Business Intelligence in the Finance Department

This is the transcript of a Webinar hosted by InetSoft entitled "Business Intelligence in the Finance Department." The speaker is Mark Flaherty, CMO at InetSoft.

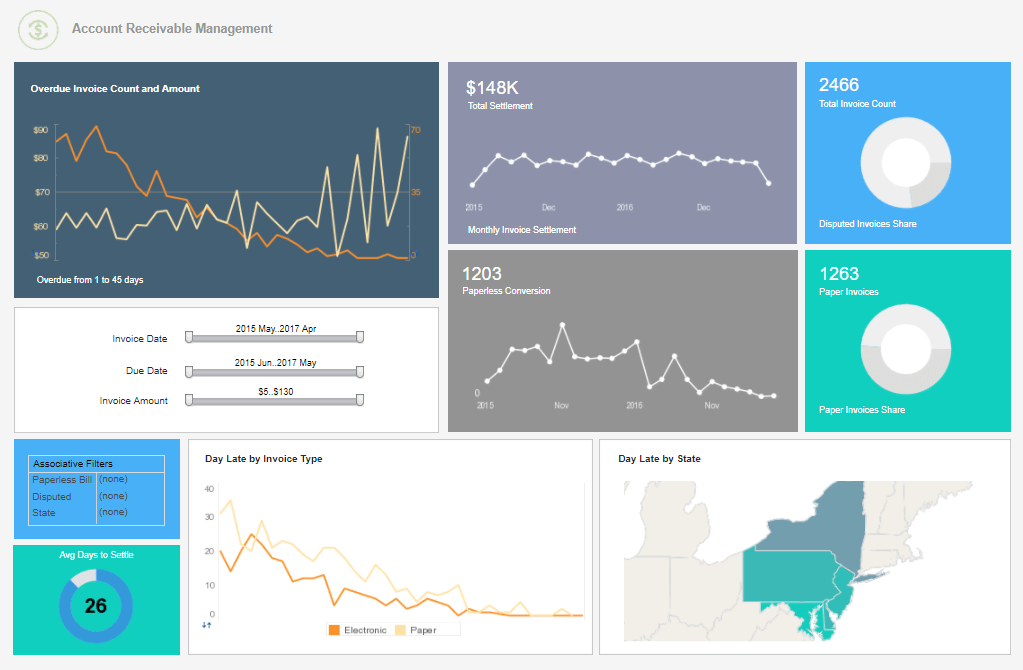

This Webinar is about how business intelligence can transform the finance department. We will show you how Finance can employ business intelligence to correlate financial outcomes with business activities to help you achieve strategic objectives. Following today’s part one of this two part series, come back and attend part two of this podcast to learn how performance management can help you organization better communicate, execute strategy and respond quickly to changing market conditions.

The first objectives here for this presentation is really to lay out the BI landscape, draw the high level issues and hopefully in future Webcasts we can come back and drill into some details. So the first thing I am going to address is the changing role of finance. It’s one department that’s undergoing significant change, thanks in most part to new technologies and new instruction being delivered by business intelligence.

We’re going to drill a little bit more into specific BI issues for finance, specifically data management issues and the difference between operational reporting and business intelligence. We’ll touch a little bit on planning and budgeting which is a key finance activity and finally finish up with performance management.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Evolving CFO Business Intelligence

So first let’s talk about the evolving role of Finance. Now traditionally people in the finance department have been more in back office I would say, more operation, more tactical and focused. They handle things like statutory reporting, management reporting, and they close the books every month of every quarter. They’ve handled budget compliance, treasury, tax, cash and capital. These are more tactical responsibilities, more back office types of operations, not necessarily directly involved in the business of the business. But we’re seeing a change.

We’re seeing a lot of finance departments led by ambitious CFOs trying to carve out a new role for themselves, trying to help the business more than simply record what it has done. We’re seeing finance departments help the company identify real value drivers, drivers of profitability and revenue.

They are helping departments reengineer their processes because they’re seeing what’s working and what’s not. They are suggesting new investments for the company to move into, implementing dashboards and scoreboards to record performance, and doing continuous planning as opposed to just annual budgeting. They are improving forecasts, calculating profitability of customers and products predicting customer churn and other things of this sort.

So I think the real question is, is Finance content to be at the back of train, to be the caboose that’s being pulled by the business? Does it want to be the department that records the performance of the business but is not actually driving the business? Is it content to be an accountant? Or does it want to be an advisor to the business? Is it content to be a book keeper? Or does it see itself as more of a savvy strategist? Is it content to be a cost center, or can it actually be a process center? I think those are the key issues facing finance departments today.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

Transformation of Finance

I believe we’re really seeing a transformation of Finance. They are moving towards being that strategic advisor for the business. But one of the big challenges for CFOs and for finance departments is they’re really trying to balance that with being a cost center. There’s always a push for greater efficiency and cost containment. So at one level, they’re trying to drive cost out of the business and do things as efficiently as possible. At the same time Finance is being asked, and the organization wants them to become much more of a strategist and strategic advisor to the business.

Here’s some quote sets are collected from CFOs. I’m just going to read these because I think they’re very powerful. One, we need to change from being a financial record keeper to a proactive partner with the business. Another CFO said I want the finance group to do more than accounting. I want them to help the company make profitable decisions.

Another said we need to collaborate with the business if we’re going to improve the financials. Showing them actuals and targets isn’t enough. We need to help them reengineer fundamental process. So in these quotes you can hear CFOs saying we need to get more involved in the business of the business. And we just can’t record what’s going on by virtue of our position in the organization.

So what does business intelligence have to do with any of this? Very simply it’s that information is the currency of finance. Business intelligence is a discipline that empowers users with information. So these are great partners, finance and business intelligence. I like to think of business intelligence as a data refinery. And you all know about oil refineries.

| Next: A Business Intelligence System Is Like a Refinery |