InetSoft Webinar: Operational Excellence KPI’s for a Law Firm

This is the continuation of the transcript of a Webinar hosted by InetSoft on the topic of "Applying Analytics to Improve Performance in Law Firms" The moderator is Mark Flaherty, CMO at InetSoft.

Mark: So the operational excellence KPI’s, that's stage one. The market growth is stage two, and leadership is stage three at some level, okay. These are what a law firm needs to track in order to maximize performance. Ron: That's right. So we can see here cluster one. We can see there a stage one cluster, and we ask, well why is that? If we just look at their overall score for the moment, they are doing 5.9. They are in the middle. 5.8 is the average. So we calculated the average at about 5.8. These guys are doing 5.9. They are a little bit above average. The 5.4 mark, there would be the 25th percentile, the 6.2 mark would be the 75th percentile, and the 6.6 would be the 90th percentile.

Most of the other KPIs work the same way. Some of the numbers are adjusted a little bit, but they are basically following the same kind of pattern as we work upwards. So this team, like I said, is doing a little bit better than average; they are 0.1 of an hour better than average. So they get a tick in the box for that KPI as being past stage one.

If we just go up to the next row, profit per partner is $866,000. $950,000 is our benchmark for that. So they are little bit behind. The next key performance indicator is staff margin, and we can come to the detail of what that means in a minute, but 34% is the benchmark. That's got a red light to the left, and they are doing 25%.

That means they haven't yet reached the 25th percentile so they are to the left, not on the chart yet. And if you look up at the top there, our lead individuals. They have got eight lead individuals, which is a very strong group actually. Lead individuals is a count of how often they are published in different publications about being preeminent in their area. So they have got eight our of their nine partners ranking for that achievement, and that’s an area to the right because they are up the scale up here and 5 was their max. So they have come up the scale there.

Mark: If I would have perused the other clusters, let me just look at maybe number three just as a contrast. Yes, their KPIs look very different, quite different.

Ron: Yes. Well, they are a pretty strong team.

Mark: So they now have four or five of the stage one metrics met, so they are officially at stage two.

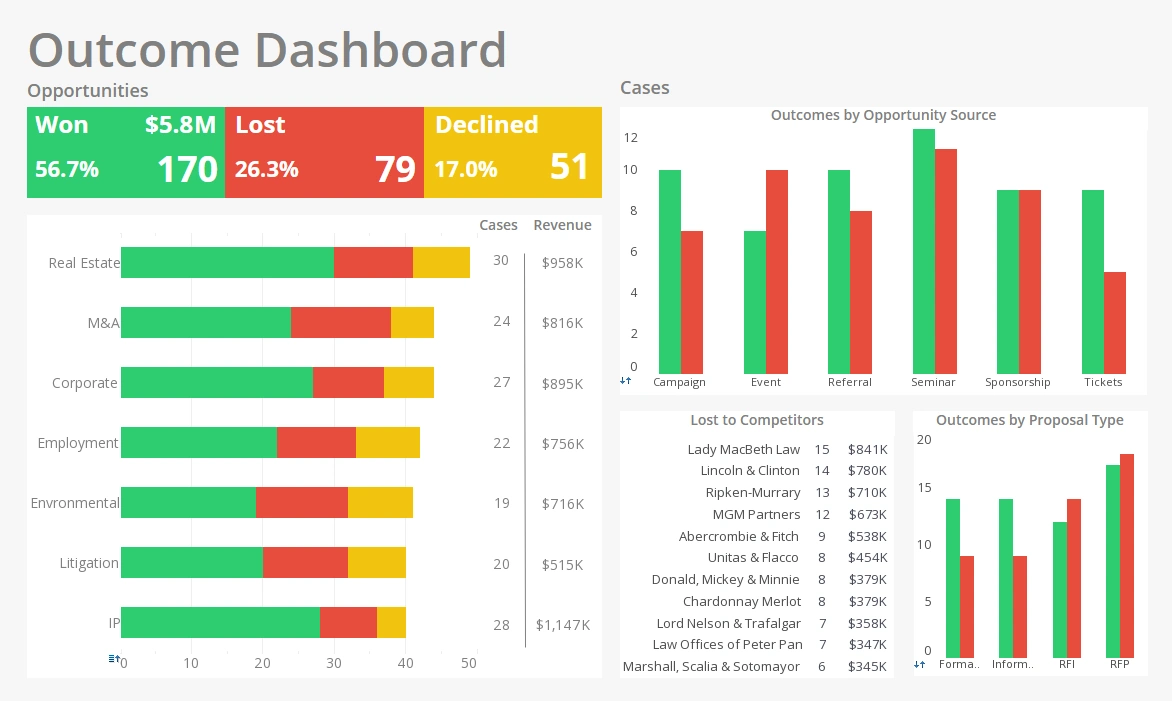

Ron: Yes, they are at stage two. So you can see there, Mark, that you said in about half a second, so it took you like half a second just to intuitively say I can see this is a strong performing team, as soon as you got there. And that's part of the power of a visual dashboard, that say if you go back to, and we were looking cluster one I think, you can see straight away by those bars that you go okay, I can see these guys aren't doing too well and there are plenty of opportunities for them.

And as you start to look at it pretty quickly from the bottom, you see number of leaders looks okay. Profit for partners is not too bad. They are getting towards $950,000. Staff margin is not so good, 25%. Working capital is not so good, 118 days. We have got a target of 90, and as I told you earlier, we got to 73 days. Write-offs, they are okay, 38. So what would I say for these guys? I would say we probably have to look at improving staff margin.

Ron: When you see this kind of performance on the KPIs, you ask, what’s causing that to be below average, and you see right away that you need to look at your working capital.

Mark: Is there way now to drill into more detail for a given metric?

Ron: Yes, probably the easiest example is here. You just click on the word saying chargeable hours, Mark.

Mark: Oh, yes. This has given me a breakdown by the different people now, how many chargeable hours they have.

Ron: Yeah, so, these are the partners in the team ranked by chargeable hours from high to low. Then you can click on the bars as you’ve done, and you can see the lawyers as well by clicking on that.

Mark: Okay, so they can get very detailed information on all their people. They can actually understand, who did how much.

A Personal Injury Law Firm Switched from Databox to InetSoft for Dashboards

Personal injury law firms rely heavily on data to drive decisions that directly affect case outcomes, client satisfaction, and firm profitability. Whether monitoring case volumes, average settlement amounts, marketing ROI, or attorney workloads, these firms depend on dashboards to deliver timely insights. For one mid-sized personal injury firm, Databox had served as the initial solution for centralizing metrics. While Databox provided a user-friendly interface and access to key marketing and case intake data, the firm discovered that its growth exposed several limitations. The need for deeper customization, better integration with legal practice management systems, and more sophisticated reporting for partners and clients drove the switch to InetSoft.

Databox excelled at aggregating marketing data, particularly for tracking campaigns across Google Ads, social media, and call tracking tools. For a firm heavily reliant on advertising to attract clients, this functionality was valuable. However, once prospective clients entered the case intake system, the firm needed visibility into case progress, attorney assignments, and financial performance. Databox’s integrations with legal practice software were limited, forcing the firm to rely on manual exports and separate spreadsheets to tie together the full client journey. Over time, this created inefficiencies and data silos, which undermined the dashboards’ purpose of providing a unified view of performance.

Another challenge stemmed from Databox’s rigidity in customization. Partners and senior attorneys wanted dashboards tailored not only to high-level firm-wide KPIs but also to specific practice areas, such as auto accidents, medical malpractice, and workplace injury claims. Databox offered templated visualizations that looked clean but lacked the flexibility to model more nuanced legal workflows. InetSoft’s platform stood out in this area, enabling the law firm to create highly customized dashboards that reflected the unique stages of personal injury cases. For example, the firm could build a dashboard to track average time from intake to settlement for car accident claims while separately monitoring trial outcomes in medical malpractice cases.

InetSoft’s strength in data mashups was particularly appealing. Personal injury firms often deal with multiple systems: a case management system, a billing and accounting platform, CRM software for intake, and external marketing tools. InetSoft allowed seamless blending of these diverse data sources without requiring time-consuming preprocessing. This capability empowered the firm’s analysts to design dashboards that revealed how marketing spend tied directly to signed cases, how case types correlated with average settlements, and how attorney caseloads affected resolution times. In effect, the firm could finally visualize the entire lifecycle of its cases within a single unified dashboard environment.

Another critical advantage of InetSoft was its ability to deliver secure, role-based access. Personal injury firms handle sensitive client data, and ensuring compliance with confidentiality standards is paramount. While Databox offered general access controls, InetSoft provided granular user permissions, allowing partners, attorneys, paralegals, and administrative staff to each see dashboards relevant to their role. This not only improved security but also enhanced productivity, since each team member could focus on the data most critical to their work without being overwhelmed by irrelevant metrics.

The transition also improved client communication. Some of the firm’s larger clients, such as unions or corporate partners, wanted regular updates on aggregated claims data. InetSoft enabled the creation of external-facing dashboards that could be securely shared with these clients, adding a layer of transparency that set the firm apart from competitors. Instead of relying on emailed PDF reports prepared manually each month, clients could log into a portal and view live updates of claims status and financial outcomes. This innovation boosted client trust and reinforced the firm’s reputation for professionalism and accountability.

Financially, the switch also made sense. While Databox was relatively affordable at the start, scaling the platform to cover more users and additional data integrations increased costs quickly. InetSoft offered a more sustainable model for enterprise-level use, particularly given its embedding and multi-tenant options. The law firm could provide dashboards for multiple offices and practice groups without significant cost escalation. Additionally, the reduced time spent manually preparing reports and cleaning data resulted in cost savings and freed up staff for higher-value tasks.