What Are the Metrics Tracked on an Insurance Coverage Analysis Dashboard?

An Insurance Coverage Analysis Dashboard is a critical tool for insurance companies, brokers, and risk managers to monitor, evaluate, and optimize insurance portfolios.

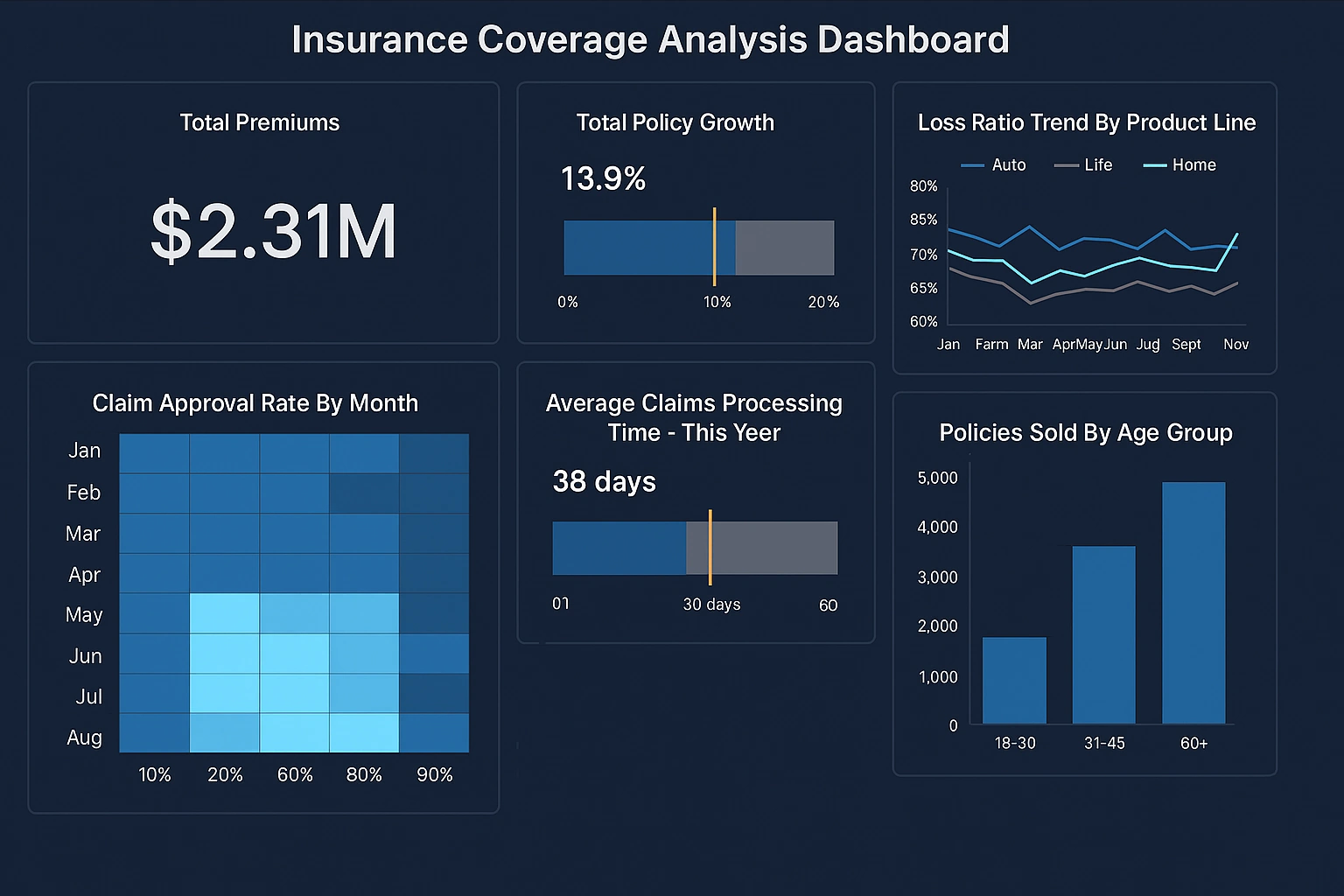

These dashboards consolidate key performance indicators (KPIs) and metrics to provide insights into coverage effectiveness, risk exposure, financial performance, and operational efficiency. Below, we explore the primary metrics tracked on such dashboards, their meanings, and how stakeholders can influence them to improve outcomes.

1. Policy Coverage Ratio

Definition: The policy coverage ratio measures the proportion of insured assets or risks relative to the total assets or risks that could be insured. It is calculated as:

Coverage Ratio = (Insured Value / Total Value at Risk) × 100

Meaning: A high coverage ratio indicates that most assets or risks are protected, reducing potential financial losses. A low ratio suggests underinsurance, which could expose the organization to significant uncovered losses in the event of a claim.

How to Affect It: To improve the coverage ratio, conduct a comprehensive risk assessment to identify all insurable assets and risks. Work with underwriters to expand coverage for underinsured areas, such as cyber risks or supply chain disruptions. Regularly review asset valuations to ensure coverage limits reflect current market values.

2. Premium-to-Claim Ratio

Definition: This metric compares the total premiums paid for insurance policies to the total claims paid out. It is expressed as:

Premium-to-Claim Ratio = Total Premiums Paid / Total Claims Paid

Meaning: A ratio greater than 1 indicates that premiums exceed claims, suggesting profitability for the insurer or cost efficiency for the policyholder. A ratio below 1 signals that claims are outpacing premiums, which may indicate high-risk exposure or inadequate pricing.

How to Affect It: To optimize this ratio, implement risk mitigation strategies, such as safety training or equipment upgrades, to reduce claim frequency and severity. Negotiate premium rates with insurers based on improved risk profiles or by bundling multiple policies for discounts.

3. Loss Ratio

Definition: The loss ratio measures the proportion of premiums that are paid out as claims. It is calculated as:

Loss Ratio = (Incurred Losses / Earned Premiums) × 100

Meaning: A high loss ratio (e.g., above 70%) may indicate that the insurance program is unsustainable, as claims are consuming a large portion of premiums. A lower loss ratio suggests better risk management or more favorable policy terms.

How to Affect It: Reduce losses by investing in risk prevention measures, such as fire suppression systems or employee training programs. Review policy terms to ensure adequate coverage without overpaying for unnecessary protections. Analyze historical claims data to identify patterns and address recurring issues.

4. Coverage Gaps

Definition: Coverage gaps represent areas where insurance policies do not fully protect against potential risks or losses. This metric is often qualitative but can be quantified by assessing the percentage of risks not covered by existing policies.

Meaning: Identifying coverage gaps helps organizations understand vulnerabilities, such as uninsured natural disaster risks or emerging threats like cyberattacks. Unaddressed gaps can lead to significant financial losses.

How to Affect It: Perform regular coverage audits to identify gaps, especially for evolving risks like climate change or technological disruptions. Collaborate with insurance brokers to tailor policies that address specific vulnerabilities. Consider specialized insurance products, such as parametric insurance, to cover unique risks.

5. Claims Frequency and Severity

Definition: Claims frequency measures how often claims are filed, while claims severity quantifies the average cost of each claim. These metrics are tracked separately but often analyzed together.

Meaning: High claims frequency may indicate recurring operational issues, while high severity suggests significant individual losses. Both metrics influence premium costs and risk management strategies.

How to Affect It: To reduce frequency, implement proactive measures like regular maintenance or employee safety programs. To lower severity, invest in robust risk controls, such as reinforced infrastructure or cybersecurity protocols. Use data analytics to predict and prevent high-cost claims.

6. Policy Renewal Rate

Definition: The policy renewal rate tracks the percentage of policies renewed versus those canceled or lapsed.

Renewal Rate = (Number of Policies Renewed / Total Policies Up for Renewal) × 100

Meaning: A high renewal rate indicates satisfaction with coverage and pricing, while a low rate may signal dissatisfaction or better alternatives elsewhere. It also reflects the stability of the insurance program.

How to Affect It: Maintain strong relationships with insurers to negotiate favorable renewal terms. Regularly compare competing offers to ensure cost-effectiveness. Address client or stakeholder concerns promptly to maintain trust and encourage renewals.

7. Risk Exposure Index

Definition: The risk exposure index quantifies the potential financial impact of uninsured or underinsured risks, often expressed as a score based on likelihood and impact assessments.

Meaning: A high index indicates significant exposure to potential losses, while a lower index suggests a well-protected portfolio. This metric helps prioritize risk management efforts.

How to Affect It: Conduct regular risk assessments to identify high-impact risks. Increase coverage limits or purchase additional policies for high-risk areas. Implement risk transfer strategies, such as outsourcing high-risk activities, to reduce exposure.

8. Compliance Rate

Definition: The compliance rate measures adherence to regulatory and contractual insurance requirements, such as mandatory coverage for workers’ compensation or liability.

Compliance Rate = (Compliant Policies / Total Required Policies) × 100

Meaning: A high compliance rate ensures legal and contractual obligations are met, avoiding penalties or coverage disputes. A low rate may expose the organization to fines or legal risks.

How to Affect It: Establish a compliance monitoring system to track regulatory changes and policy requirements. Work with legal and insurance advisors to ensure all mandates are met. Automate compliance checks to reduce human error.

9. Cost per Policy

Definition: This metric calculates the average cost of maintaining each insurance policy, including premiums and administrative expenses.

Cost per Policy = Total Insurance Costs / Number of Policies

Meaning: A high cost per policy may indicate inefficiencies or overpriced coverage, while a lower cost suggests optimized spending. This metric helps evaluate the financial efficiency of the insurance program.

How to Affect It: Consolidate policies with a single insurer to benefit from volume discounts. Review administrative processes to reduce overhead costs. Use data analytics to identify cost-saving opportunities without compromising coverage.

10. Time to Claim Resolution

Definition: This metric tracks the average time taken to process and resolve claims, from filing to payout or denial.

Meaning: A shorter resolution time improves customer satisfaction and cash flow, while a longer time may indicate inefficiencies or disputes with insurers. It reflects the effectiveness of claims management processes.

How to Affect It: Streamline claims reporting by using digital tools or automated systems. Maintain clear communication with insurers to expedite reviews. Train staff to handle claims efficiently and accurately.