InetSoft Webinar: Data Analytics in the Insurance Industry

Below is the transcript of a Webinar hosted by InetSoft on the topic of Data Analytics in the Insurance Industry. The presenter is Christopher Wren, principal at TFI Consulting.

The first question to ask really is what do we mean by an analytical insurer. Personally we know that data and the use of data is not new in the insurance industry. In fact, we were using data in the form of MI 20 years ago, and we were putting in a spreadsheet and performing manual data analytics on it.

We were able to actually use pivot tables. Things have moved on of course in those 20 years, and of course, nowadays we view the analytical insurer as an insurance company using analytics throughout the organization to improve business performance, with emphasis on the word throughout.

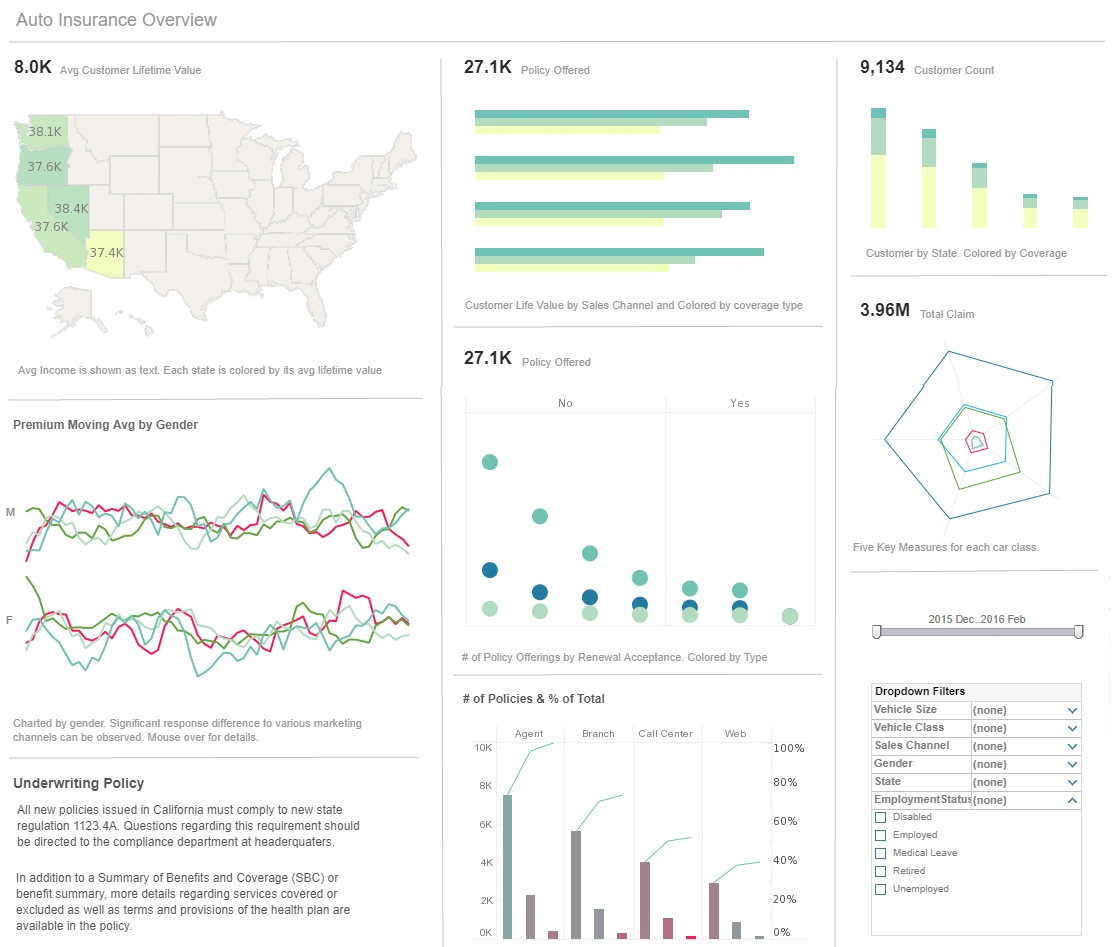

Of course, many departments within the insurance business use some form of tactical analytics tools, such as for bidding claims or marketing or risk. Often those tactical analysis tools operate in silos, and the ability to exchange information between the different departments seems to be missing somehow. Really, the analytical insurer, by definition, has to have an enterprise wide view of the data and information available to them.

Of course, never more has it been critical for an insurer to have an enterprise wide view than the current time. The slide in front of you reminds you that the insurance business really is quite an interconnected red fuse, for lack of a better expression. The issues of distribution, consumers both direct distribution and indirect through third parties and the emerging impact of Blockchain are factors.

The customer is much more savvy, much more knowledgeable. The digital customer is becoming the norm, and of course, different customers behave in different ways.

Risk management and typically the issue of Solvency II has dominated the agenda for the past while, and with Brexit we're currently thinking of Solvency II in a new light and whole issue of equivalency. Insurers, of course, have a demand for growth, and everybody wants to expand, but it's particularly challenging in a competitive environment, particularly in Western Europe where there is simply an overcapacity of insurers.

Then finally, of course, there is the whole challenge of the economy, and partly about Brexit, or should we also be adding President Trump to the equation? I guess the need to recognize the volatility of what's happening within the economy and how that will change the purchasing behavior of customers creates the need to be on top of our game as an insurance industry. It might be worthwhile discussing the mega technology trends going on in the data analytics industry. We identify five key issues going on at the moment: cloud, social, analytics, mobile and fintech. Of course, each of these possibly deserves a complete session in their own right, but I'll comment very briefly on each of them.

The topic of the cloud is increasingly critical, and we recognize the volume of data is now getting too large for our on premise analytics. Of course there are inevitably issues of data security. In fact, what we see around the issue of security is the loss of data is more likely to be due to physical means or disgruntled employees, and of course there are solutions such as hybrid cloud and the rest.

The area of social media analytics, of course, is one of the big trends of our time because of Facebook, Twitter and others. Social media provides context and sentiment in terms of the viewpoint of our customers. Invariably there are issues of privacy and ethics, and some of you will be aware of the recent story involving one UK insurer.

These are things which I personally believe can be resolved. New insurance models will emerge, such as the whole concept of peer-to-peer insurance. Of course, from a social point of view nowadays the digital customer is as likely to complain socially at the same time as they complain directly to their insurance company. Social media is a real key thing for insurers to be aware of.

Finally, analytics must be tied to clear business outcomes. It's all very well to generate visualizations and models, but without measurable KPIs—such as reduced claims leakage, improved customer retention, or faster underwriting turnaround—the value remains theoretical. Insurers should start with the questions they need answered and then work backwards to the data and techniques required to deliver actionable insight.

From a technology perspective, advanced analytics and machine learning are becoming more accessible, but they demand disciplined data management. Robust data governance, consistent master data, and well-defined metadata are prerequisites to ensure models are reliable and auditable. Without that foundation, insights can be misleading and compliance risks can increase, particularly in highly regulated markets.

Culture and capability are the final pieces of the puzzle. Embedding analytics across the enterprise means upskilling staff, promoting cross-functional collaboration, and creating feedback loops so that insights are continuously validated and refined. When people, process and technology align, analytics becomes a true competitive advantage rather than a siloed experiment.