How Business Intelligence Changes Law Firm Management Today

Reynolds Porter Chamberlain (RPC), the London-based law company, was struggling. Due to ineffective practices, the firm's partners had to do a lot of basic legal work rather than delegating it to them. As a result, the clients and partners of RPC spent more money than they should have on legal work, and the reputation of the company was undermined, too.

The main reason why RPC's lawyers struggled to do their job efficiently was the lack of access to business analytics. After the company's management reviewed the problem, they made a decision that changed the way the managers worked: provide them with access to a business analytics program with an intuitive dashboard on iPads which were given to the lawyers.

As a result, RPC's clients started to delegate more legal work to the company and their individual bills were lowered. By changing the way employees obtained access to business intelligence, the company was able to make quicker and more effective decisions.

RPC is, of course, just one example of how business intelligence has made a difference for a law firm. The global business intelligence market has been growing like crazy, with the current size of $63.3 billion projected to reach $97.3 billion by 2025.

How Investors in Business Intelligence and Analytics Tools Gain a Competitive Edge in the Legal Practice Market

The legal industry has traditionally been conservative when it comes to adopting technology, often relying on manual processes, paper-based records, and billing systems with limited analytical capabilities. In recent years, however, a significant shift has occurred, driven by the influx of investors in business intelligence (BI) and analytics tools. These investors recognize that law firms, from boutique practices to multinational firms, face growing competitive pressures—from cost-conscious clients, regulatory changes, and increasingly complex caseloads. By adopting BI and analytics platforms, investors and law firm management teams are not only improving operational efficiency but also creating a tangible competitive advantage in the legal market.

Enhancing Case and Matter Management

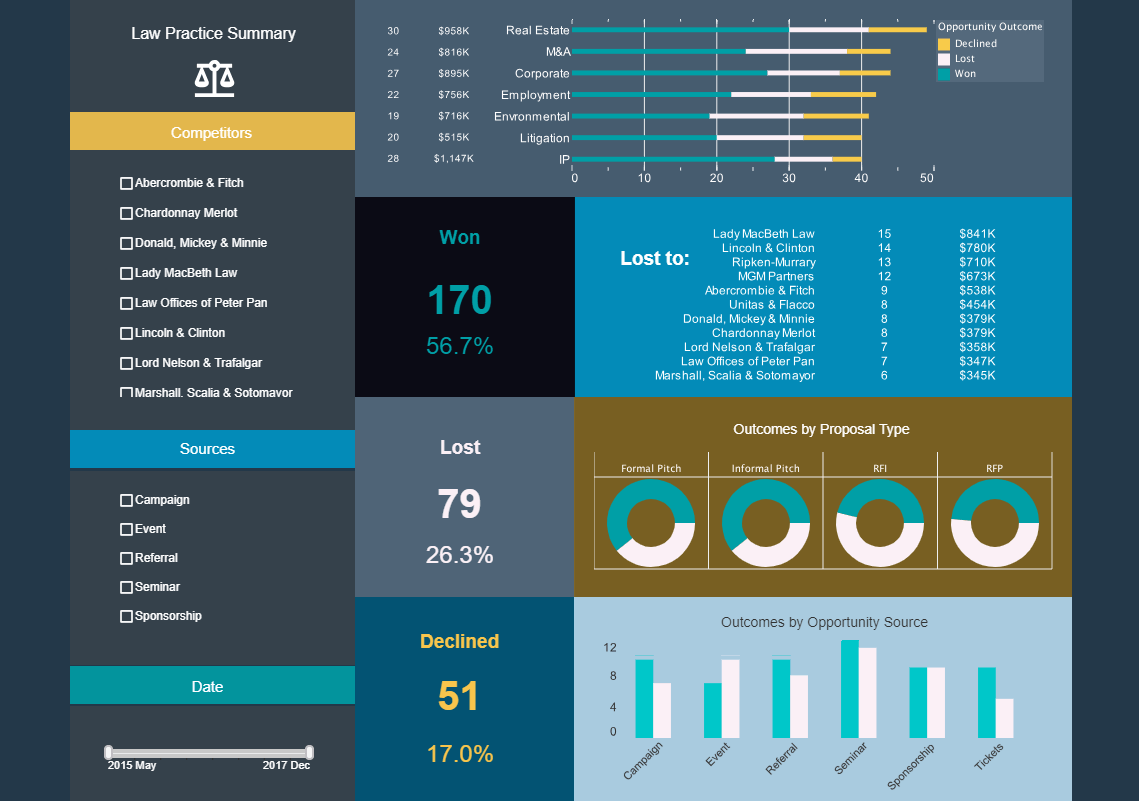

One of the core ways investors leverage BI tools is by improving case and matter management. Modern analytics solutions allow law firms to track and visualize the status of cases in real time, monitor progress against key milestones, and allocate resources more effectively. Investors who champion these technologies encourage firms to use dashboards that display caseload distribution, pending deadlines, and the performance of attorneys on various matters. With these insights, firms can identify bottlenecks early, redistribute workloads efficiently, and ensure that high-value clients receive priority attention. By optimizing case management, firms reduce turnaround times, improve client satisfaction, and create a measurable competitive advantage.

Financial and Billing Analytics

Billing inefficiencies and opaque cost structures have long been challenges in law firm management. Business intelligence tools enable firms to break down revenue streams, track billable hours with precision, and analyze client profitability on a granular level. Investors are particularly interested in metrics such as realization rates, collection rates, and write-offs per practice area. By aggregating this data, firms can identify unprofitable engagements, adjust pricing strategies, and predict cash flow more accurately. Advanced analytics also allow predictive modeling of billing trends and workload forecasts, helping law firms anticipate peak periods and allocate resources accordingly. Firms that master these insights can offer more competitive pricing, demonstrate financial transparency to clients, and differentiate themselves in a crowded market.

Client Relationship Management and Business Development

Business intelligence also revolutionizes client relationship management and business development in the legal sector. By integrating analytics with CRM systems, firms can track client interactions, monitor engagement, and identify opportunities for cross-selling or upselling services. Investors see this as a critical factor for growth: firms that leverage client data to understand behavior patterns, historical engagement, and service preferences are better positioned to retain clients and expand their relationships. Advanced analytics can also identify high-value prospects and optimize marketing campaigns based on client segmentation and conversion probability. By using data-driven insights, law firms enhance their business development strategies, secure more lucrative contracts, and increase overall market share.

Operational Efficiency and Resource Allocation

Law firms are labor-intensive organizations, and operational efficiency is essential for profitability. Business intelligence tools help firms monitor staff productivity, optimize scheduling, and manage resource allocation. Investors encourage the use of analytics to measure attorney utilization rates, track support staff performance, and balance workloads across teams and offices. Predictive analytics can anticipate staffing needs based on case volumes or client demands, reducing idle time and preventing burnout. Firms that optimize resource allocation not only improve internal efficiency but also demonstrate reliability and responsiveness to clients—key differentiators in the competitive legal landscape.

Risk Management and Compliance

Compliance and risk management are growing concerns in legal practice. BI solutions provide robust capabilities to monitor regulatory adherence, track matter-specific compliance requirements, and flag potential risks before they escalate. Investors and law firm executives are using these tools to create dashboards that highlight conflicts of interest, missed deadlines, or deviations from standard procedures. Advanced analytics can also identify patterns that might indicate litigation risk, malpractice exposure, or operational inefficiencies. By proactively managing risk, firms reduce liability and safeguard their reputation, creating both legal and financial advantages.

Competitive Benchmarking and Market Intelligence

Investors in BI tools encourage law firms to use data analytics for competitive benchmarking. By analyzing internal performance metrics alongside market data, firms can compare productivity, pricing, case outcomes, and client satisfaction against peers. This information helps law firms identify strengths, weaknesses, and emerging trends within the industry. For example, a firm may discover that a competitor consistently resolves cases faster or achieves higher client retention rates. Using BI insights, law firms can implement targeted strategies to improve performance, refine marketing approaches, and invest in high-impact practice areas. This kind of informed decision-making provides a clear competitive edge in a highly fragmented market.

Data-Driven Decision Making

Perhaps the most transformative impact of BI and analytics in law firms is the shift toward data-driven decision making. Investors are championing systems that enable leadership teams to move away from intuition-based decisions and instead rely on objective, measurable metrics. Dashboards and reporting tools consolidate complex datasets into actionable insights, allowing law firm executives to prioritize initiatives, allocate budgets effectively, and monitor performance continuously. Whether deciding on staffing, technology investments, or marketing strategies, data-driven decision making ensures that firms respond quickly to market changes and client needs, improving agility and long-term competitiveness.