Fraud Management and Detection Dashboards for Social Media Platforms

Analytic dashboards play a crucial role in fraud management, as they can help organizations detect and prevent fraudulent activities. By analyzing patterns and trends in data, organizations can identify potential fraudsters and take appropriate measures to stop them.

InetSoft's dashboarding tool provides various charts with rich visual components for analytic dashboards in a single Web App which helps organizations to identify areas of vulnerability and strengthen their fraud prevention measures accordingly.

Using Cards and Dynamic Text for Better Data Insights

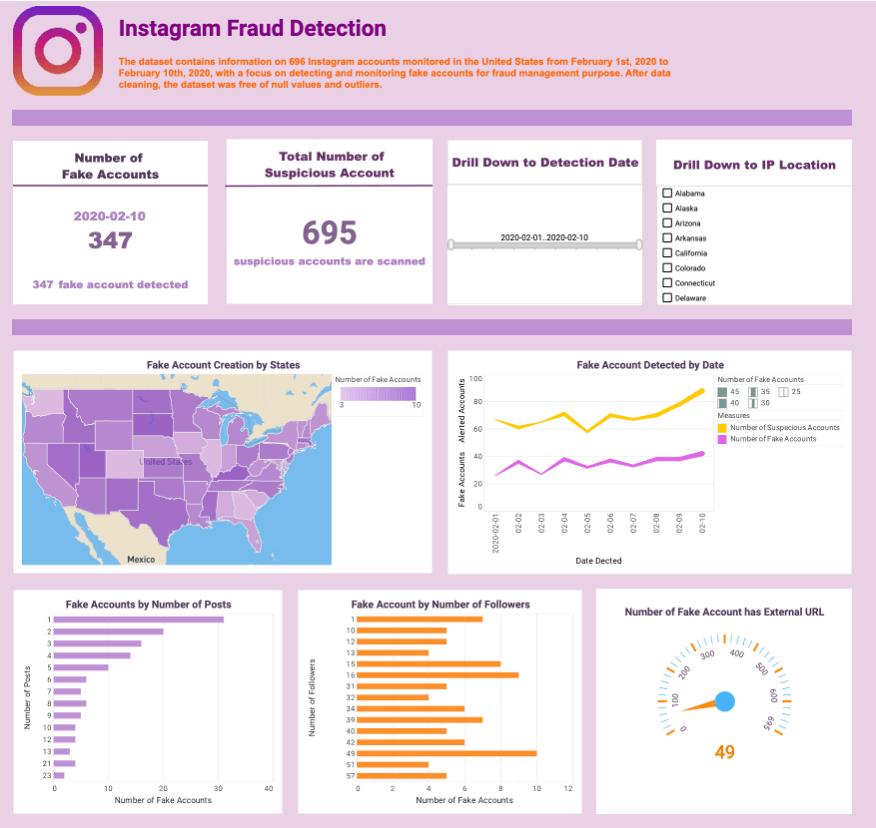

One of the key features of InetSoft's fraud management dashboard is the ability to monitor and analyze data in real-time. This can be done through the use of dynamic text, which is text that is hooked up to data sources and updates automatically as new data becomes available. For example, the dashboard could display the number of fake accounts that have been detected, along with a breakdown of these accounts by various criteria such as location and date.

Tracking Fake Accounts by State with a Regional Map

Another important feature of InetSoft's fraud management dashboard is the ability to visualize data in a clear and intuitive way. InetSoft's product allows users to create interactive dashboards that can display data in various formats, such as charts, graphs, and maps. For example, a map could be used to show the geographical distribution of fake accounts, while a chart could be used to track the number of fake accounts over time.

Tracking Influence or Impression of Fake Accounts

The influence or impression of fake accounts is a critical factor in fraud management, as the presence of fake accounts can skew data and create a false perception of user engagement or sentiment. By tracking fake accounts by the number of followers or posts, fraud management teams can gain insights into the potential impact of these accounts on their social media platforms. One way to track this information is by using a Histogram that displays the fake account count segmented by the number of followers or posts. This can help users to identify patterns and trends in the data and track the influence of fake accounts over time.

For example, if a high number of fake accounts with a large number of followers are detected, it could indicate that the fraudsters behind these accounts are attempting to manipulate user sentiment or influence public opinion. Similarly, if a large number of fake accounts with a low number of posts are detected, it could indicate that these accounts are being used for spamming or phishing purposes.

Filtering and Drill Down

In addition, this dashboard is designed to assist organizations in detecting and preventing fraudulent activities, such as fake accounts on social media platforms. Users can expect to find a range of features within the dashboard, including visualizations of patterns and trends and the ability to filter and analyze data based on various criteria, such as IP location, or date.

In summary, analytics plays a critical role in fraud management, and a well-designed dashboard can help organizations to detect and prevent fraudulent activities in real-time. InetSoft's product offers a range of features that can be used to create interactive dashboards for fraud management, including dynamic text, data visualization, and real-time monitoring capabilities.

What Are the Metrics Tracked on a Fraud Management Dashboard?

1) Fraud Detection Rate

What it means: The fraud detection rate measures the percentage of fraudulent attempts successfully identified before financial or reputational damage occurs. A high detection rate indicates that systems are effectively spotting anomalies and stopping them in time. Low detection rates suggest that fraudulent activity is slipping through, often revealed later during audits, chargebacks, or customer complaints.

How to affect it: Improve detection rate through enhanced machine learning models trained on diverse fraud scenarios, wider use of anomaly detection techniques, and incorporating external data sources such as blacklists or consortium data. Regular model retraining and adding rule-based thresholds for emerging threats can also push detection rates higher.

2) False Positive Rate

What it means: False positives occur when legitimate transactions are flagged as fraudulent. The false positive rate shows how often this happens relative to total flagged cases. A high rate can frustrate customers, increase support calls, and undermine trust, even if fraud is prevented.

How to affect it: Balance detection sensitivity with precision by tuning thresholds in fraud models, refining decision rules, and segmenting customers. Using contextual risk scoring—for example, differentiating between unusual but acceptable activity and high-risk anomalies—can help reduce false alarms while maintaining security.

3) Fraud Loss Amount

What it means: This metric measures the total financial value lost to fraud within a given period. It is the most tangible indicator of fraud’s impact on the organization. Even if detection rates are strong, high loss amounts can signal either large-scale fraud events or gaps in response time.

How to affect it: Minimizing loss requires both stronger prevention and faster containment. This involves investing in automated case management workflows that immediately freeze suspicious accounts or transactions, deploying real-time monitoring instead of batch analysis, and training staff to respond quickly to fraud alerts.

4) Time to Detect

What it means: Time to detect measures the average duration between when fraudulent activity occurs and when the system or team identifies it. Shorter detection windows reduce exposure and limit potential losses. Longer detection times often indicate that fraudsters can operate undetected across multiple transactions or accounts.

How to affect it: Implement continuous monitoring, automate risk scoring, and deploy AI-driven anomaly detection to shorten detection windows. Integrating multiple data streams in real time—such as payments, logins, and geolocation—helps highlight fraud as it happens rather than after the fact.

5) Time to Resolution

What it means: This metric tracks the average time it takes to fully resolve a fraud case after detection. Resolution includes investigation, remediation, customer communication, and closing the case in systems. Faster resolution prevents repeat fraud and restores customer trust more quickly.

How to affect it: Automating low-risk or clear-cut cases, providing investigators with comprehensive case data in a single view, and integrating fraud tools with customer service systems can accelerate resolution times. Clear escalation policies also prevent bottlenecks when cases are ambiguous or complex.

6) Chargeback Rate

What it means: In industries such as e-commerce and financial services, chargeback rate measures the percentage of transactions reversed due to fraud. High chargeback rates not only increase financial losses but can also damage merchant relationships with card networks and payment processors.

How to affect it: Reduce chargebacks by verifying identity at checkout, applying velocity checks for suspicious purchase patterns, and adding two-factor authentication for high-value transactions. Educating customers to quickly report suspicious account activity also helps stop fraud before it escalates into chargebacks.

7) Suspicious Transaction Volume

What it means: This metric captures the total number of transactions flagged for review by the fraud detection system. Spikes in suspicious volume can indicate emerging attack campaigns, while consistently high levels may suggest overly broad rules or miscalibrated models.

How to affect it: Tune detection rules to focus on high-risk indicators, apply risk-based authentication to reduce unnecessary flags, and regularly test fraud models against historical data to ensure they balance precision with recall. Monitoring the ratio of suspicious transactions to confirmed fraud cases can also highlight over- or under-filtering.

8) Account Takeover Attempts

What it means: Account takeover (ATO) attempts measure how frequently fraudsters try to gain unauthorized access to legitimate customer accounts. This is one of the fastest-growing fraud types, fueled by credential stuffing and phishing campaigns.

How to affect it: Strengthen defenses with adaptive authentication, device fingerprinting, and monitoring login velocity (e.g., multiple login attempts from different geographies in short time frames). Proactive dark web monitoring for credential leaks and encouraging multi-factor authentication adoption also reduces successful ATOs.

9) Velocity of Fraudulent Activity

What it means: Velocity metrics track how quickly fraud attempts are occurring—such as the number of fraud alerts per minute or hour. Sudden spikes often indicate coordinated attacks, bots, or systemic vulnerabilities being exploited.

How to affect it: Establish alert thresholds for velocity spikes, apply automated blocking mechanisms for suspicious bursts, and analyze whether spikes correlate with specific channels or geographies. Real-time throttling can contain bot-driven attempts before they overwhelm defenses.

10) Fraud by Channel

What it means: Fraud by channel categorizes fraudulent incidents across online, mobile, call center, in-person, or partner channels. Understanding where fraud is concentrated helps allocate resources and refine defenses specific to those environments.

How to affect it: Channel-specific security measures, such as voice biometrics in call centers, IP geofencing in online transactions, and chip-and-PIN enforcement in physical transactions, can help reduce fraud. Cross-channel monitoring also detects fraudsters attempting to exploit weaker links.

11) Repeat Offender Rate

What it means: This metric measures how often the same fraudster or entity reappears in fraud cases. High repeat offender rates can indicate weak remediation steps, incomplete data sharing, or insufficient blocking measures.

How to affect it: Strengthen blacklist enforcement, share intelligence across internal systems, and collaborate with external fraud networks or consortia to identify repeat offenders more effectively. Automated blocking of known fraudulent devices, IPs, or accounts helps reduce recurrence.

12) Geographic Fraud Heatmap

What it means: A geographic breakdown of fraud incidents shows where fraudulent activity originates or clusters. Certain regions may be more prone to specific types of fraud due to regulatory gaps or concentrated criminal networks.

How to affect it: Adjust fraud models to apply stricter controls for high-risk geographies, deploy region-specific risk scoring, and allocate investigative resources accordingly. Geo-analysis can also guide proactive monitoring of emerging hotspots.

13) Customer Impact Score

What it means: This composite metric measures how fraud affects the customer experience, including account lockouts, delayed transactions, or loss of trust. High scores indicate that fraud management processes are intruding too heavily into legitimate customer journeys.

How to affect it: Apply step-up authentication only when risk is truly elevated, streamline case resolution communications, and provide transparent updates to customers when fraud is suspected. The goal is balancing security with seamless user experience.

14) Investigator Productivity

What it means: Investigator productivity tracks how many fraud cases a human investigator can close per day or per week. It highlights the efficiency of the case management process and whether tools provide adequate support for investigations.

How to affect it: Equip investigators with automated case enrichment (customer history, device data, transaction context) so they spend less time gathering information. Intelligent prioritization queues can also route high-severity cases first, boosting overall productivity.

15) Cost of Fraud Management

What it means: This metric calculates the operational cost of preventing, detecting, and resolving fraud, including technology, staff, and investigation expenses. It provides a business lens on whether fraud controls are cost-effective.

How to affect it: Reduce costs by automating repetitive processes, investing in scalable fraud platforms that integrate across channels, and applying cloud-based models that eliminate redundant infrastructure. Tracking ROI against fraud loss prevention ensures budget is used effectively.