How Financial Institutions Can Use Big Data to Improve Operations

Big data has entered the mainstream and businesses from a wide variety of industries have attempted to reap the benefits that come from data integration and analytics. Financial institutions have evolved to use big data in almost every aspect of their business, from customer service to business intelligence, but some business leaders are unsure of how they can build the right data foundations to extract the maximum value from their big data projects. Here are some ways in which financial institutions are using modern data practices to improve operations and some tips for financial institutions who wish to begin doing the same.

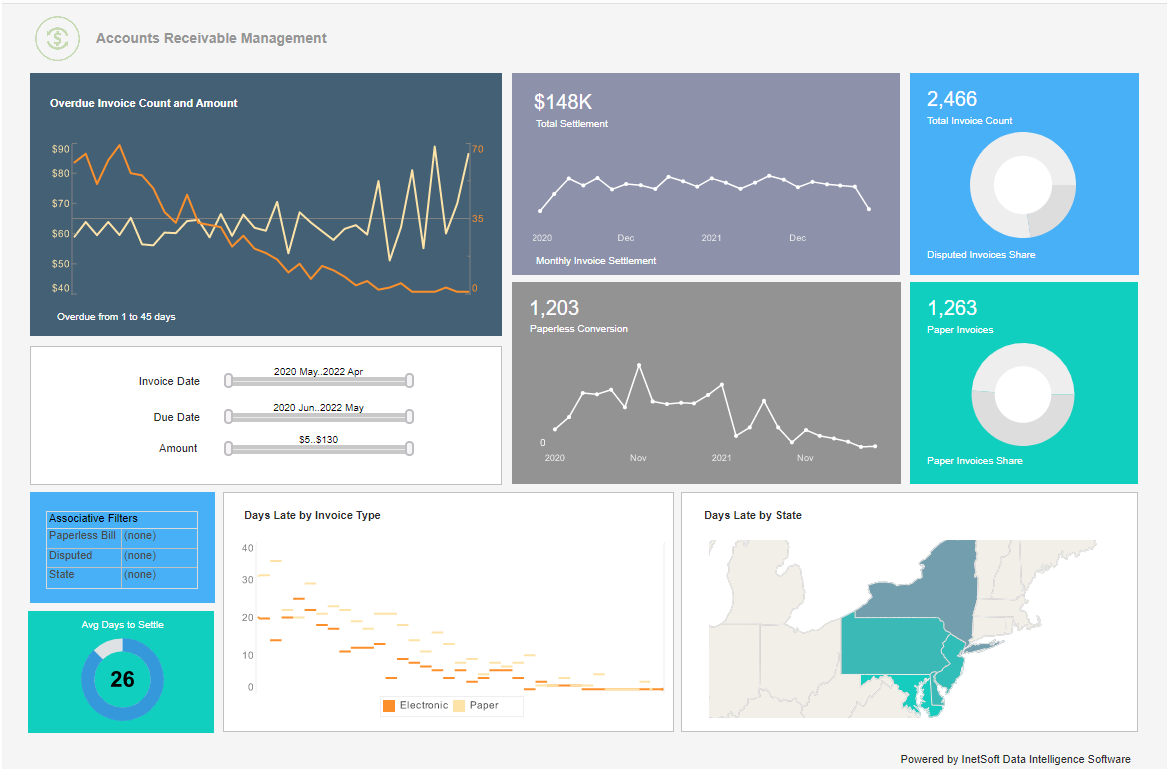

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

How are financial institutions using big data?

Data can provide a better basis for risk assessment

Banks and other financial institutions use risk assessments to facilitate important business activities such as lending and investing. Traditional methods allow risk assessment teams to focus on important indicators to build a base risk profile for each customer before engaging with them on lending activities. AI-based modern methods of risk assessment enable financial institutions to collect and analyze information from a wide variety of sources and effectively use a wider range of metrics than before. Risk profiles are also dynamic. Using a data-centric approach for risk assessment allows financial institutions to quickly identify and react to changes in spending patterns, income, and other important indicators of wealth and liquidity.

Financial institutions can improve customer segmentation with detailed data points on each customer

Financial institutions often serve diverse customer bases, with customers coming from a wide range of incomes, demographics, and backgrounds. This can make it difficult for businesses to target marketing and product activities to specific customers effectively. While financial institutions will continue to serve a diverse customer base, product lines have become increasingly targeted in recent years. Extensive data analysis empowers financial institutions to identify and target customers for specific product lines that are designed for them.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Fraud prevention can be automated with the appropriate data foundation to build security models on

Fraud is a massive problem for financial institutions worldwide. Malicious actors have evolved in recent years with cybercrime and cryptocurrencies changing the way fraud activities are conducted. Fraud can be conducted in a variety of ways that affect both internal and external processes. With fraud activities constantly changing and evolving, financial institutions must employ protections that can keep pace with these changes. Collecting and analyzing customer use and internal operational data allows financial institutions to be more aware of changes in behavior or discrepancies in internal operations. Modern software has also evolved to store and analyze more data points than ever before, making protections more comprehensive.

Data analysis helps financial institutions support and communicate with existing customers more effectively

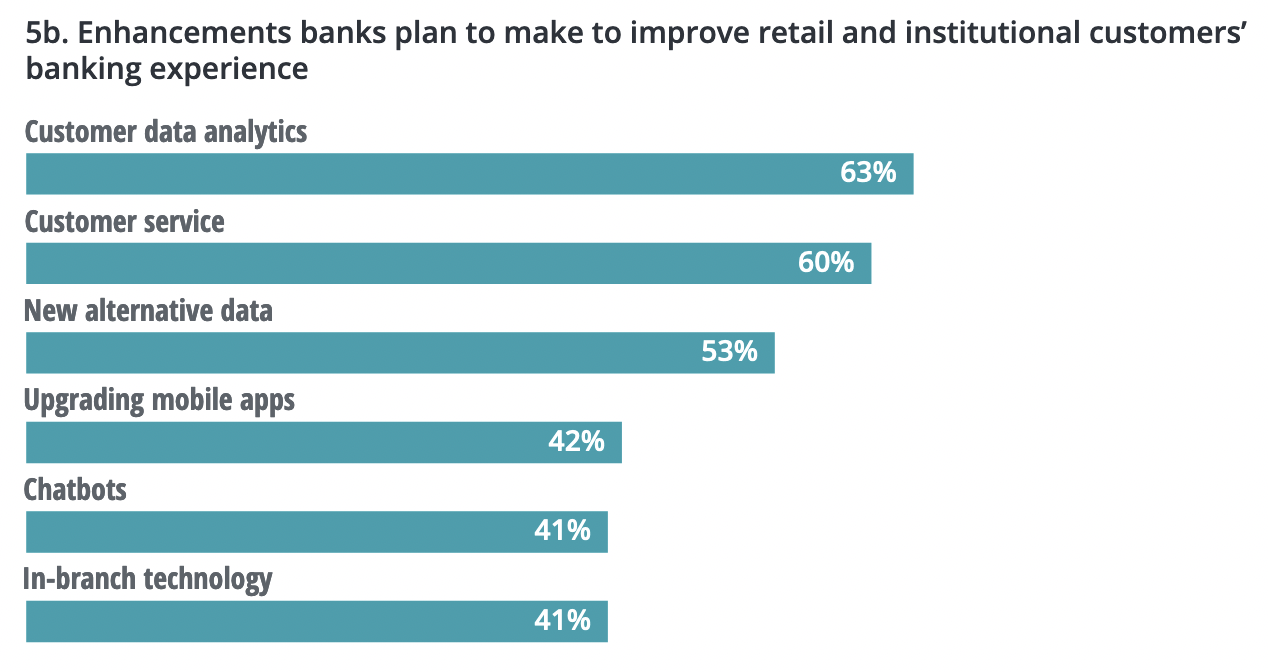

Customer experiences are increasingly used as a differentiating factor for businesses and financial institutions are no different. As customers gain more avenues to share their positive and negative experiences with a brand, businesses have to be more careful with the experiences they provide at their physical locations and online.

This is one of the reasons 63% of financial institutions use customer data analytics to ensure that their customers are satisfied with the service they receive. When a customer behaves differently or reduces their interaction with the financial institution, data points can highlight this change quickly and even recommend actions that can be taken to improve their experience.

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

How financial institutions can leverage data observability to reap the benefits of big data

As explained Forbes contributor Sanjit Singh Dang, PhD, Data Observability is an approach delivered through a set of tools that tracks the health of enterprise data systems and identifies, anticipates, and troubleshoots problems with data environments.

"Data Observability provides continuous, holistic, and cross-sectional visibility into complex data systems, such as the analytics and AI applications that companies would like to use to guide their businesses and personalize customer experiences," he wrote in a 2020 Forbes article. Data observability can help financial institutions remove the challenges associated with big data in the following ways.

Eliminate Information Silos and Create 'Certified' Data Sets

Financial institutions collect and store a vast amount of data spread across different operational departments that use disparate systems to collect, store, analyze, and manage customer and operational data. The resulting information silos pose challenges for data teams supplying consumers and leaders with the data used to analyze company performance and make strategic decisions for the future. Exploring data profiles and meta data, data observability applications can surface a holistic view of all data sets across an organization. From here, financial institutions can leverage visibility into current and historical metrics of data quality, reliability and performance and create 'certified data sets' for internal or external consumers.

Eliminate blind spots and Identify data points that provide actionable insight for business leaders and decision makers

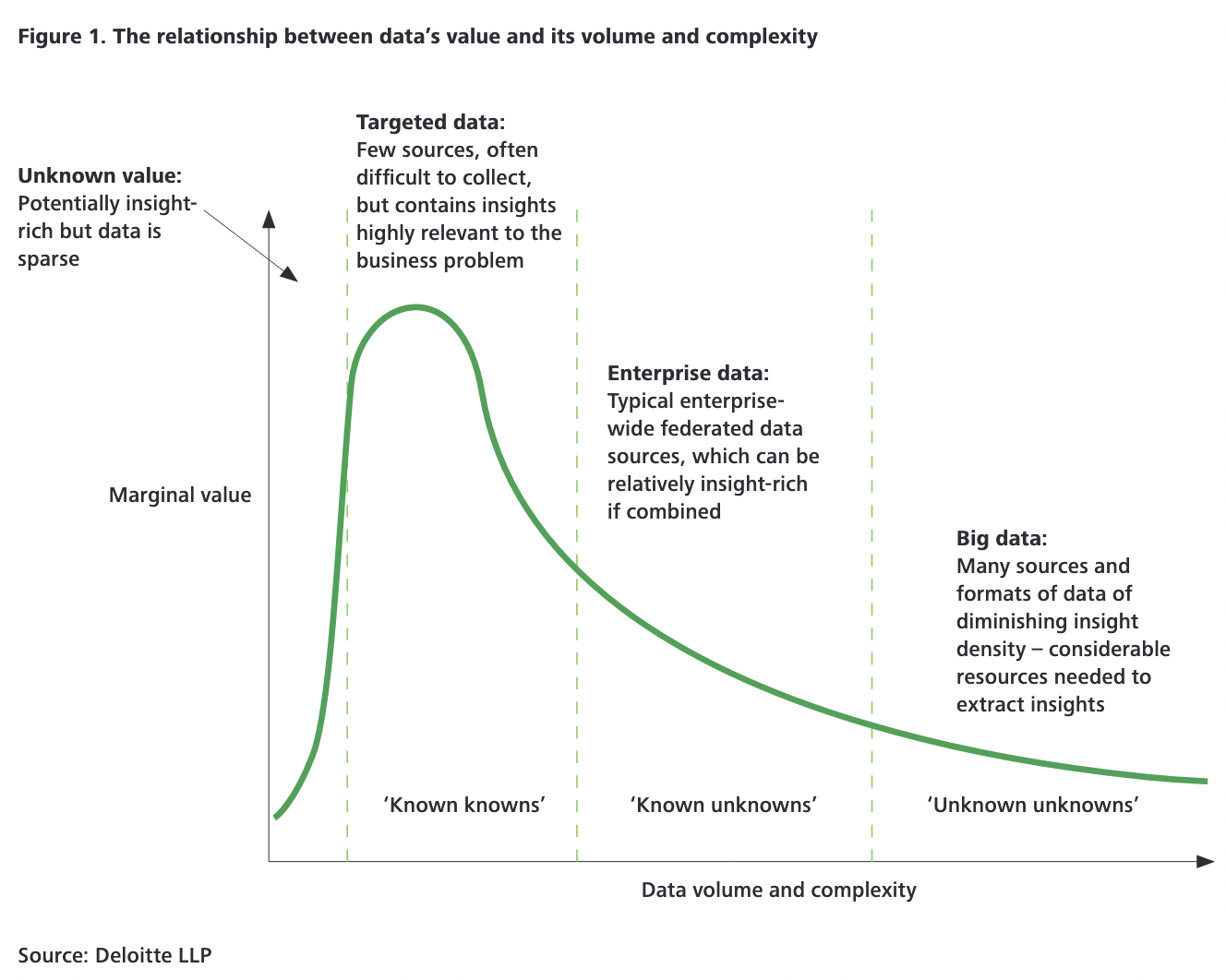

As more businesses realize the utility of data collection and analysis, business leaders tend to put effective data collection processes in place. However, this data is often collected indiscriminately across the entire business. In a recent survey, 75% of senior executives revealed that they are wasting more than half of the data they already have due to 'known unknowns' and 'unknown unknowns'.

By monitoring for all data risks, including schema drift, data drift, data quality, processing performance & bottlenecks, data movement, and more, data observability platforms can help eliminate data blind spots, and deliver value and insights into data without extensive resources.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Automate data management processes to maintain high levels of data quality and reliability

For businesses to use data to improve important processes and increase visibility into their operations, maintaining high levels of data quality and reliability is of the utmost importance. Financial institutions can find that poor data management practices create duplicate and incomplete data, as well as incorrect information. This information is then used to make highly consequential business decisions. Financial institutions must take concrete steps to continually and consistently evaluate data quality and fix data issues promptly.

With data observability, financial organizations can scale data quality and reliability with ML-based data quality rules that do not rely on data engineers or large technical teams. By leveraging controls and multiple channels for alerts and notifications, any data issues will be identified early and often so that data teams in financial institutions can be the 'first to know and the first to fix.

Modern financial institutions use data in a wide variety of ways. Fern Software builds digital solutions that allow these financial institutions to make the most of the systems that their data empowers. Acceldata observes data as it flows through data pipelines from ingestion to consumption, ensuring financial institutions that the data they use to improve customer experiences, increase business visibility, and improve operational efficiency is accurate and reliable. As more financial institutions digitally transform, the effectiveness of their data operations and the reliability of their data will determine their success and competitiveness in the marketplace.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

Author Bio

Loretta Jones is VP growth at Acceldata with extensive

experience marketing to SMBs, mid market companies and enterprise organizations. She is a self proclaimed

'startup junkie' and enjoys growing early stage startups. She studied Psychology at Brown University and

credits this major to successful marketing as well as navigating a career in Silicon Valley. She's a nature

lover and typically schedules her vacations around the migratory patterns of whales and large ocean creatures.