What KPIs and Analytics Does an Accounting Analyst Use?

Accounting gives decision-makers vital information about a company's financial situation, assisting them in making wise decisions. The use of Key Performance Indicators (KPIs) and analytics to assess and track financial performance is a crucial component of contemporary accounting.

To evaluate the success of financial plans and identify opportunities for development, accounting analysts depend on these measurements. This article will examine the essential KPIs and analytics used by accounting analysts to fuel corporate performance.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

1. Profitability Ratios

The ultimate objective of every firm is profitability. To evaluate a company's capacity to produce profits in relation to its revenue, assets, or equity, accounting analysts utilize a variety of profitability measures. Some typical profitability ratios are:

- Gross Profit Margin: The revenue-to-cost ratio calculates the proportion of sales that surpasses the cost of items supplied. Higher values imply better cost management and pricing strategies. It shows how well a firm produces and sells its goods.

- Net Profit Margin: The net profit margin, as opposed to the gross profit margin, takes into account all operational costs, such as taxes and interest. It displays the portion of income that is still profit after all costs have been paid.

- Return on Equity (ROE): The return produced for shareholders' investments is measured by ROE. It shows how well a business turns stock held by shareholders into earnings.

- Return on Assets (ROA): The effectiveness of an asset's use in creating profits is assessed by ROA. It aids analysts in comprehending how efficiently a corporation generates profits from its assets.

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

2. Liquidity Ratios

A company's capacity to fulfill its immediate financial commitments is evaluated using liquidity ratios. These ratios play a key role in determining if a company has adequate cash and liquid assets to pay urgent costs. Some important liquidity ratios are:

Current Ratio: This ratio examines the relationship between a company's current assets and liabilities. A number higher than 1 indicates that the company's assets are larger than its liabilities.

Quick Ratio (Acid Test Ratio): Similar to the current ratio, the fast ratio does not include inventory as current assets since it may be difficult to convert inventory to cash.

Cash Ratio: The most conservative liquidity measure is the cash ratio, which only counts cash and cash equivalents as assets. It sheds light on a company's capacity to settle immediate debts independently of sales or inventory.

|

Read how InetSoft saves money and resources with deployment flexibility. |

3. Efficiency Ratios

Efficiency ratios examine a company's resource and asset management to assess its operational effectiveness. These indicators aid in identifying inefficient regions and prospective areas for cost-cutting. Typical efficiency ratios are as follows:

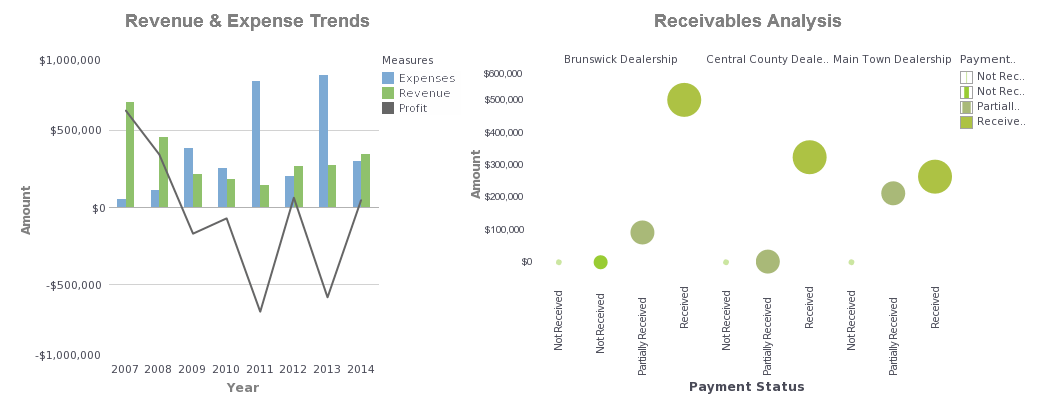

- Accounts Receivable Turnover: This ratio indicates how rapidly a business receives money from clients. A high turnover rate suggests successful collections and credit management.

- Inventory Turnover: Inventory turnover measures how well a business manages its stock. Increased turnover indicates effective inventory management and less risk of obsolescence.

- Accounts Payable Turnover: The turnover of accounts payable measures how quickly a business pays its suppliers. A greater turnover ratio can indicate improved cash flow management or good supplier connections.

4. Debt Management Ratios

Leverage ratios, commonly referred to as debt management ratios, assess a company's capacity to fulfill its long-term financial commitments. These ratios are essential for assessing a company's financial risk and debt-handling capabilities. Important debt management ratios are:

- Debt-to-Equity Ratio: This ratio assesses how much equity a firm has in relation to all of its obligations. A larger ratio denotes more risk and financial leverage.

- Debt Ratio: The debt ratio calculates the percentage of an organization's assets that are funded by debt. A higher ratio indicates a greater danger to the economy.

- Interest Coverage Ratio: This ratio evaluates a company's capacity to cover interest costs associated with outstanding debt. Better financial health and a lesser chance of default are indicated by higher ratios.

5. Cost Analysis

Accounting must include cost analysis, where analysts carefully study different cost components to optimize expenditure and raise profitability. Among these analyses are:

- Cost-Volume-Profit (CVP) Analysis: The link between costs, volume, and profits may be determined via CVP analysis. Finding the breakeven point and comprehending how variations in volume impact profitability are made easier with its help.

- Variance Analysis: Variance analysis allows businesses to spot inconsistencies and take remedial action by comparing actual expenditures and revenues to projected or standard numbers.

- Activity-Based Costing (ABC): Based on how much resources those particular activities or goods really use, ABC assigns charges to them. The image it paints of actual production or service delivery costs is more accurate.

6. Budgeting and Forecasting

Accounting analysts are essential to the processes of forecasting and budgeting. They provide practical budgets and predictions that serve as a basis for corporate choices using past financial data and market trends.

- Budget vs. Actual Analysis: Managers can identify areas of over- or under-performance by comparing the actual financial performance to the planned statistics using this methodology.

- Rolling Forecasts: Rolling forecasts, which are continuously updated based on the most recent data and assumptions, enable businesses to respond swiftly to changing market circumstances rather of having to create an annual budget.

|

Learn about the top 10 features of embedded business intelligence. |

7. Trend Analysis

Examining financial data over time to spot trends and generate educated forecasts about future performance is known as trend analysis. It aids companies in anticipating long-term trends and making plans appropriately.

- Time Series Analysis: Analyzing data points across time periods enables the detection of trends, seasonal patterns, and cyclical changes.

- Regression Analysis: In order to forecast future results, regression analysis looks at the connection between variables. When there is a direct link between a certain variable and financial performance, it is beneficial.

8. Activity Ratios

Activity ratios, commonly referred to as turnover ratios, evaluate how well a business uses its resources to produce income. These metrics support measuring the efficiency of operations and the efficacy of resource management. Some typical activity ratios are:

- Total Asset Turnover: This ratio assesses how well a business generates sales revenue from its total assets. Better asset use is indicated by a greater turnover.

- Fixed Asset Turnover: The efficiency with which a corporation utilizes its fixed assets, such as its real estate, machinery, and equipment, to produce sales is measured by its fixed asset turnover.

- Inventory Days: Inventory days, commonly referred to as days inventory outstanding (DIO), determine the typical time it takes for a business to sell all of its inventory. Lower inventory days are a sign of effective inventory control.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

9. Cash Flow Analysis

Analyzing cash flow is crucial for determining if a corporation has enough cash on hand. To comprehend the company's cash situation and capacity to satisfy financial commitments, accounting analysts thoroughly study operating, investment, and financing cash flows.

- Operating Cash Flow (OCF) Ratio: This ratio shows how effectively a company's profits are converted into cash by comparing operational cash flow to net income.

- Cash Conversion Cycle (CCC): The CCC calculates how long it takes a business to turn its investments in inventory and accounts receivable into money from customers. Better cash flow management is indicated by a shorter CCC.

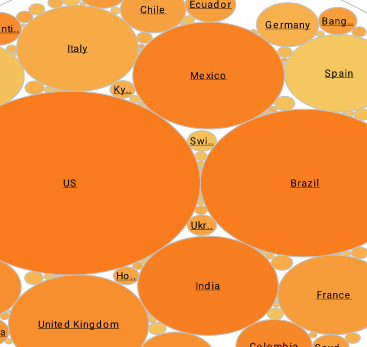

10. Employee Productivity Metrics

To analyze workforce effectiveness and cost management, accounting analysts may also look at other staff productivity indices.

- Revenue per Employee: By dividing total income by the number of workers, this measure sheds light on the efficiency with which employees generate money.

- Cost per Hire: Cost per hire measures the price associated with acquiring new workers and aids businesses in streamlining their hiring procedures.

|

Learn the advantages of InetSoft's small footprint BI platform. |

11. Financial Ratios for Investment Analysis

Accounting analysts are essential in determining if new investments are financially viable. To assess the appeal and risk of investment possibilities, they employ a variety of financial measures.

- Price-Earnings Ratio (P/E): P/E ratio measures how much investors are ready to pay for every dollar of profits by comparing a company's share price to its earnings per share.

- Dividend Yield: Dividend yield estimates the return on investment from dividends by converting the yearly dividend payment to a percentage of the current share price.

12. Compliance and Regulatory Reporting

Financial rules and reporting requirements must be followed, and accounting analysts are in charge of doing so. To guarantee accuracy and openness in financial accounts and disclosures, they track and analyze financial data.

- Financial Statement Analysis: To ensure the correctness of financial data, this entails analyzing the income statement, balance sheet, and cash flow statement.

- Sarbanes-Oxley Act (SOX) Compliance: Accounting analysts make sure businesses comply with the Sarbanes-Oxley Act, which requires stringent internal controls and financial reporting guidelines to safeguard investors and thwart fraud.