4 Ways How Credit Unions Use Dashboards and Analytics

Like many other businesses now, many credit unions are struggling with continuous technology adoption and innovation. Some may find themselves behind on many important technological trends and face increasing concerns such as cyber security issues, fintech solutions, and marketing challenges.

To survive and thrive in the ever-changing banking industry, credit unions need to invest in the latest industry technology. Not only does this strategy provide a competitive advantage, but it also helps with attracting young talent and improves the ability to adapt to constantly changing market standards.

Business Intelligence (BI) solutions like dashboards and data analytics are some of the most interesting

technology investment options for credit unions. Powered by machine learning, these solutions allow to get

insights from current and historical business data and make sound predictions about the future.

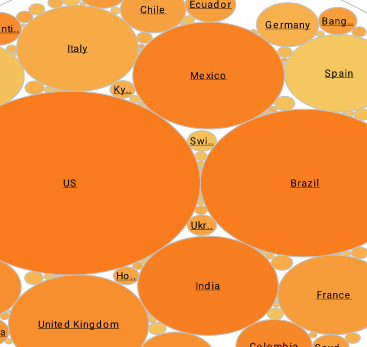

Businesses around the world are investing in these solutions; in fact, the global BI and analytics software

market is set to increase by at least $3 billion in the next three years.

What should you do?

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Let's review four ways credit unions can use dashboard and analytics software so you can decide.

1. Turn Customer Data into Profitable Insights

Like many other businesses, credit unions have accumulated tons of data to better serve their customers, including demographic, behavioral, transactional, payment, and others. This data comes from member surveys, marketing platforms, interviews, member accounts, and third-party software.

However, 45 percent of credit unions don't have a strategy for implementing data analytics and analyzing

patterns in customer data, says Credit Union Journal.

Business intelligence solutions like dashboards and analytics now help with collecting even more data and

turning it into trends, patterns, and ideas.

For example, an advanced analytics tool can help with achieving these strategies:

- Customer segmentation to identify the members who are more likely to churn

- Segmentation to differentiate the most profitable members

- Define the most effective member communication channels that bring leads

- Analyze the most popular and valuable services used by customers.

From there, you can use the insights to create more customized service packages and practices to improve customer loyalty and satisfaction. With modern self-service analytics tools like InetSoft, your employees can perform complex data analysis without IT assistance thanks to a user-friendly dashboard interface.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

2. Streamline Internal Reporting

A data visualization dashboard is perfect for this task because of the existing reporting systems that need an upgrade (in fact, 77 percent of decision-makers in the banking industry say reporting is a challenge for their organizations). For example, many credit unions typically segment their operations by products and services like credit cards, loans, and retirement accounts. This approach significantly hinders data sharing across the organization.

Let's consider an example. The marketers who conducted a campaign along with the mortgage department announce the conversion of 100 leads. This news is greeted by the executives, so the managers decide to launch another, similar campaign to get even more customers.

But there's a problem. People who analyzed the performance of the first campaign have found that 85 percent of mortgages that were sold were actually in default. So the project wasn't as successful as initially declared, because it means that the organization netted only 15 percent of the potential sales.

This example shows how a lack of a centralized reporting platform that everyone can access and analyze resulted in a huge waste of time planning and launching the second campaign.

There are two steps to improve internal reporting and avoid these situations. First, find a solution that maximizes self-service, both for banking managers and technical staff. Next, provide data visualization tools that are accessible by all employees in order to improve data access and maintain internal reports in an automated fashion.

If done right, a centralized reporting platform can help with increasing the speed of document processing and reducing issues like typos and duplicates. Moreover, decision-makers would be able to make data-supported service development choices and improve the performance of their departments.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

3. Improve Lending Assessment Accuracy

Experts agree that leading assessment is something that analytics can really help credit unions with."BI solutions are often based on machine learning algorithms whose purpose is to find patterns in data. This makes them a suitable option for credit unions," says Tim Dawson, a data science researcher at Studyker. "One major use case is to improve profitability and lending assessment accuracy."

If a credit union systematically applies BI solutions powered by machine learning to underwriting decisions, they can:

- Enhance the value of "soft information" in judging borrower's creditworthiness. Traditionally, lenders review a limited number of factors to make a decision (debt, income, repayment history, etc.). While critical, they don't provide enough information to help with understanding the real debt-servicing capacity of the borrower. With machine learning, lenders can analyze "soft information" and judge borrower's creditworthiness more accurately

- Make smaller loans more viable. In many cases, credit unions pass on small-size loans to avoid spending a lot of time conducting a credit review. With a machine learning assessment tool they can do so within much shorter timeframes, therefore do more business

- Identify more risk indicators. BI analytical tools detect relationships between these indicators and credit risk outcomes

- Increased control over the lending process. Lenders using analytics can reduce operating costs and come up with more competitive and accurate risk premiums.

Learn how InetSoft's data intelligence technology is central to delivering efficient business intelligence. |

4. Assess Loan Performance of Individual Officers and Branches

If you collect loan performance with reporting software, you can view this data in a single dashboard. This is especially relevant to CEOs and other supervising positions who need to access sales data in one place and make improvement decisions as quickly as possible.

Loans by a branch or individual loan officer are one of the most useful data for performance evaluation. Viewing it in a summary dashboard would be much easier compared to traditional reports and presentations; for example, the user can manipulate the data, check different timeframes, and save tables and graphs to their computer.

There are multiple types of dashboards that can be used by credit unions. For example, feel free to interact with a live sales dashboard to see how easy it is to use them in your work.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Conclusion

Using data visualization dashboards and analytics solutions is a proven way for credit unions to achieve their goals. By using them, they identify and monitor loan risks, analyze loan applications, monitor loans and applications for steering and discrimination, streamline reporting, find patterns and trends, and do many other things to advance. See this list of business intelligence user case studies to see how various businesses have benefited from using data analytics tools and dashboards.

What KPIs Do Credit Unions Track?

Credit unions are member-owned financial organizations that function to provide their members financial services. Credit unions, like any other financial organization, must monitor key performance indicators (KPIs) to gauge their effectiveness and success. KPIs assist credit unions in determining their strengths and weaknesses, assessing their performance, and making defensible choices. The important performance metrics that credit unions monitor is covered in this article.

Membership Growth

One of the most crucial KPIs that credit unions monitor is membership growth. It tracks how quickly the credit union is adding new members. For credit unions to boost income and improve their financial condition, their membership base must be regularly expanded. Credit unions keep track of their pace of membership growth by keeping track of how many new members sign up each month, quarter, or year.

Loan Growth

By making loans to its members, credit unions make money. Due to the fact that it gauges how quickly the loan portfolio is growing, loan growth is a crucial KPI for credit unions. By keeping track of the number of new loans issued each month, quarter, or year, credit unions may determine their loan growth rate. An important sign of a credit union's financial stability and capacity to provide credit to its members is the growth of its loan portfolio.

Asset Quality

Asset quality evaluates the caliber of the credit union's loan portfolio, making it an important KPI for them. By keeping an eye on their loan portfolio's delinquency and default rates, credit unions keep track on the quality of their assets. The proportion of loans that are delinquent is measured by delinquency rates, while the percentage of loans that have not been repaid is measured by default rates. Delinquency and default rates that are too high are a sign that the credit union is taking on too much risk, which might result in losses.

Net Interest Margin

The difference between the credit union's interest revenue and the interest paid on deposits is measured by a KPI called net interest margin (NIM). Since it monitors the credit union's profitability, NIM is a crucial KPI for credit unions. Credit unions measure NIM by keeping an eye on interest payments made on deposits as well as interest revenue received on loans and investments. A high NIM shows that the credit union is outpacing the cost of funding in terms of return on assets.

Return on Assets

A KPI called return on assets (ROA) gauges how profitable a credit union is in relation to the value of all of its assets. As it gauges the effectiveness of the credit union's activities, ROA is a crucial KPI for them. ROA is measured by credit unions by dividing net income by total assets. An elevated ROA shows that the credit union is making a sizable profit off of its assets.

Operating Expenses

Another crucial KPI for credit unions is operating expenditures, which gauge how well the institution manages its costs. Credit unions keep track of running costs by keeping an eye on the price of wages and benefits, as well as rent, electricity, and other costs. The profitability and financial stability of the credit union may be considerably impacted by high operational expenditures.

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

Capital Adequacy Ratio

A KPI that gauges a credit union's capacity to absorb losses is the capital adequacy ratio (CAR). By dividing the credit union's total capital by its risk-weighted assets, the CAR is determined. Credit unions monitor CAR to make sure they have adequate capital to cover any possible loan portfolio losses.

Member Retention Rate

A KPI called member retention rate gauges the credit union's success in keeping members. By keeping track of how many members renew their memberships each year, credit unions may determine their member retention rate. High member retention rates are a sign that the credit union is giving its customers good service and taking care of their financial requirements.

Customer Satisfaction

A KPI called customer satisfaction gauges how satisfied credit union members are. Credit unions gather member comments and conduct surveys to gauge client satisfaction. High customer satisfaction levels show that the credit union is meeting the financial needs of its members and offering top-notch customer service. With the goal of boosting member satisfaction, credit unions use this KPI to pinpoint areas for improvement and improve the services they offer.

|

Read how InetSoft saves money and resources with deployment flexibility. |

Loan-to-Share Ratio

A KPI used to gauge a credit union's capacity to meet members' financial needs is the loan-to-share ratio. By dividing the credit union's total loans by its total shares, the ratio is calculated. Credit unions monitor this KPI to make sure they have the resources necessary to satisfy the lending demands of their members.

Cost of Funds

A KPI called cost of funds calculates the interest rate that the credit union pays on its members' deposits. Credit unions monitor this KPI to control their interest rate risk and make sure they are offering their depositors a competitive interest rate.

Efficiency Ratio

A KPI called the efficiency ratio assesses the credit union's operational costs in relation to its income. By dividing the credit union's operational costs by its total income, the efficiency ratio is determined. Credit unions monitor this KPI to make sure they are running successfully and controlling their costs.

Loan Balance on Average

The average loan balance per member or per account is tracked by this KPI. It aids credit unions in comprehending the lending requirements of their members and in spotting chances to boost loan volumes.

| Related: Reducing eCommerce Fraud with Better Analytics |