The Business Value of Operational Intelligence for Sell-Side Banks

The Marketplace Today

As Wall Street embraces and deploys more technology to conduct business, relationships between Buy-side and Sell-side banks have been transformed from voice and human operations to computerized electronic trading platforms. This new systems-driven way of conducting business has rapidly changed the trading landscape.

Historically, a Buy-side bank would phone a Sell-side bank and place an order or ask for a quote for a particular instrument. The Sell-side bank would then respond, receive and �work the order� during the course of the trading day (or sometimes days). At their discretion, banks would update the trade status to the Buy-side client.

This process gave the Sell-side bank a tremendous advantage to easily establish prices, premiums and margins for the instrument while the order was worked. Conversely, the Buy-side bank had limited visibility, not knowing how much of the trade was executed until they received either an order confirmation or updated status.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Real-time Data Intelligence for Trading Firms

Today, the pendulum has swung in the Buy-side’s favor. Time-honored personal relationships no longer guarantee orders for Sell-side banks. As newer electronic trading channels have opened and emerged, the Buy-side bank no longer needs personal contact with the Sell-side bank to handle a trade. The net result: personal relationships are not enough to guarantee an order.

To win in Fixed Income or Foreign Exchange, the Sell-side bank now must be either more creative in pricing or the quickest to respond to the request for quote. Similarly, within Equities trading, the Sell-side bank must be the quickest to execute an order, with the �best execution price.� If not, an order is at risk of getting cancelled.

The competitive nature of Sell-side banks, with each attempting to outperform its peer group or a market segment, has led to innovations and technological advances, such as automated trading. Yet, these advances have created a new set of challenges. On the Sell-side, automated trading has provided speed and efficiency at the cost of visibility and control. Manual processes have been replaced by computerized �black boxes� that mask visibility into trade flow processes. Without visibility, the Sell-side lacks meaningful control.

Moreover, the Sell-side's investment into lightweight, customer-facing trading applications, which gave Buy-side customers more information into their trades, created a backlash. Now, any latency or weakness in the Sell-side trading infrastructure is exposed. As a result, the Buy-side customers often discover order execution issues before the dealers themselves.

All of this has left many Sell-side banks feeling like they are conducting business �flying blind.� Other equally important shifts have emerged. Instrument pricing and execution have driven margins down to razor-thin levels. In Fixed Income and Foreign Exchange, trading revenue per million has fallen to tens of dollars per transaction. In Equities, the revenue per-share-filled has dropped to two to three cents. Not surprisingly, competition for order volume among Sell-side banks has never been greater.

The challenge is clear. What can a Sell-side bank do to increase revenues, provide the best execution and maintain the highest level of customer service?

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Addressing Critical Operational Challenges

One of the biggest challenges facing Sell-side banks is the lack of visibility into their own trade execution processes. These blind spots limit their ability to successfully run their business. Some key questions are:

● How do you know what pricing strategy to quote if you can’t determine how long it takes to generate a price and deliver it to the ECN?

● Can you win a competitive deal if you’re the last person generating the quote?

● How are you going to increase trading volumes without visibility into the open-order status?

● Are you risking significant revenues and reputational integrity by processing lesser-valued orders when a premier customer has an extremely large order to execute?

● Which trading execution strategy are you going to employ if you lack measurements that can help you make the decision?

● How well are your trading strategies performing?

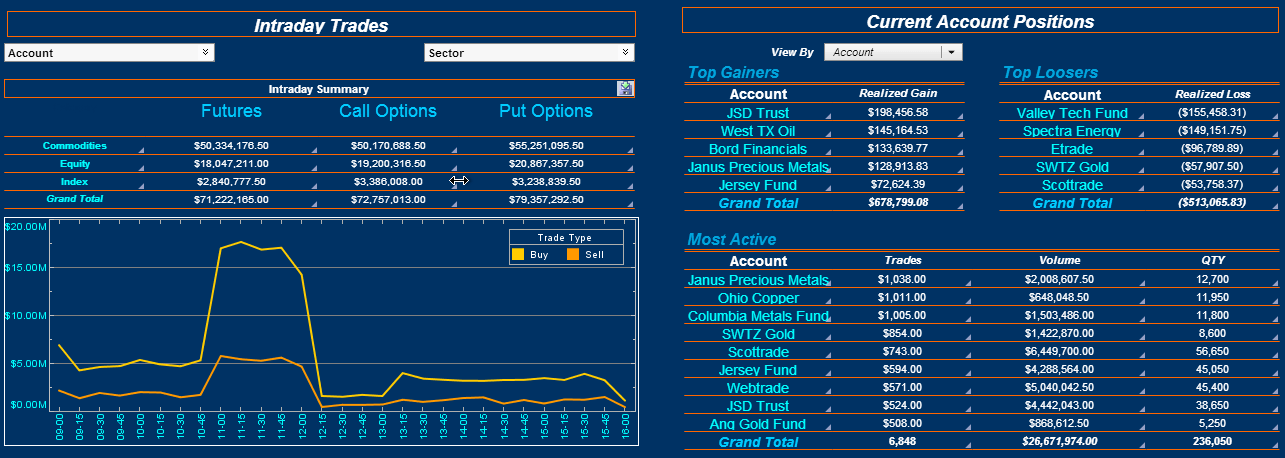

To address these challenges you need to leverage your technologies for a more business responsive enterprise. Operational visibility is key. Without it, you’ll never know what to act upon - much less what to do first. Stale information is useless when milliseconds mean the difference between filling an order and losing it. Multi-dimensional analysis is critical. To make split-second decisions you must be able to analyze current trading data across multiple dimensions. An automated action framework is essential. You need to have the option to automatically impose behavior on your underlying systems without human intervention. Where can you find business analytics software that brings together operational visibility, multi-dimensional analysis and automated actions?

This article discusses a workable solution that leverages InetSoft's operational intelligence platform.

| Next: InetSoft's Operational Intelligence Solution for Capital Markets |