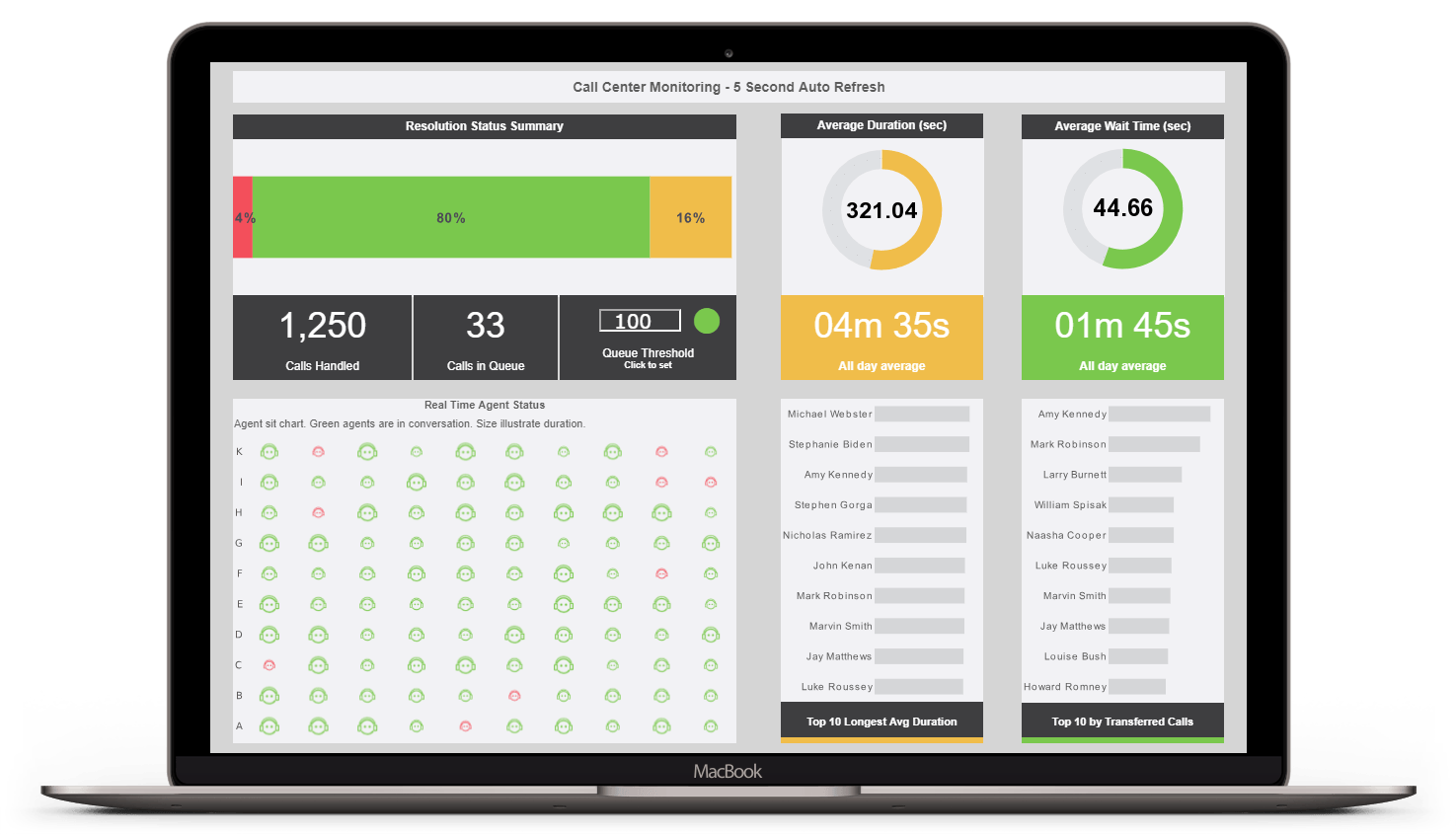

Evaluate InetSoft's Business Activity Monitoring App

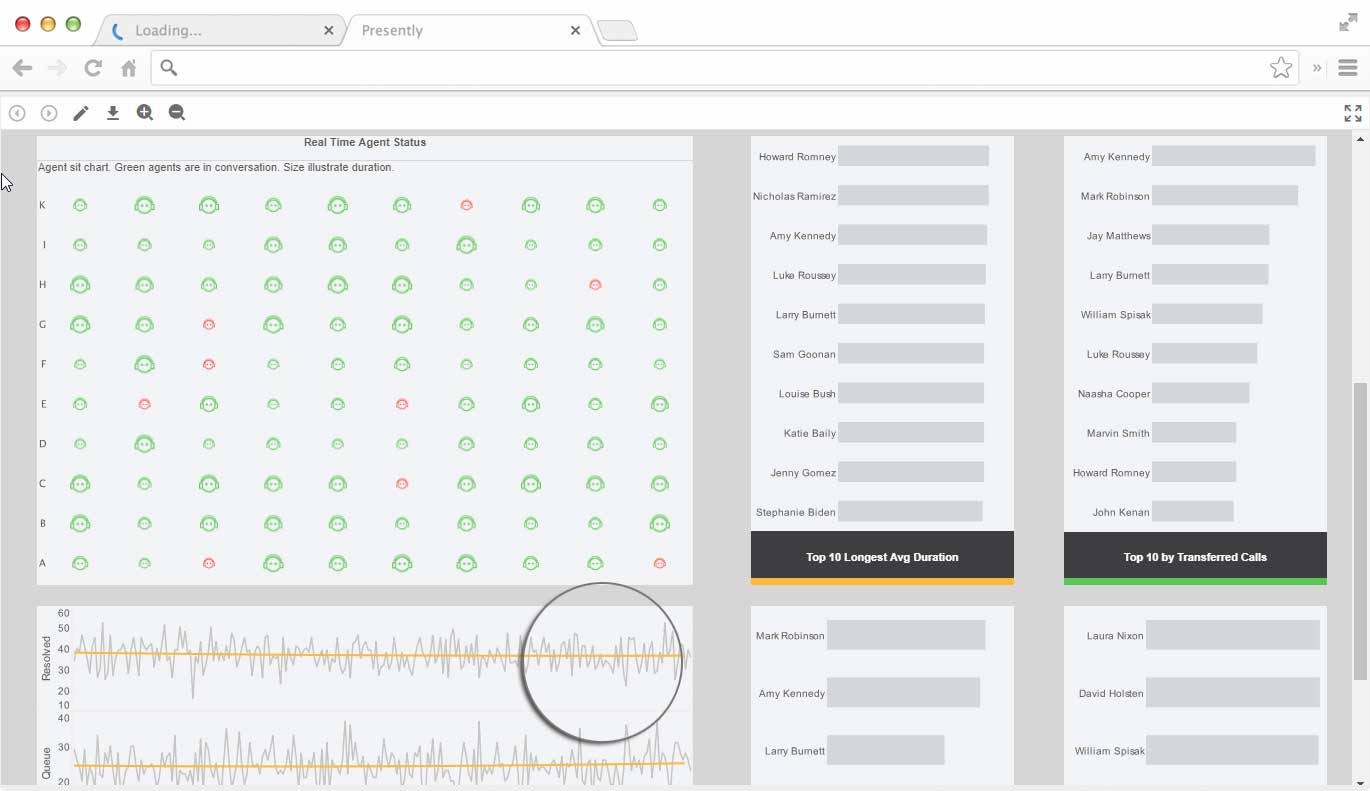

InetSoft's visualization dashboards are the best way to present high level views of organizational data. Visual KPIs must not only present clear, refreshing visibility, they must also be actionable. InetSoft's visualization engine has deep built-in interactivities. It allows business users to drill down and interrogate underlying data to discern proper action.

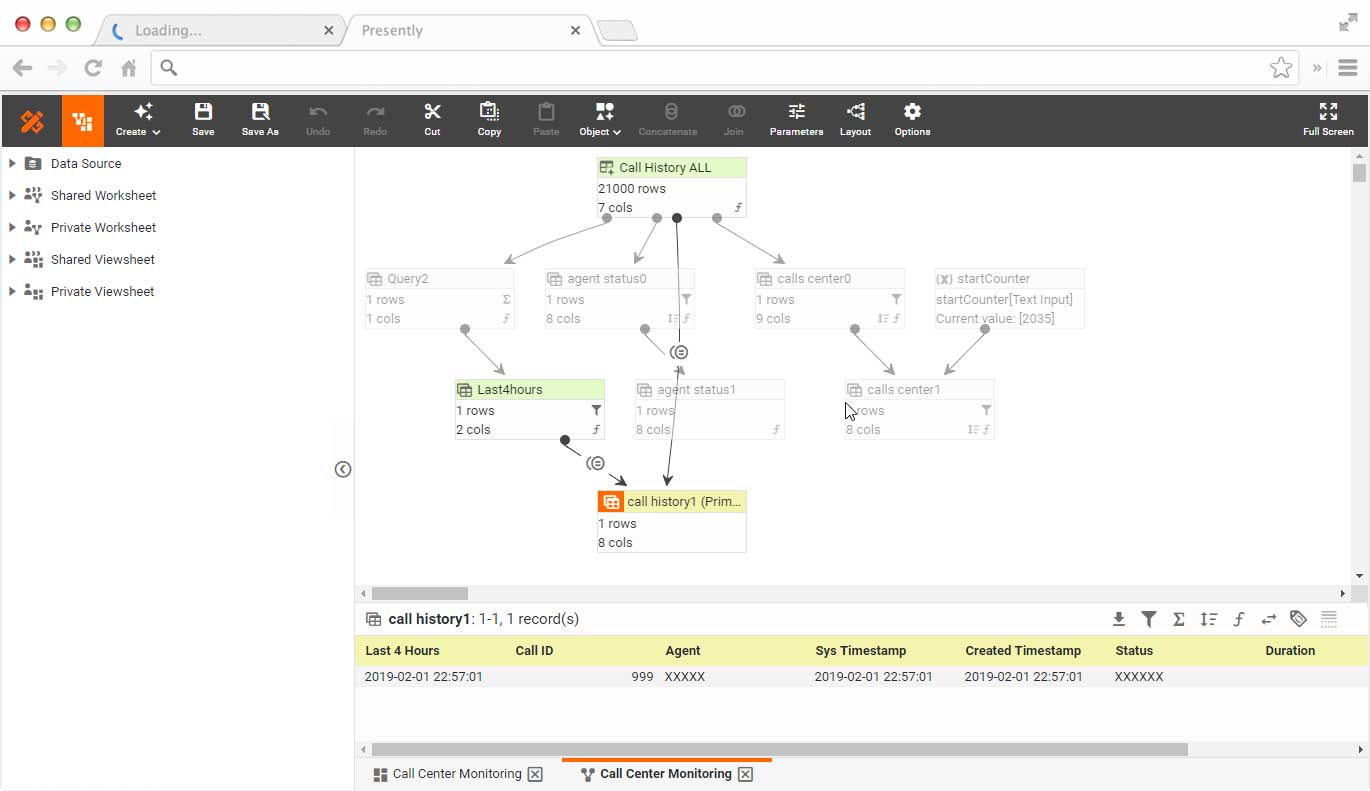

Mashup Real Time Data With Its Historical Context

For BAM, historical context is as important as all other types of business analytics. It's often the case that historical data and real time data come from different channels. Data transformation and mashup are critical to gain a comprehensive view.

Spotlight: What Activity Does a Merchant Service Provider Monitor?

Merchant service providers (MSPs) play a vital role in facilitating electronic transactions for businesses, handling everything from credit card processing to payment gateway services. One of the key activities that MSPs monitor is the authorization and processing of payment transactions. This involves scrutinizing each transaction to ensure its legitimacy, detecting any signs of fraud or suspicious activity, and verifying that the transaction meets the necessary security standards and compliance regulations. By closely monitoring transaction activities, MSPs help protect both merchants and consumers from fraudulent practices while ensuring the smooth and secure flow of electronic payments.

Another critical aspect of monitoring for MSPs is risk management. MSPs assess various types of risks associated with payment processing, including financial risks, operational risks, and compliance risks. They monitor factors such as transaction volumes, chargeback rates, and changes in merchant behavior to identify potential risks and mitigate them proactively. Additionally, MSPs monitor industry trends, regulatory developments, and security threats to stay ahead of emerging risks and adapt their risk management strategies accordingly. By effectively managing risks, MSPs help safeguard the integrity of the payment ecosystem and maintain trust among merchants, consumers, and financial institutions.

Furthermore, MSPs monitor the performance and reliability of their payment processing systems to ensure optimal functionality and uptime. This involves tracking metrics such as transaction processing times, system downtime, and error rates to identify any performance issues or bottlenecks. By continuously monitoring system performance, MSPs can promptly address any technical issues or infrastructure limitations that may impact the efficiency and reliability of payment processing services. Ultimately, through vigilant monitoring of payment transactions, risk factors, and system performance, merchant service providers play a crucial role in maintaining the integrity, security, and efficiency of electronic payment systems.

What Metrics Does a Merchant Service Provider Track?

Merchant Service Providers (MSPs) are responsible for facilitating and managing electronic payment transactions between merchants and their customers. To ensure smooth operations, security, compliance, and customer satisfaction, MSPs track a wide range of metrics. These metrics provide insights into transaction patterns, system performance, risk factors, and overall business health. Below is an in-depth exploration of the key metrics that MSPs monitor and why each is important.

1. Transaction Volume

Transaction volume refers to the total number of payment transactions processed within a specific period (hourly, daily, monthly, etc.). Monitoring transaction volume helps MSPs understand business growth, identify peak periods, and allocate resources efficiently. Sudden spikes or drops in volume can indicate promotional campaigns, seasonal trends, or potential technical issues.

2. Transaction Value

This metric tracks the total monetary value of all transactions processed. It helps MSPs assess revenue flow, detect high-value transactions that may require additional scrutiny, and forecast financial performance. Analyzing average transaction value can also reveal changes in customer purchasing behavior.

3. Authorization Rate

The authorization rate measures the percentage of payment requests that are successfully approved by issuing banks. A low authorization rate may indicate issues with payment gateways, card network problems, or increased fraud attempts. Monitoring this metric helps MSPs optimize approval processes and reduce lost sales.

4. Decline Rate

The decline rate is the percentage of transactions that are rejected, either due to insufficient funds, expired cards, suspected fraud, or technical errors. High decline rates can negatively impact merchant revenue and customer experience. MSPs analyze decline reasons to identify and address underlying problems.

5. Chargeback Rate

Chargebacks occur when customers dispute transactions and request refunds through their card issuers. MSPs track the chargeback rate to monitor potential fraud, customer dissatisfaction, or merchant errors. Excessive chargebacks can lead to penalties from card networks and damage a merchant’s reputation.

6. Refund Rate

The refund rate measures the proportion of transactions that are refunded to customers. High refund rates may signal product quality issues, customer dissatisfaction, or potential abuse of refund policies. MSPs use this metric to work with merchants on improving service and reducing unnecessary refunds.

7. Fraud Detection Metrics

MSPs employ various metrics to detect and prevent fraudulent activities, including:

- Fraud Rate: The percentage of transactions identified as fraudulent.

- Suspicious Transaction Alerts: The number of transactions flagged for manual review.

- Velocity Checks: Monitoring rapid transaction attempts from the same account or IP address.

8. Settlement Time

Settlement time refers to the duration between when a transaction is processed and when funds are deposited into the merchant’s account. Faster settlement times improve merchant cash flow and satisfaction. MSPs track this metric to identify delays and optimize settlement processes.

9. System Uptime and Availability

MSPs must ensure their payment processing systems are reliable and available around the clock. Uptime metrics measure the percentage of time systems are operational. Downtime incidents are tracked to identify causes and implement preventive measures. High availability is critical for maintaining merchant trust and minimizing lost sales.

10. Transaction Processing Time

This metric measures the average time taken to process a transaction from initiation to completion. Slow processing times can frustrate customers and lead to abandoned sales. MSPs monitor this metric to optimize system performance and enhance user experience.

11. Error Rate

Error rate tracks the frequency of failed transactions due to technical issues, such as network errors, integration failures, or system bugs. High error rates can indicate underlying problems that require immediate attention to prevent revenue loss and customer dissatisfaction.

12. Payment Method Distribution

MSPs support various payment methods, including credit/debit cards, digital wallets, ACH transfers, and alternative payment options. Tracking the distribution of payment methods helps MSPs understand customer preferences, identify emerging trends, and ensure broad compatibility.

13. Merchant Onboarding Metrics

The efficiency of onboarding new merchants is crucial for MSP growth. Metrics include:

- Onboarding Time: The average time taken to approve and activate a new merchant account.

- Onboarding Success Rate: The percentage of applications successfully completed.

14. Compliance and Regulatory Metrics

MSPs must comply with industry regulations such as PCI DSS, AML, and KYC. Metrics in this area include:

- Compliance Audit Pass Rate: The percentage of successful compliance checks.

- Number of Regulatory Incidents: Instances of non-compliance or regulatory breaches.

15. Customer Support Metrics

Providing timely and effective support is essential for merchant retention. MSPs track:

- Average Response Time: How quickly support teams respond to merchant inquiries.

- Resolution Time: The time taken to resolve issues.

- Customer Satisfaction Scores: Feedback from merchants regarding support quality.

16. Revenue and Fee Metrics

MSPs generate revenue through transaction fees, monthly charges, and value-added services. Key metrics include:

- Gross Revenue: Total income from all sources.

- Net Revenue: Revenue after deducting costs and chargebacks.

- Average Fee per Transaction: Helps assess pricing strategies and profitability.

17. Retention and Churn Rates

Retention rate measures the percentage of merchants who continue using the MSP’s services over time, while churn rate tracks those who leave. High retention indicates strong service quality and satisfaction, whereas high churn may signal issues that need addressing.