Top Ways Analytics Are Used In the Insurance Industry

1. 10 Insurance Analytics Usage Cases

2. Benefits of Analytics for Insurance

Providers

3. 15 KPIs Specific to Insurance

The insurance industry is highly competitive, with many different companies competing for the same customers. In the past, evaluating risks was a lengthy process.

Insurance companies collect customer information relating to claims, policies, and actuarial so that the underwriters could consider the risks involved in insuring clients. This process was not always accurate and did not allow the business to scale.

The industry has seen rapid changes over the years as it has become digital and continues to make technological advancements. Most insurance companies now use data analytics to extract essential and meaningful information from big data. Using analytics allows them to better understand their consumers and lower their own business risks.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

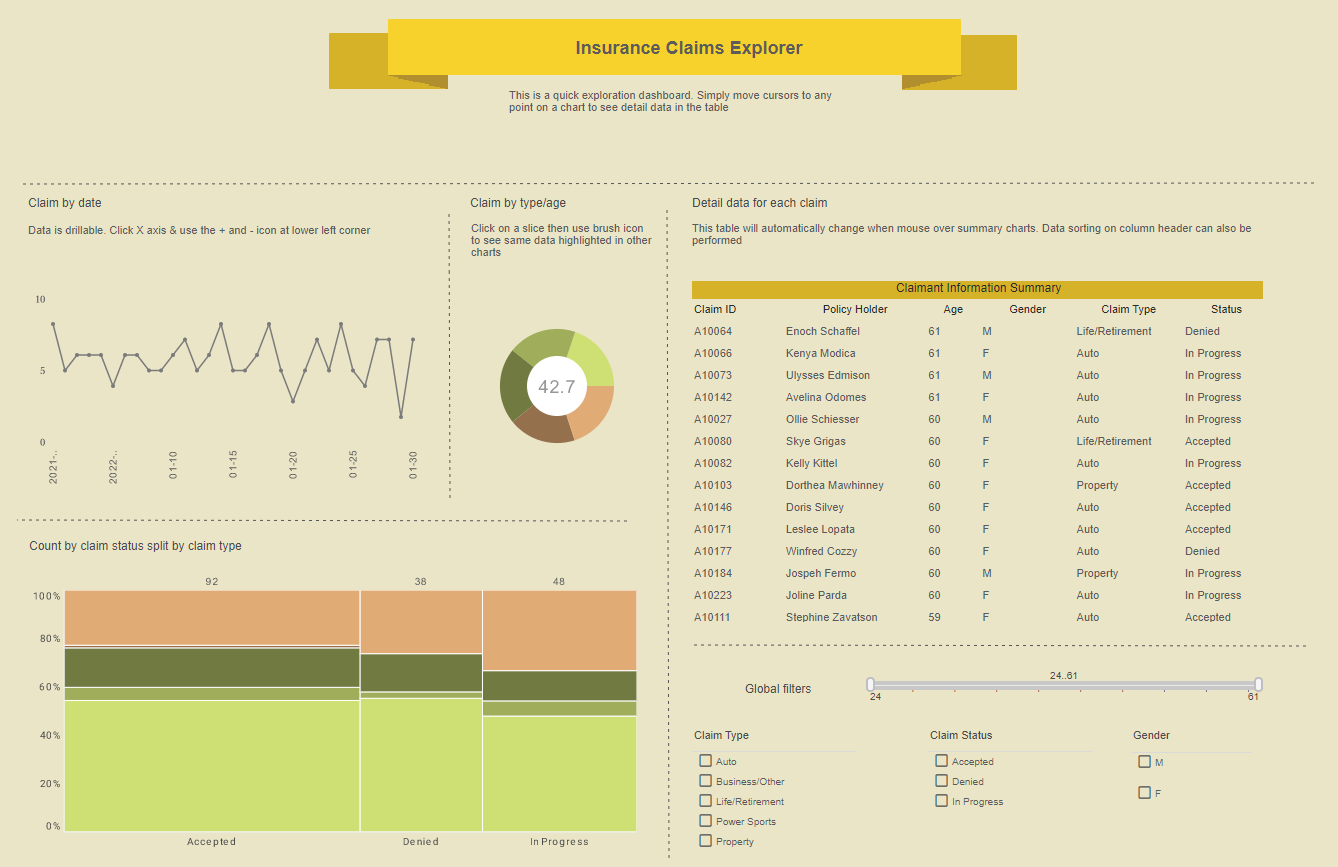

10 Ways Insurance Companies Use Analytics

Successful insurance companies are adept at mitigating risk. While people are complex, these companies work to understand the behavior patterns of their customers. They analyze information and data to put customers into groups based on their risk, which allows them to cut expenses and prevent fraud.

Analytics is an important tool for the insurance industry and is used for the following:

Internal Processes

The use of analytics allows insurance firms to work efficiently and make decisions quickly. Data analytics indicates which line of the business is performing well and lets you know how profitable the company is. With this information, you change your sales process and have a better idea of which business areas to focus on.

Using algorithms means that your processes are more automated. The algorithms cut down the time an insurance broker spends reviewing a customer's history and then working on a pricing model.

Using analytics, the algorithm works out what risk class a customer belongs to and automates claims. Insurance brokers can respond to clients more quickly and spend less time on each policyholder. This frees up time to take on more customers.

Gain New Customers

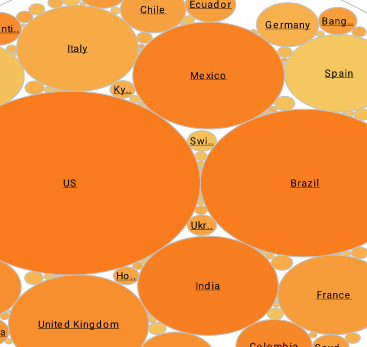

Given that the insurance industry is incredibly competitive, companies need to continually attract and acquire new customers to stay in business. With the use of the internet and social media, massive amounts of data are generated and exchanged.

Insurance companies track the online behavior of their potential customers, as this is more meaningful than other research methods like questionnaires and surveys. The information they gather from this process is classified as unstructured data. Insurance companies then analyze this data to create targeted marketing campaigns.

Companies can also use tools to access potential clients shopping for insurance. For example, insurance leads from Nectar Marketplace give insurance brokers the information of people looking for insurance quotes.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Retain Customers

It's incredibly easy and common for clients to switch between insurance companies, so retaining clients can be challenging. Every insurance broker knows that it's cheaper to retain a client than to acquire a new one. As a result, high client retention is imperative for the company's success.

Insurance companies use analytics to help retain the customer. Algorithms monitor the clients' activities and can predict when customers are unsatisfied with their insurance company for various reasons like the service level or price.

Insurance companies can react swiftly to retain unsatisfied clients with these insights and information. Insurance companies often offer discounts or improve their service to retain the customer.

Offer Personalized Services

These days, consumers are looking for customization and personalized services. There's no longer room for a one-size-fits-all policy. Apart from reliability, consumers are looking for insurance companies that can offer them policies that meet their individual needs.

Analytics allow insurance companies to analyze data and use it to offer clients policies that suit their needs. For example, when offering life or health insurance, a company can access the client's medical history and offer them a plan based on their individual needs.

|

Read how InetSoft saves money and resources with deployment flexibility. |

Accurately Price Premiums

Consumers are price-sensitive, and most want to spend as little as possible on insurance. Others can only afford the bare minimum and switch to the company offering the lowest-priced premium.

Since so many insurance companies offer similar services, accurately pricing your premiums is vital. Insurance companies use analytics to model their prices and remain competitive. They can also use consumer data to offer policies to customers based on the individual customer's budget.

Assess Risk

To be profitable, insurance companies must diversify their risk. To assess each client's risk, insurance companies verify their customer's information and use this to group customers into different segments based on their risk.

Assessing risk was a long process in the past, and the results could be iffy. With analytics, the process of analyzing customer information and assessing their risk is much more efficient. The process is also more accurate as companies use predictive modeling to identify possible risks.

Detect and Prevent Fraud

The insurance industry faces a large amount of fraud. Fraud affects not only the insurance company but also customers. If a company becomes a victim of fraud, they are forced to push up the prices of their premiums to make up for the loss, and ultimately, their clients suffer from having to pay a higher premium.

Insurance companies use data analytics to reduce attempted fraud. These tools allow them to analyze clients' data and compare them to past fraudulent profiles. This way, they can identify possible fraudsters or flag suspicious clients for further investigation.

|

Learn about the top 10 features of embedded business intelligence. |

Reduce Costs

Labor, particularly skilled labor, is expensive. Since the insurance industry is super competitive, companies need to find ways to reduce costs to stay in business. In the past, insurance was a very labor-intensive industry where brokers spent hours on each client and claim.

Technology has changed this, and the use of analytics has reduced the number of hours spent on typically manual processes like managing claims, price modeling, and administration. Since these processes are not automated and cheaper to perform, insurance companies can offer lower premiums and attract more clients.

Customer Self Service

While good customer service and speaking to a real person are important to some, many tech-savvy people prefer the convenience and efficiency of managing their policies themselves at any part of the day or night.

To this end, self-servicing policies are becoming more popular and a significant innovation successfully implemented in the insurance industry. A customer portal allows clients to access their policies and manage them independently. This is a win-win for companies and clients. It frees up insurance brokers' time and enables clients to manage their policies whenever it suits them.

The self-service portal also provides valuable customer information to insurance companies. Companies can use technology to monitor how clients manage their policies and use this information to offer clients additional cover or services when buying new policies or renewing existing ones.

Manage Claims

Insurance brokers spend a significant amount of time managing and processing claims. Before a claim is paid out, insurance companies must verify that it is legitimate.

Even before managing a claim, insurance companies use data analysis during the underwriting stage to analyze customer data and look for any potential discrepancies. When a client files a claim, it is easy for the company to establish if it is legitimate.

This process saves the insurance company time and allows claims to be paid out quickly. Quick payouts mean happy, satisfied customers.

Benefits of Analytics for Insurance Providers

Data analytics is helpful in the insurance industry as it allows for processes to be automated and gives companies access to valuable consumer information. Insurance companies that use data analytics are better at making sound decisions quickly and attracting new customers by offering them policies that suit their needs.

These companies can also better satisfy their customers as they already know their customers' needs and can react early when customers are unsatisfied. Happy customers act as a great marketing tool - word of mouth. Satisfied clients often refer their friends and family, which leads to more clients buying policies.

Another significant benefit of using analytics is that it aids in business growth. For an insurance company to grow, it must be able to quantify its risk. Previously, identifying the risk involved looking at history and taking into account estimations and intuition, which isn't very scientific or accurate. With technology, insurance companies analyze data to reduce risks, mitigate losses and accelerate growth. |

View live interactive examples in InetSoft's dashboard and visualization gallery. |

15 Key Performance Indicators (KPIs) That Are Specific to the Insurance Industry

Key Performance Indicators (KPIs) are used to measure the performance and efficiency of an insurance company. The information from KPIs is invaluable in assisting insurance companies to identify areas they succeed in and areas that require more work, focus, and resources. The most common KPIs include:

Quote Rate

Quote rates are fundamental in an industry where speed and exceptional service can make or break the business. A quote is usually a potential client's first interaction with an insurance company, so it must be accurate and sent timeously.

A quote rate looks at how many quotes an insurance broker compiled and supplied compared to the number of leads they contacted.

Cost per Quote

When shopping for insurance, people seek to get a few quotes before selecting one company to do business with. Since a quote doesn't guarantee a sale, it makes good business sense to keep the cost of quotes as low as possible while still being efficient.

To get an idea of how much it costs to generate each quote, add up all the expenses that go into generating a quote. These should include time, labor, materials, and any other resources.

High costs could point to inefficient quote processes, which could result in potential clients choosing to work with another company.

|

Read why choosing InetSoft's cloud-flexible BI provides advantages over other BI options. |

Number of Referrals

Referrals are an excellent way to secure new business as the marketing costs are zero. Also, referrals indicate that customers are happy and satisfied with the company's service since they referred their family or friends.

Knowing how many people were referred to the business also helps identify how much of the company's growth is organic compared to growth driven by marketing. Typically, insurance companies look at how many of the total number of new clients were referred by existing clients.

Quota Rate

Even more critical than the quote rate since it directly links to revenue. The quota rate measures whether or not the insurance broker reaches its sales target.

While it's good for insurance brokers to be challenged, their sales target must also be realistic. If it's too low, the company is missing out on potential business. But if it's too high, insurance brokers can feel that it's unattainable, which can be demotivating.

New Policies per Agent

The New Policies per Agent metric lets you track the individual performance of each insurance broker in your company.

Most companies monitor how many new policies every agent signs weekly and monthly. Individual performance is then compared against other brokers in the company as well as brokers from competitor companies. This data is then used to set goals and identify training opportunities to improve sales.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Cost per Application

The cost per application calculates how much it costs to process each new insurance application. While essential to growing the business, capturing and processing new applications can be expensive.

Some reasons that increase the cost of new applications include a large number of manual entries that are usually not standardized, quotes generated incorrectly, and unproductive staff.

A good way to cut down on expenditure is to find ways to automate the process, which cuts down opportunities for human error. If automation is not an option, companies should look for ways to simplify and standardize the process. Additionally, insurance employees should be given extensive training.

Underwriting Cycle Time

Another KPI that measures efficiency, insurance companies must keep track of how long it takes an underwriter to process a policy application. The entire length of time must be measured in business days from when the application was submitted to when a formal decision was made.

Looking at the underwriting cycle time will help the company to identify underwriters who are unproductive. When dealing with unproductive underwriters, consider the reasons for this. Often, customer information is missing or collected inefficiently, which delays the underwriting process.

Claims Employees per 1000 Reported Claims

The Claims employees per 1000 reported claims KPI gives you an indication of whether you have enough or too little staff in relation to the workload. If the value of the KPI is high, it could mean that you have more employees than you need. If it's too low, it could mean employees are stretched.

If the number is high, but employees feel their workload is heavy, it could signal that processes are inefficient or employees are just not productive. Find ways to streamline the claims process, automate some functions and offer more training.

Average Cost per Claim

A major part of any insurance company is about paying claims - this is why they are in business but paying claims is an expense. Knowing how much the average claim costs helps insurance companies price premiums and estimate their financial performance.

Ideally, insurance companies want the cost per claim to be low. To work out the average cost per claim, companies total the value of all the claims they received and paid out and divide that number by the number of claims.

Average Policy Size

Knowing the average size of each policy helps companies to manage risk. It may seem more manageable and efficient for an insurance company to have a few large policies as this means there are fewer clients to service. But having a few big policies is far riskier than many small policies because it's a lot cheaper and better for the business to pay out small claims than a big one.

To work out the average policy size, divide the total amount of all the premiums by the total number of policies.

Learn how InetSoft's data intelligence technology is central to delivering efficient business intelligence. |

Expense Ratio

This KPI tells insurance companies how much it costs them to earn one dollar and it's a relatively good indicator of how efficient the company is and whether it will enjoy long-term success.

The amount of money going out of an insurance company can quickly be more than the amount that comes in without anyone noticing. Hence, it's vital for the company to be aware of the expense ratio.

The calculation to work out the expense ratio is simple: divide the total amount of expenses by the total revenue.

Loss Ratio

Another financial KPI, the loss ratio, looks at the amount of money the company pays out in claims in comparison to the money collected in premiums. Ideally, the money coming into the company in the form of premiums must be higher than the amount paid out for claims.

If the opposite is true, and the company pays out more than they get in, it could mean that they are assessing risk incorrectly or the price of their premiums is too low.

While it's normal for an insurance company to occasionally pay out more than they get in, this should be the expectation rather than the norm, or they will soon be out of business.

|

Learn how InetSoft's native big data application is specifically designed for a big data operating system. |

References

- Duckcreek: 11 Ways Predictive Analytics in Insurance Will Shape the Industry in 2022

- Damcogroup: Five Benefits of Data Analytics in Insurance

- Xenonstack: Data Analytics in Insurance

- Outsource2india: 6 Ways Data Analytics Transformed the Insurance Industry

- Opsdog: 6 Key Performance Indicators Every Insurance Manager Should Know

- Spiderstrategies: Finance and Insurance KPIs