Stripe Dashboard Software

Technology has made many aspects of our lives easier, and shopping is no exception. Online sales are becoming a larger portion of overall revenue for many businesses. eCommerce transactions are just one of the many kinds of data that it benefits to store and analyze.

One development that has accelerated the growth of online shopping is the rise of third party payment processors, such as Stripe. Customers feel secure using these processors since they can make purchases throughout the web without giving each website their bank account information.

Mashup Stripe Data

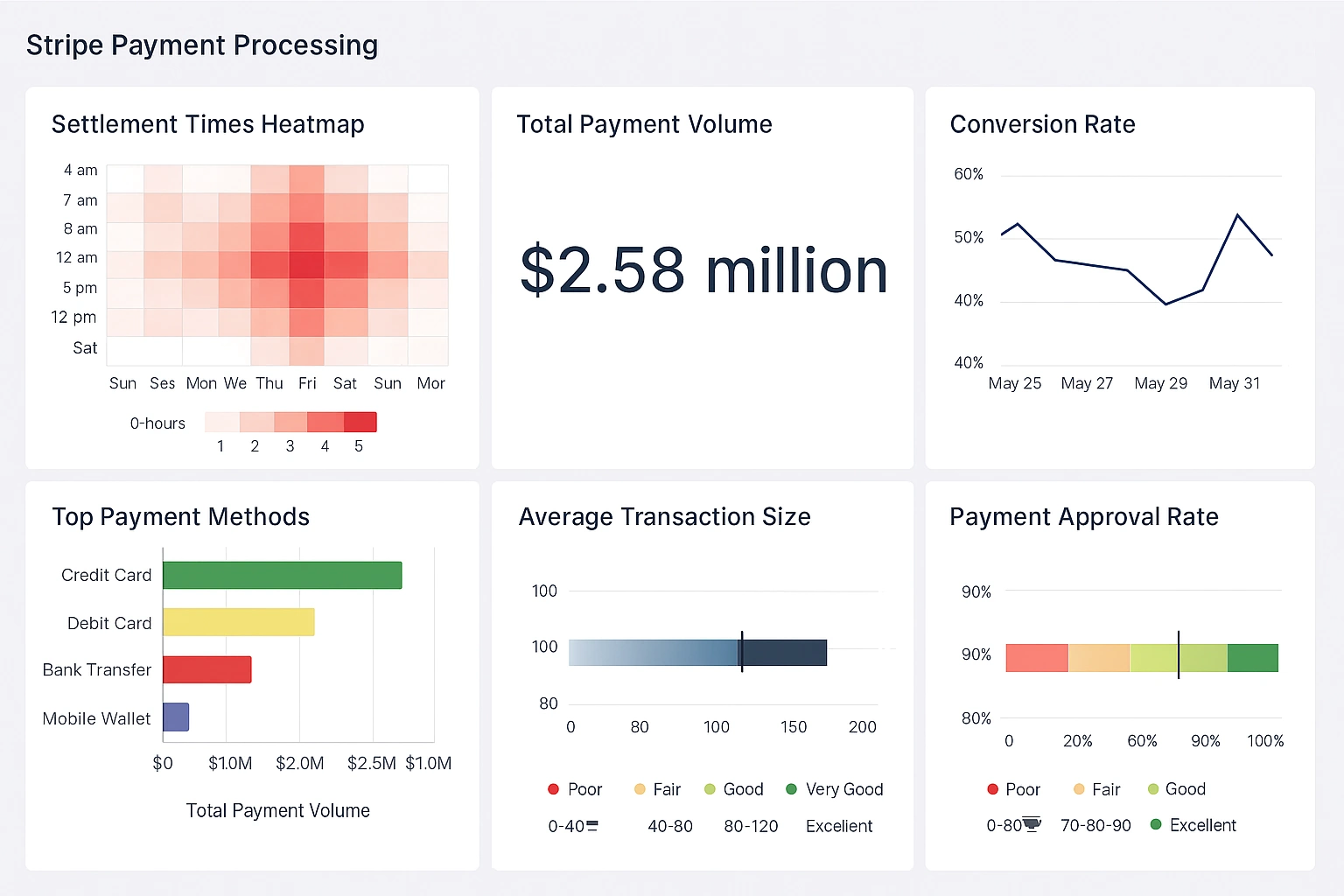

With InetSoft's StyleBI, sales tracking metrics, customer return ratio, and website page views can all be mashed up with data from Stripe and other payment processors. With InetSoft's user-friendly drag and drop tool, it's easy to learn how to create mashups with data from your website and online store combined.

Let's say you're using StyleBI to take the information that you have from your own eCommerce store to track your executed sales transactions. While doing so, you could also pull data you have from Google Analytics which displays who has visited the website and who has stayed on the website or made a purchase.

You could take the two different pieces of data and join them, using InetSoft's data mashup to create a combined dataset. StyleBI™ will allow you take in and combine both pieces of data using the unique data mashup tool. With that data you can come up with new metrics, for example, a ratio of page views to new customers.

How a Subscription-Based Mystery Box Service Upgraded Its Payment Processing Dashboards with StyleBI

Subscription-based “mystery box” services have exploded in popularity over the last decade. From gourmet snacks sourced from around the world to beauty and wellness kits tailored for adventurous customers, these services thrive on the excitement of surprise and personalization. Behind the scenes, however, these businesses are intricate operations where customer acquisition, churn management, recurring billing, and fulfillment efficiency all have to line up seamlessly. A crucial part of managing this complexity lies in understanding payment flows: who is paying, when renewals happen, which payments fail, and how revenue trends evolve over time. Many of these companies begin with Stripe, which provides a solid foundation for online transactions. But as the subscription service grows, the built-in dashboards often prove limiting. This was the challenge facing one mid-sized mystery box company, and it led them to upgrade their analytics from Stripe’s native dashboards to custom-built dashboards using StyleBI.

Stripe’s Dashboard: A Solid but Limited Starting Point

Stripe is widely recognized for its ease of use, clean API, and ability to handle everything from single purchases to recurring billing across multiple currencies. The built-in dashboard provides transaction histories, revenue summaries, and basic churn reporting. For a startup mystery box service, this was more than enough in the early days. Founders could log in, see how much revenue had been collected, and track customer growth month over month. The visualizations were simple, and the reporting tools required little training.

However, as the company scaled to thousands of subscribers across different tiers and geographies, the built-in Stripe reporting became too narrow. The team needed to see much more than just revenue totals. They wanted insights into failed transactions segmented by country, trends in retry success rates, comparisons of churn between subscription tiers, and lifetime value projections that incorporated both revenue and payment success. Stripe’s dashboards provided snapshots, but they lacked the flexibility to combine Stripe data with other operational data sources.

The Growing Complexity of Subscription Analytics

Running a subscription business creates unique analytical challenges. Unlike one-time purchases, recurring revenue models depend heavily on consistency, retention, and forecasting. For the mystery box service, payment-related metrics became central to decision-making. Questions like “How many customers failed renewal last week due to expired cards?” or “What is the difference in churn between premium subscribers and entry-level subscribers?” became daily concerns for management.

Adding to the complexity, the company wanted to mash up Stripe data with marketing and fulfillment systems. For instance, did customers acquired through social media promotions have higher payment failure rates than those acquired organically? Did late box deliveries correlate with higher cancellation rates after a failed payment? Answering these required dashboards that could blend data from Stripe with other systems in a unified view.

Why StyleBI Was Chosen

The management team evaluated several BI platforms but ultimately selected StyleBI for its flexibility, mashup capabilities, and cost-effectiveness. They recognized that while Stripe’s dashboards were polished, they were also rigid. StyleBI allowed them to bring in data directly from Stripe’s API while simultaneously pulling customer information from their CRM, logistics performance metrics from their warehouse software, and campaign data from their marketing automation system. The result was a complete view of the business, with payment processing at the core.

Another deciding factor was StyleBI’s ability to empower non-technical staff. With its drag-and-drop dashboard creation and reusable templates, analysts and even some team leads could design their own views without waiting for IT. This agility was crucial, because the payment environment is fluid—chargeback rules change, card processor behavior evolves, and fraud detection requires ongoing adaptation. The team needed a BI platform that could keep up with these shifts without months of custom development.

Designing the New Dashboards

When the mystery box company rolled out StyleBI, they focused on four major types of dashboards: revenue health, payment success, customer retention, and operational correlation.

Revenue Health: This dashboard tracked daily, weekly, and monthly revenue flows segmented by subscription tier. It also highlighted trial conversions, upgrades, and downgrades, giving management a complete picture of revenue dynamics. Stripe data provided the transactions, but StyleBI made it possible to overlay cohort analysis and projections based on churn rates.

Payment Success: Failed payments are a subscription service’s nightmare. The team built dashboards that monitored decline codes, retry attempts, and eventual recovery rates. By visualizing payment failures by geography and card type, they uncovered patterns—for example, certain international customers had higher rates of decline, which allowed the company to adjust retry intervals and customer communication strategies.

Customer Retention: This dashboard combined payment data with churn events to understand not only when customers canceled but whether failed payments were a trigger. They tracked customer lifetime value over time, broken down by acquisition channel. Marketing spend could then be optimized toward channels that produced high-value, low-failure customers.

Operational Correlation: The most advanced dashboards merged fulfillment performance with payment data. Late shipments often preceded cancellations after failed payments. With StyleBI’s mashup capabilities, managers could spot these correlations and address root causes, such as shipping delays in specific regions.

Benefits Realized

The move to StyleBI produced tangible benefits almost immediately. Managers gained deeper visibility into the heartbeat of the business. Instead of reacting to generic revenue drops, they could pinpoint whether declines were driven by churn, payment failures, or changes in customer cohorts.

One striking improvement came in the area of failed payment recovery. With Stripe’s dashboard, the team knew how many payments failed but couldn’t easily segment them. With StyleBI, they identified that retrying payments in the early morning led to higher success rates in certain regions. This insight alone recovered thousands of dollars in otherwise lost revenue every month.

Another benefit was in forecasting. With Stripe’s built-in dashboard, future revenue projections were simplistic, often just linear extrapolations of recent trends. StyleBI allowed the team to build models that incorporated churn patterns, customer acquisition, and retry success rates, giving them far more reliable forecasts for both investors and internal planning.

Improved Team Collaboration

Beyond raw metrics, the dashboards became a communication tool. Different teams—marketing, operations, finance—could all access a shared truth. Marketing could see how their campaigns affected customer payment stability, while operations could understand how fulfillment performance tied to renewals. Finance, meanwhile, gained clarity into cash flow predictions and risk exposure.

Because StyleBI dashboards were accessible across devices, managers on the go could check payment recovery rates or churn metrics from a tablet or phone. This mobility encouraged more frequent review and faster decision-making. Instead of waiting for weekly finance updates, teams had near real-time visibility.

Lessons Learned

The transition wasn’t without its challenges. Pulling Stripe data through APIs required initial setup and careful validation to ensure accuracy. Some staff initially resisted the new dashboards, preferring the simplicity of Stripe’s interface. Training sessions were necessary to familiarize everyone with the new features and flexibility.

However, once adoption spread, the company realized that the customization was worth the learning curve. They could tailor dashboards not only to executives but also to customer support, who used payment dashboards to quickly identify why a customer’s subscription lapsed. This reduced support times and improved the customer experience, creating a virtuous cycle of retention and satisfaction.

The Strategic Impact

In the end, upgrading from Stripe’s built-in dashboards to StyleBI was about more than just nicer visuals. It was a strategic shift in how the company understood and managed its subscription business. By putting payment analytics at the center and connecting them to other operational data, the company moved from reactive problem-solving to proactive growth management.

Investors responded positively as well. When pitching for their next funding round, the company demonstrated their advanced dashboards as evidence of operational maturity. This level of visibility reassured stakeholders that the business could not only grow but sustain and optimize that growth through data-driven insights.