Information about OLAP Software

OLAP, or online analytical processing, is a term that falls under the business intelligence umbrella. OLAP is a method of analyzing business performance using an information architecture (called an OLAP cube) that is optimized for responding to user queries.

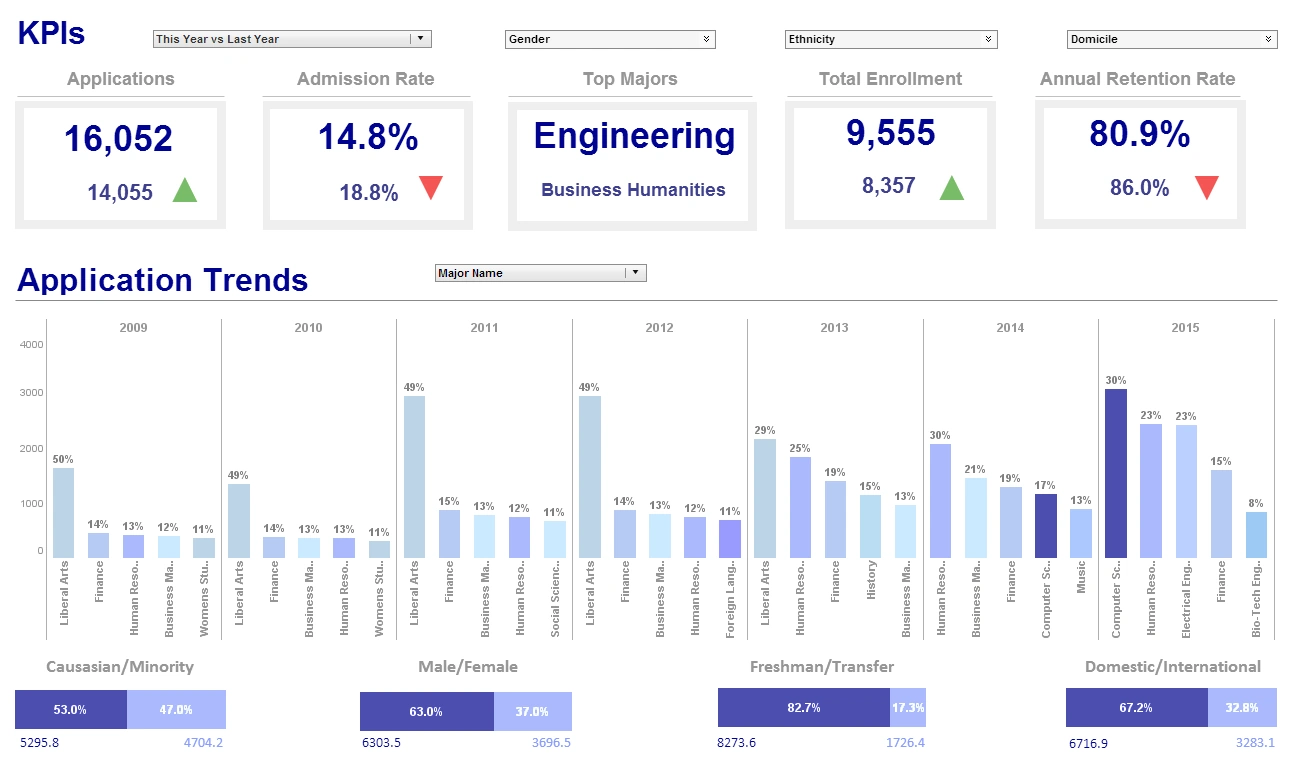

The goal of business intelligence and OLAP is to leverage available data to make informed decisions. For businesses operating in today's world, knowing just your average sales figures or your lead times is not enough. This narrow approach to business intelligence omits important variables from business decisions and leaves valuable data unutilized. The more information a company can gather and analyze, the greater their chances of making the best possible business decisions.

Even small businesses collect a wealth of information about their operations, performance, and customers. In an OLAP cube, the data businesses generate is aggregated and organized in a manner that is designed to provide deep insights into business performance.

Spreadsheets are two dimensional and can only provide a limited analysis of business operations. Say, for example, your spreadsheet shows regions where you do business on the horizontal axis and sales figures on the vertical axis. More dimensions of information translate into richer data, which leads to better decision making. However, the more dimensions we add, the harder it becomes to store, organize, and interpret the data. Imagine trying to analyze spreadsheets with 20 dimensions of data. It would be difficult to organize and impossible to interpret.

OLAP software organizes data and enables multidimensional user query. In other words, OLAP software lets users find answers to more sophisticated business performance questions. Below are just a few examples of multidimensional business queries.

OLAP Software Queries

- What is the breakdown of sales by salesperson in a specific region?

- What proportion of net sales is attributable to running a promotion on a single product line?

- How does lead time across departments compare to last year's performance?

- Which sales reps are selling the most of a specific product in a specific region?

The benefit of understanding the answers to these questions is that managers can then re-allocate resources where they are needed the most. Businesses have multiple departments carrying out different, but related, functions. OLAP software can provide deep insights to guide decision making. Multidimensional analysis of business performance is a critical step towards growing your business.

Why InetSoft?

Traditionally, OLAP software would sit on an OLAP server between the client and the database(s). This server-client approach can be costly and require cumbersome deployment and maintenance. InetSoft's zero-client solution requires only a web browser on the client side, enabling swift deployment while still providing robust functionality, like drill down and data mashup.

InetSoft's small-footprint, Web-based application provides a streamlined, intuitive interface for all users. As an innovator in OLAP software since 1996, InetSoft has pioneered the evolution from static reporting towards interactive visualization of data via dashboards.

Why Do People Still Use OLAP Software?

Online Analytical Processing (OLAP) software has been a cornerstone of business intelligence (BI) since the 1990s, enabling organizations to analyze multidimensional data for complex reporting and decision-making. Despite the rise of modern BI tools like Power BI, Tableau, and cloud-based analytics platforms, OLAP remains relevant in 2025. This article explores why organizations and professionals continue to rely on OLAP software, focusing on its unique strengths, compatibility with legacy systems, performance in complex scenarios, and its role in specialized industries.

1. Multidimensional Data Analysis and Flexibility

OLAP’s core strength lies in its ability to handle multidimensional data analysis, allowing users to slice, dice, drill down, and roll up data across multiple dimensions, such as time, geography, or product categories. This capability is invaluable for organizations needing to explore data from various angles quickly. For example, a retail company can analyze sales by region, product, and quarter simultaneously, uncovering trends that might be missed in flat, two-dimensional reports. Modern BI tools often prioritize visualizations, but OLAP’s multidimensional approach excels in scenarios requiring deep, hierarchical data exploration, such as financial forecasting or supply chain optimization.

Unlike some newer tools that rely heavily on predefined dashboards, OLAP systems like IBM Cognos, SAP BusinessObjects, or Oracle Essbase allow users to dynamically query data without extensive preconfiguration. This flexibility is critical for analysts who need to answer ad-hoc questions or perform what-if analyses, making OLAP a preferred choice for data-intensive roles in finance, marketing, and operations.

2. Performance with Large and Complex Datasets

OLAP systems are designed to process large volumes of data efficiently, leveraging pre-aggregated data cubes to deliver fast query performance. This is particularly important for organizations dealing with massive datasets, such as those in retail, telecommunications, or manufacturing. For instance, a telecommunications company analyzing call data records across millions of customers benefits from OLAP’s ability to precompute aggregations, reducing query times compared to real-time processing in some cloud-based tools.

While modern BI platforms like Power BI offer impressive performance, they can struggle with extremely large datasets or complex calculations without additional optimization, such as data warehousing or cloud scaling. OLAP’s cube-based architecture, whether in MOLAP (Multidimensional OLAP), ROLAP (Relational OLAP), or HOLAP (Hybrid OLAP), ensures consistent performance for complex analytical tasks, making it a reliable choice for enterprises with high-performance needs.

3. Compatibility with Legacy Systems

Many organizations continue to use OLAP software due to its deep integration with legacy systems. Large enterprises, particularly in industries like banking, insurance, and manufacturing, rely on legacy applications built on platforms like IBM Cognos Series 7 or Oracle Essbase. These systems store critical business logic and historical data that are costly and risky to migrate. For example, a financial institution might use Essbase for budgeting and forecasting, with decades of data and processes embedded in OLAP cubes. Transitioning to a modern BI tool often requires rebuilding these models, which can disrupt operations and demand significant resources.

OLAP’s compatibility with older databases and ERP systems, such as SAP or Oracle, ensures continuity for organizations hesitant to overhaul their IT infrastructure. Even as companies adopt newer tools, they often maintain OLAP systems in parallel to leverage existing investments, especially when third-party support providers extend the life of unsupported platforms like Cognos Series 7.

4. Robust Security and Governance

OLAP software offers robust security and governance features, which are critical for industries with strict compliance requirements, such as finance, healthcare, and government. OLAP systems allow administrators to set granular access controls, ensuring users only see data relevant to their roles. For instance, IBM Cognos provides role-based security that restricts access to sensitive financial data, a feature that aligns with regulations like GDPR or HIPAA.

Modern BI tools emphasize self-service analytics, which can lead to governance challenges if users create unverified reports or share sensitive data. OLAP’s centralized architecture, with predefined cubes and metadata, ensures tighter control over data access and report generation. This is particularly appealing for organizations prioritizing data security and auditability, as OLAP systems provide a structured environment that reduces the risk of data breaches or non-compliance.

5. Specialized Use Cases in Finance and Planning

OLAP remains a go-to solution for specialized use cases, particularly in financial planning, budgeting, and forecasting. Tools like Oracle Essbase and SAP BPC (Business Planning and Consolidation) are tailored for complex financial modeling, enabling organizations to perform scenario analysis, variance reporting, and long-term planning. For example, a multinational corporation might use OLAP to model currency fluctuations across regions, a task that requires multidimensional calculations beyond the capabilities of some visualization-focused BI tools.

In industries like insurance, OLAP supports actuarial analysis and risk modeling, where multidimensional data structures are essential for calculating premiums or reserves. While modern tools like Tableau can visualize financial data, they often lack the depth of OLAP’s calculation engines, which are optimized for these niche applications. This specialization keeps OLAP relevant for professionals in finance and strategic planning.

6. Support for Complex Business Logic

OLAP systems excel at embedding complex business logic within data models, which is critical for organizations with intricate reporting needs. For instance, a manufacturing company might use OLAP to calculate production costs across multiple factories, incorporating variables like labor rates, material costs, and exchange rates. This logic is stored in OLAP cubes, enabling consistent and repeatable analysis without manual intervention.

While modern BI tools support calculated fields, they often require users to redefine logic for each report, which can lead to inconsistencies. OLAP’s ability to centralize business rules in the cube ensures uniformity across reports, reducing errors and saving time. This is particularly valuable for organizations with standardized reporting processes, such as regulatory reporting in banking or healthcare.

7. User Familiarity and Training Investment

Many organizations continue to use OLAP software because their teams are already trained and proficient in tools like IBM Cognos or Oracle Essbase. Retraining staff on modern BI platforms, such as Power BI or Qlik Sense, requires significant time and cost, especially for large teams. For example, analysts familiar with Essbase’s multidimensional querying may find it more efficient to continue using it rather than learning Tableau’s visualization-centric approach.

Additionally, OLAP’s structured interface is intuitive for users accustomed to spreadsheet-like analysis, a common skill in finance and operations. This familiarity reduces resistance to adoption and ensures productivity, particularly in organizations with limited resources for upskilling.

8. Hybrid Integration with Modern Tools

Rather than replacing OLAP, many organizations integrate it with modern BI tools to combine the strengths of both. For instance, OLAP cubes can serve as a backend data source for Power BI dashboards, leveraging OLAP’s processing power and Power BI’s visualizations. This hybrid approach allows companies to modernize their BI capabilities without abandoning reliable OLAP systems. Tools like SAP HANA and Microsoft Analysis Services facilitate this integration, ensuring OLAP remains a vital component of the BI ecosystem.

The ability to complement modern tools makes OLAP a strategic choice for organizations transitioning to new platforms while maintaining existing workflows. This flexibility is particularly appealing for enterprises with complex data environments.