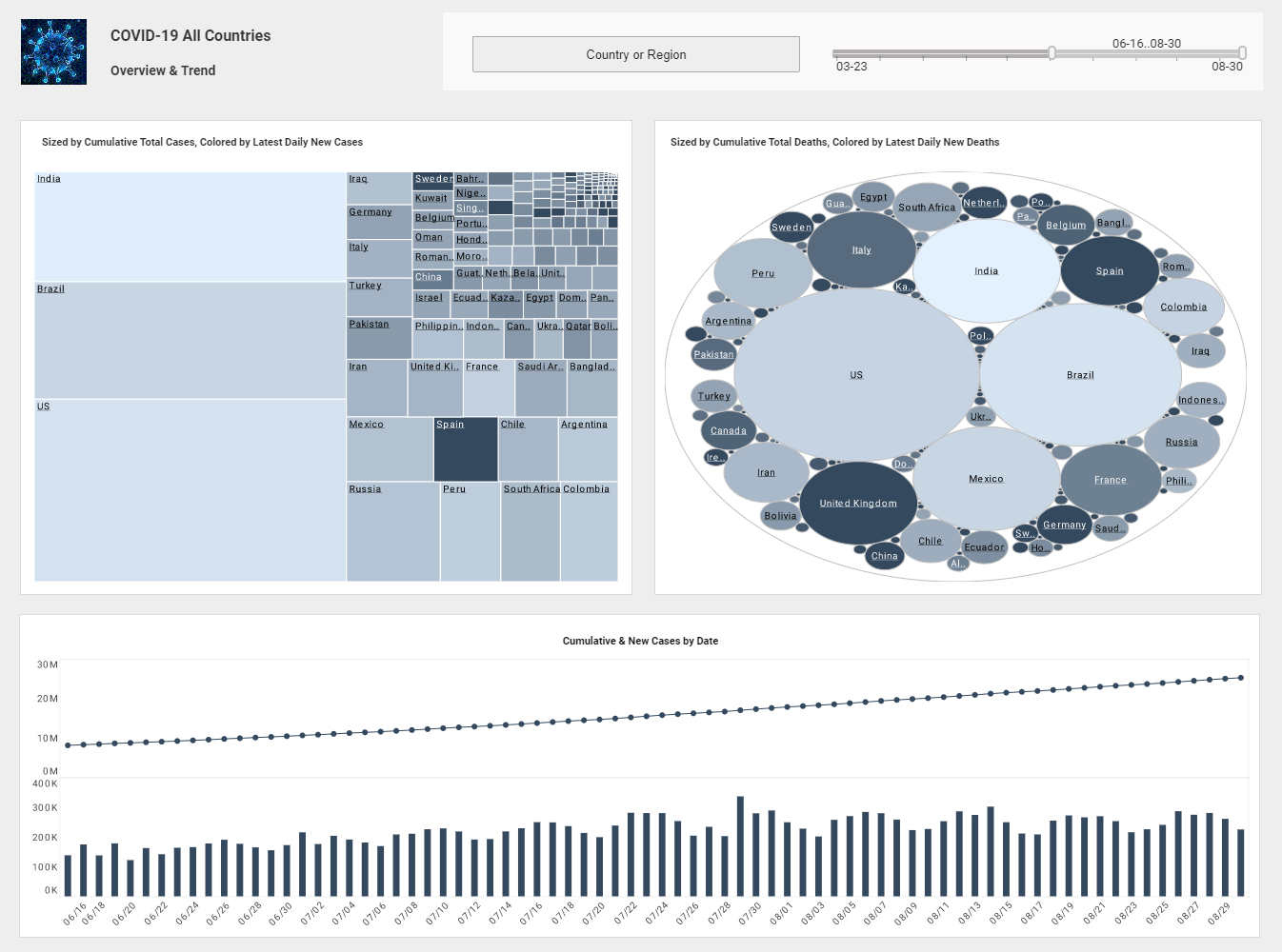

It's not uncommon for insurance companies to store massive volumes of data, whether it be patient or customer information. Traditional BI tools are not equipped to handle this amount of data, or gain any kind of useful insights from it.

InetSoft is staying ahead of the curve with Big Data compatibility, with custom connectors for all popular Big Data sources, and an advanced caching technology for keeping waiting times low. InetSoft's dashboard and visualization software, StyleBI, can access big data sources such as Apache Spark, Cloudera, Hadoop, MapR, and SAP HANA. It's data access technology employs a hybrid of in-memory storage, intelligent disk-caching and Hadoop-like column-based indexing to deliver high performance on massive amounts of data.

All data is stored on a secure infrastructure, where access to data is only available to the builder of the dashboards and whoever is given authorization by the administrator. Permissions can be altered by the administrator at any time.

Optimize Your Performance With Analytics

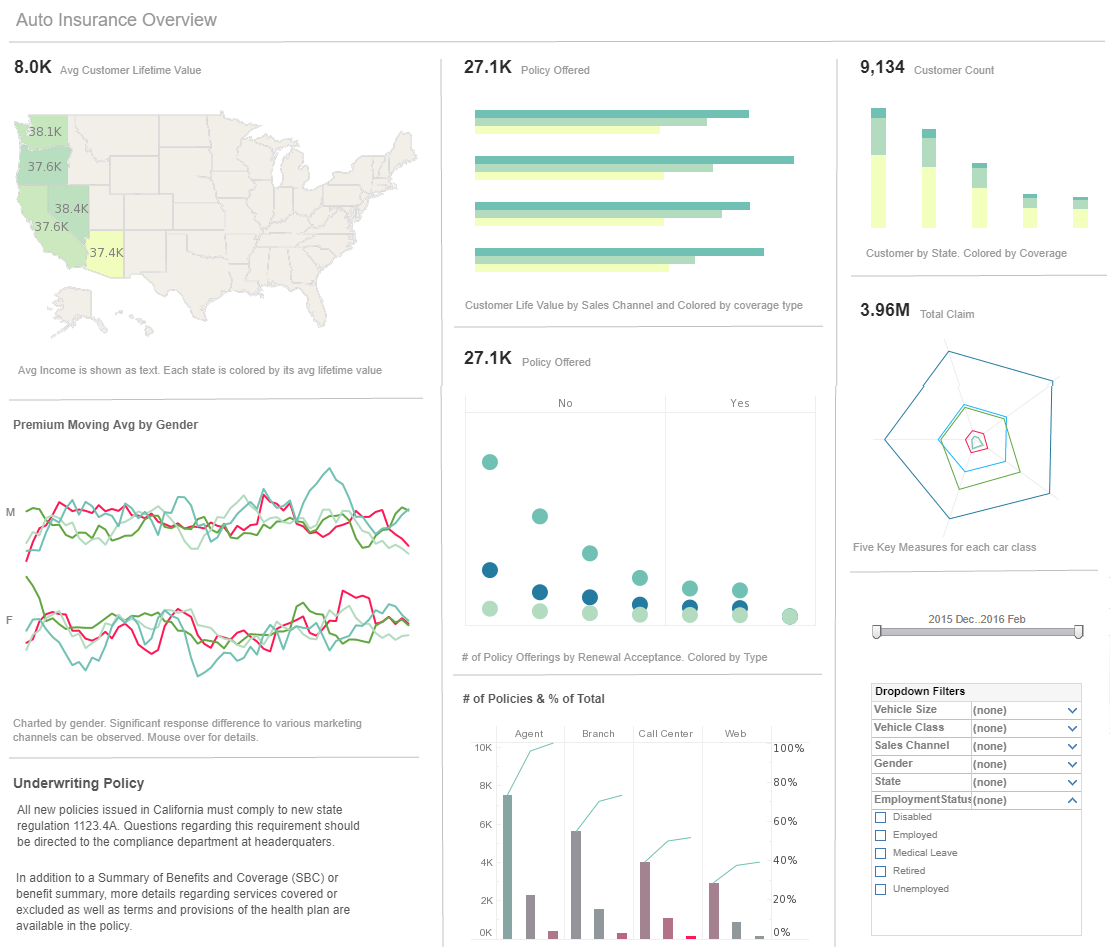

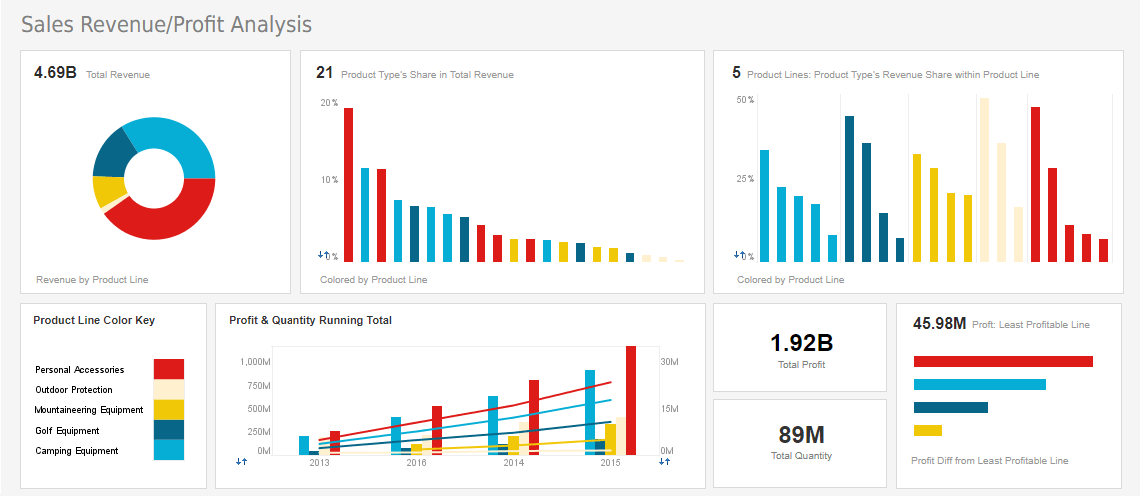

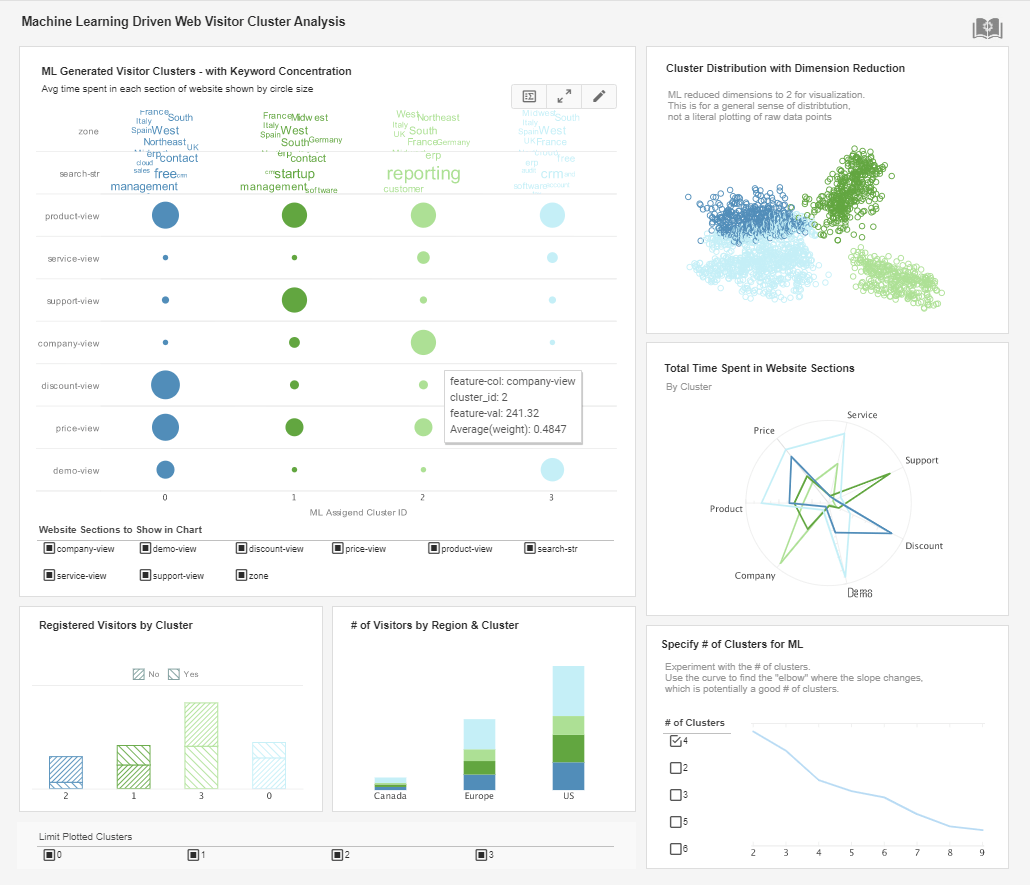

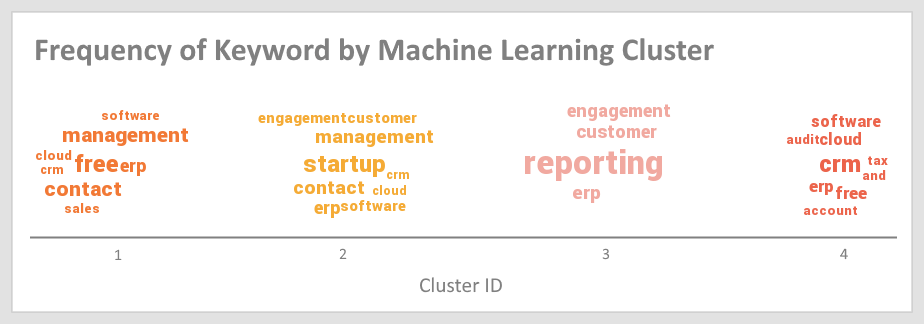

With InetSoft's solution, creating interactive dashboards is simple for end-users. With easy-to-use visual analytics, managers can determine which product lines need to be extended and what will benefit each customer segment, even drilling down to individual customer profiles, if desired.

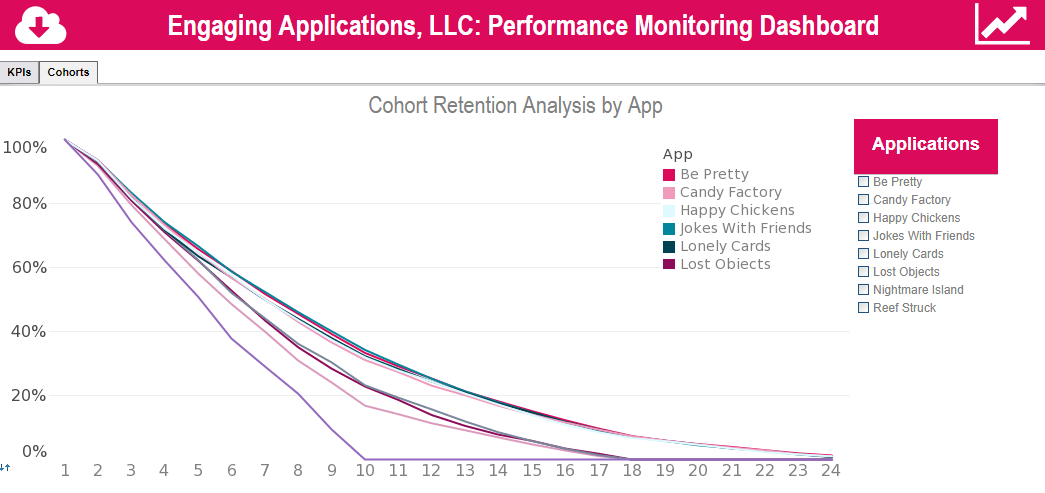

In the everyday insurance business, multiple calculations and algorithms are performed to assess risks and suggest rates to be applied to various categories of people. Through the use of visual analytics, users can see how accurate their organization's predictions are, and how well their strategies for coverage are working. StyleBI's what-if analysis can even be used to predict the effectiveness of new customer models.

Empower your organization by gaining a clearer understanding of business activity, allowing for optimal decisions affecting business performance, profitability, and customer happiness. Regularly scheduled reports will keep insurance managers aware of business activity, while a robust toolset allows analysts to weave quantitative analysis, quantitative alerts, and predictive analytics into a coherent process that can effectively increase revenue, control costs, and help to manage risk.

Get Custom Dashboards

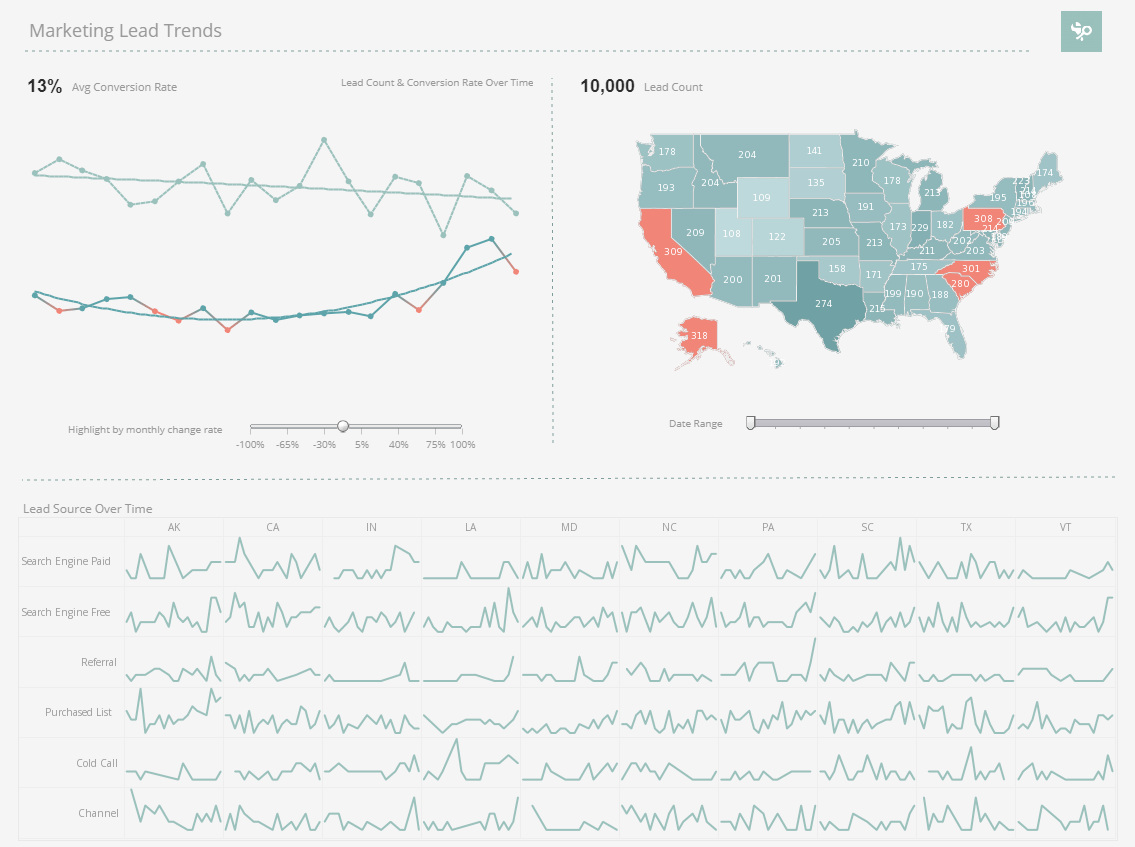

Custom dashboards can be built to highlight metrics that need improvement, in order to meet minimum standards set for key performance indicators, such as: the number of days claims are open, percentage of claims missing without documentation, and so on.

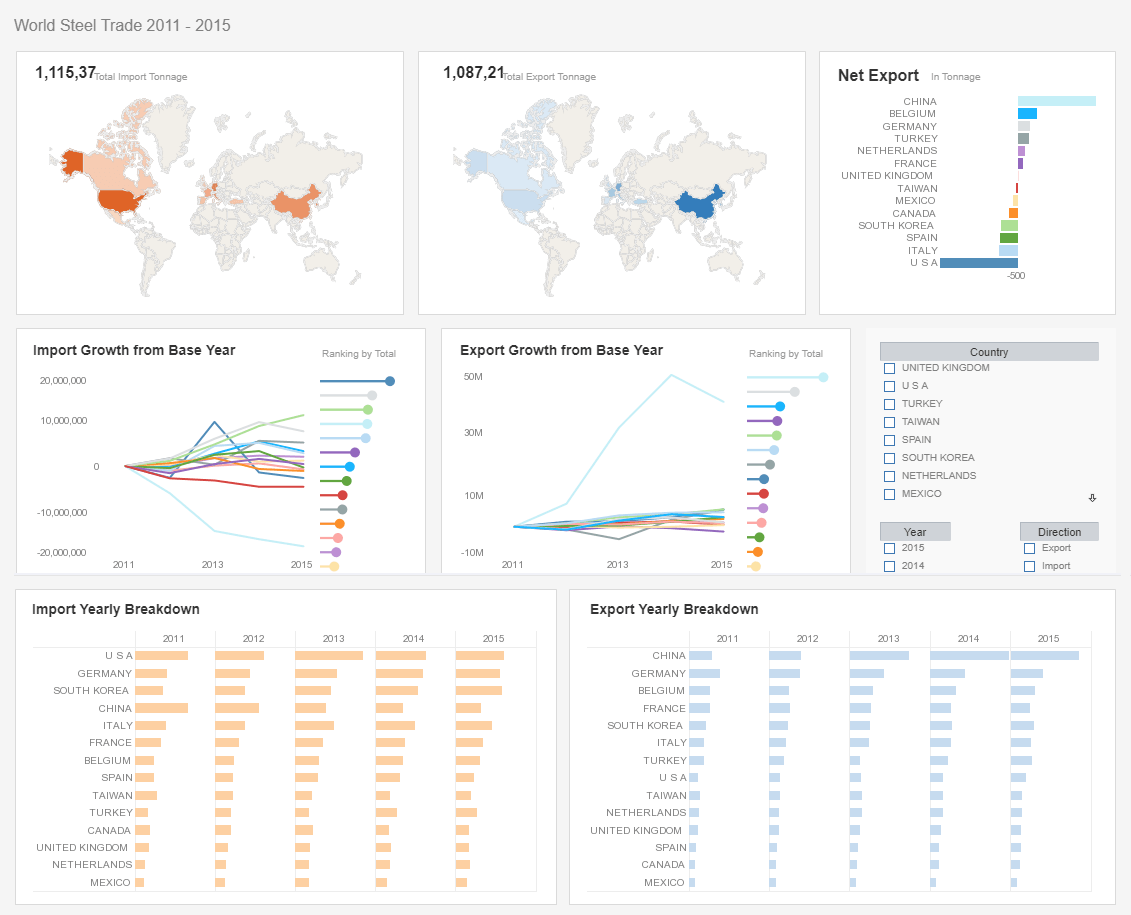

Users can ask questions of their data through filtering with sliders, drill down reporting, brushing, dynamic data binding, multi-dimensional charting, custom geographic data binding, and multi-source data mashup visualization, all through the use of a drag-and-drop tool. Whether your organization prefers to have their BI solution hosted on the cloud or on-premise, InetSoft's web-based interface can be accessed anywhere, from a desktop, tablet or any mobile device.

Simple and Flexible

Through the use of InetSoft, enterprises can seamlessly evaluate multi-dimensional data with simple user-created visual representations. Running your business will be much less of a hassle. With InetSoft as your BI vendor, analyzing data and optimizing your company's performance is made simple.

The software is available through a flexible pricing structure which empowers your company to select affordable pricing based on its projected usage. Both simple to use and affordable, InetSoft is an ideal BI vendor for insurance providers.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Some of InetSoft's Customers in the Insurance Industry

- Canal Insurance Company

- Great American Insurance Group

- ING North America Insurance Group

- MetLife