How Energy Companies Use Analytics

Energy companies—ranging from utilities to oil and gas operators, renewable energy producers, and grid operators—are increasingly leveraging analytics to optimize operations, enhance safety, improve customer experiences, and achieve financial efficiency. The adoption of data analytics, machine learning, and business intelligence has enabled these companies to harness massive volumes of structured and unstructured data, providing actionable insights across multiple facets of the business.

Operational Optimization

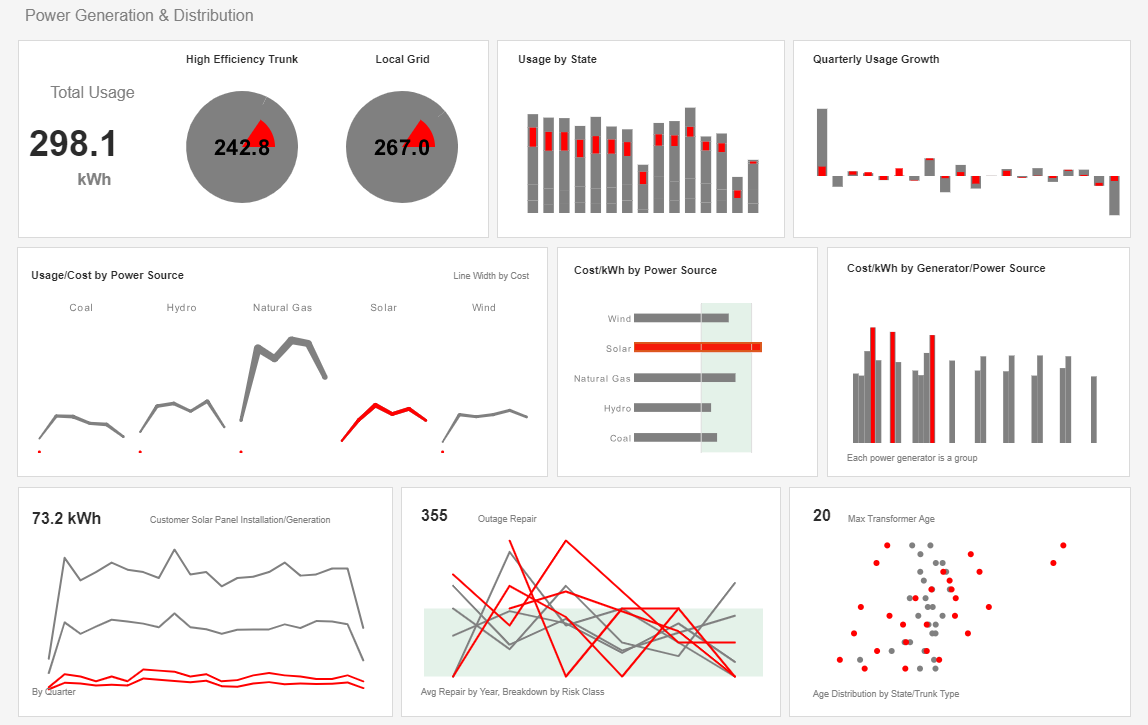

One of the most significant applications of analytics in the energy sector is operational optimization. Traditional energy operations involve complex systems, including generation, transmission, distribution, and maintenance, all of which generate vast quantities of data. Analytics tools help energy companies monitor equipment performance in real-time, detect inefficiencies, and predict potential failures. For example, sensors embedded in turbines, generators, and pipelines continuously collect data on temperature, vibration, pressure, and flow rates. Predictive analytics models can then analyze this data to forecast equipment degradation and schedule preventative maintenance, reducing downtime and avoiding costly unplanned outages.

In renewable energy, analytics plays a critical role in optimizing generation efficiency. Wind farms use real-time weather data, turbine sensor readings, and historical performance metrics to adjust blade angles and turbine orientation for maximum energy capture. Solar operators analyze sunlight intensity, panel temperatures, and inverter performance to forecast output and improve energy yield. By applying advanced machine learning algorithms to these datasets, energy companies can predict output variations and enhance the overall efficiency of their generation assets.

Energy Trading and Market Analytics

Energy companies also rely on analytics for trading and market strategy. The energy market is highly volatile, influenced by fuel prices, weather conditions, regulatory changes, and geopolitical events. Advanced analytics platforms enable traders to model market scenarios, forecast demand and supply, and optimize bidding strategies. Real-time dashboards provide insights into price fluctuations, contract performance, and risk exposure. By leveraging predictive analytics and scenario modeling, energy companies can improve profit margins, hedge risk, and make data-driven decisions on commodity trading.

Analytics also enhances demand forecasting. Utilities use historical consumption data, weather patterns, economic indicators, and population trends to predict electricity demand with high precision. Accurate forecasts allow better planning of generation schedules, reducing reliance on expensive peaking plants and minimizing wastage. Similarly, natural gas operators use predictive analytics to anticipate pipeline demand, ensuring efficient allocation and reducing the risk of shortages or surpluses.

Grid Management and Smart Infrastructure

The rise of smart grids has made analytics indispensable for grid management. Modern grids are equipped with smart meters, IoT devices, and sensors that generate high-frequency data on energy consumption, voltage levels, and equipment status. Analytics tools process this data to detect anomalies, identify inefficiencies, and prevent outages. For instance, utilities can pinpoint which transformer or feeder is overloaded or underperforming, enabling rapid intervention. Furthermore, analytics supports real-time load balancing and energy redistribution, improving grid stability and reducing operational costs.

Energy storage is another area where analytics provides significant benefits. Operators of battery storage systems use predictive models to determine optimal charge and discharge cycles, based on electricity demand, market pricing, and renewable generation forecasts. Analytics helps maximize the economic value of storage assets while ensuring grid reliability.

Safety and Risk Management

Safety and risk management are critical priorities in the energy sector. Analytics helps companies identify potential hazards and improve operational safety. For oil and gas companies, predictive maintenance analytics can detect pipeline corrosion, equipment fatigue, or pressure anomalies before they result in accidents. Machine learning models trained on historical incident data can highlight high-risk operations or sites, allowing targeted safety interventions.

In addition to physical safety, analytics supports environmental risk management. Energy companies track emissions, leaks, and spills, applying analytics to ensure compliance with environmental regulations. For renewable energy, analytics predicts the impact of extreme weather events on generation assets, allowing proactive measures to protect infrastructure and reduce downtime. Overall, data-driven safety management reduces accidents, mitigates financial losses, and enhances corporate responsibility.

Customer Experience and Engagement

Analytics also transforms the customer experience for energy consumers. Utilities use consumption data from smart meters to provide personalized insights to households and businesses. Customer-facing dashboards display usage patterns, cost forecasts, and energy-saving recommendations. Advanced analytics enables segmentation of customers based on consumption behavior, enabling targeted marketing, demand-response programs, and tailored energy plans.

Predictive analytics also helps energy companies anticipate customer churn and improve retention. By analyzing billing history, service interactions, and consumption behavior, companies can identify at-risk customers and implement proactive engagement strategies. For renewable energy providers, analytics helps promote participation in distributed generation programs, such as rooftop solar incentives or community energy initiatives.

Financial Planning and Regulatory Compliance

Energy companies operate in heavily regulated environments. Analytics assists in compliance by tracking reporting obligations, monitoring emissions, and ensuring adherence to financial and operational regulations. Predictive financial models also improve capital planning, investment decision-making, and cost control. For instance, energy firms can simulate different investment scenarios for renewable projects, evaluating projected returns, operational costs, and regulatory impacts before committing resources.

Additionally, analytics enhances procurement and supply chain efficiency. Energy companies analyze fuel supply chains, vendor performance, and logistics data to optimize procurement costs and reduce operational risks. Advanced analytics helps identify trends in fuel pricing, supply disruptions, and market opportunities, enabling more strategic sourcing decisions.

Innovation and Strategic Planning

Finally, analytics is central to strategic planning and innovation in the energy sector. Companies use historical and real-time data to identify market trends, evaluate new technologies, and assess the feasibility of emerging energy solutions. Analytics provides insights into renewable integration, electric vehicle adoption, energy storage, and smart city initiatives. Investors and executives leverage these insights to make data-driven decisions about expansion, mergers, acquisitions, and technology adoption.