Business Intelligence for Healthcare Insurers

This is the transcript of a Webinar hosted by InetSoft on the topic of "Business Intelligence for Healthcare Insurers." The speaker is Mark Flaherty, CMO at InetSoft.

Today’s Webinar is about exploring the enterprise business intelligence challenges healthcare insurers face in the 21st century and how analytic solutions are helping create better industry performance and competitive advantage through better business decisions and stronger customer relationships.

Our first topic is about how analytics drive innovation for commercial health care companies. We have worked with a large healthcare insurer. Those companies that are responsible for some of the financial side of the whole healthcare equation often called the payers. What we are finding now is a shift in orientation where what were traditionally considered healthcare payers, the companies handling the financial transactions, are now really broadening their value add to our healthcare system.

They are really thinking about how they move beyond being a payer and really more of a wellness partner, teaming more closely with not just the large employers that hire or that buy services from the health insurance companies, but the individual members. And a big part of that shift coming from a transaction processor to a wellness partner is really about how well health insurance companies know their customers, how well they know what products best serve customers, how they can best provide guidance, provide people the kinds of programs that improve their overall health.

Analytics Drive Innovation for Commercial Health Care Companies

So I think, from an innovation perspective, typically, you wouldn’t think about healthcare arenas being terribly innovative, frankly from a standpoint of applying information. But there is a huge opportunity to improve the health outcomes, the health and well being of the membership of the population overall by using information, by understanding which medical technologies work best with which segments of the population, which interventions, which protocols are having the best results in aiding diabetics to better control their condition, to help reduce the overall situation with heart patients that have chronic heart conditions.

With good customer analytics, BI vendors like us can help healthcare insurers innovate around information, and we can all see how it can lead to better outcomes in a health care delivery system. I think this is real and is something that our clients are embracing now as they recognize a shift from being just a payer, a transaction processor to a wellness partner.

Also business intelligence also helps companies look internally. There are almost always opportunities for companies such as health insurance companies and certainly as service providers to this industry to think about innovating around the processes that are needed in the back office if you want to deliver the best services to the marketplace.

Being more efficient, more cost effective is all about understanding where we have inefficiencies, where we have manual blockages, if you will, in some of our workflows, in applying information to accelerate, to automate and in many cases, embed analytics or embed business intelligence into these operational processes to reduce manual efforts and to increase automated processes and automated mechanisms for addressing the internal aspects of our business.

Where do you see analytics having the greatest impact for the health care payer industry? I think there are two areas, and they’re multifaceted. The two primary dimensions I think where you see analytics playing a big role is in managing what are the internal costs, the SG&A, the administrative cost of just running a health plan. The other side is the actual cost around delivering the medical care.

Streamline Operations with Business Intelligence

Today, depending on how well the organization operates, depending on the morbidity, if you will, of their population, you might see the medical cost being up to 90% of the overall cost structure and administrative cost being 10%. It could be as much as 15%, and you might see medical cost being 85%. So you have got an opportunity to work both those levers, the medical cost side of the equation and the administrative cost side of the equation. And those are both multibillion dollar propositions.

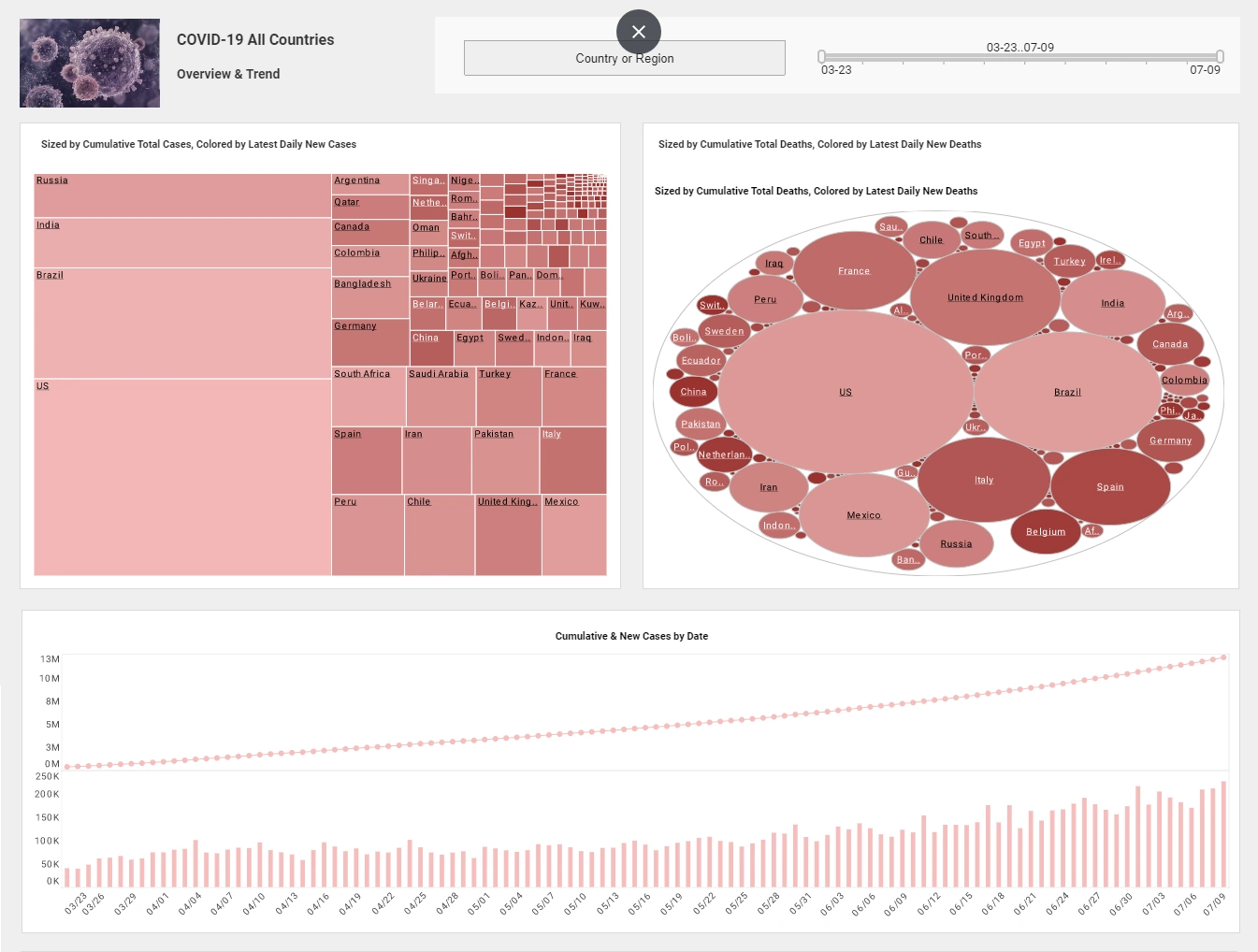

Healthcare insurers increasingly rely on business intelligence (BI) to streamline operations, manage risk, and improve decision-making across the enterprise. At its core, BI helps insurers collect, integrate, and analyze data from claims, electronic health records, member services, and provider networks. By creating a single source of truth from these disparate data systems, BI tools enable insurers to reduce fraud, detect anomalies, and identify cost drivers. Dashboards and visual analytics allow actuaries, claims managers, and executives to quickly spot trends such as rising costs in specific treatments or regions, which can then be addressed through policy adjustments or new care management initiatives.

Another critical area where BI adds value is in optimizing member engagement and care outcomes. Insurers can use predictive analytics and segmentation tools to better understand the health risk profiles of their populations. This enables them to design targeted wellness programs, recommend preventative care, or trigger early interventions for high-risk members. For example, a BI system might flag individuals with chronic conditions who are not adhering to medication schedules, prompting outreach from care coordinators. This not only improves the health outcomes for members but also reduces avoidable hospitalizations and long-term costs, aligning with value-based care goals.

From a strategic standpoint, BI supports healthcare insurers in staying competitive in an evolving regulatory and consumer-driven landscape. BI helps track compliance with government mandates, analyze plan performance, and assess market demand. It also provides granular insights into customer behavior, enabling more personalized product offerings and pricing strategies. With powerful self-service capabilities like those offered by tools such as StyleBI, insurers empower business users to explore their data without IT bottlenecks, accelerating insight generation and fostering a more agile, data-driven culture across the organization.