| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index |

|

Read More |

Accuracy Metrics

Payroll processing accuracy is crucial, and dashboards monitor it using indicators like data reconciliation, mistake rates, and tax compliance. Organizations may ensure compliance requirements are fulfilled and employee compensation is accurate by keeping an eye on accuracy KPIs and taking timely corrective action when differences are discovered.

Timeliness and Compliance

Payroll accuracy is essential for both regulatory compliance and employee happiness. Dashboards track important parameters such processing time, deadlines for submissions, and compliance with tax laws. Organizations may avoid fines, maintain regulatory compliance, and guarantee on-time salary payments with the use of this real-time monitoring.

Employee Productivity and Engagement

Payroll dashboards explore employee productivity and engagement in addition to standard measures. Organizations may cultivate a proactive approach to people management by gaining insights into worker dynamics via measures like as attendance patterns, overtime trends, and performance-related incentives.

Cost Efficiency and Budget Compliance

A major consideration in payroll administration is cost effectiveness. Dashboards monitor labor costs, operating expenditures, and budget adherence. With the use of this data, firms may better allocate resources, spot areas for cost savings, and make sure payroll procedures follow overall financial objectives.

Turnover Analysis

Although employee turnover is a normal part of company, it may have a big effect on payroll. Payroll dashboards examine expenditures related to turnover, reasons for leaving, and rates of turnover. This makes it possible for businesses to see patterns, put retention plans into action, and handle the financial effects of staff turnover..

|

“Flexible product with great training and support. The product has been very useful for quickly creating dashboards and data views. Support and training has always been available to us and quick to respond.

- George R, Information Technology Specialist at Sonepar USA

|

Benefit Utilization

Benefits for employees are included in total pay packages, and benefit use numbers are tracked via dashboards. These analytics provide a thorough grasp of benefit consumption trends, assisting in strategic decision-making for employee welfare ranging from healthcare costs to retirement contributions.

Tax Efficiency and Compliance

The laws governing taxes are complex and dynamic. Payroll dashboards keep businesses competitive by tracking tax compliance parameters including withholding tax accuracy, timely return submission, and conformity to legislation changes. By being proactive, the likelihood of fines and legal issues is reduced.

Integration with HR Systems

Data consistency depends on the HR and payroll systems integrating seamlessly. Dashboards monitor integration indicators to guarantee smooth system-to-system transfer of personnel data. This improves overall operational effectiveness, lowers data inaccuracies, and offers a comprehensive perspective on personnel management.

Data Security and Confidentiality

One of the main concerns in payroll administration is data security. Dashboards keep track of incidences of illegal access, encryption techniques, and access limits. Organizations may see any weaknesses and take preventative action to protect sensitive payroll data by monitoring these security KPIs.

Mobile Accessibility and User Experience

Current payroll dashboards place a high value on accessibility and user experience. Metrics pertaining to user comments, interface responsiveness, and mobile use help to improve our comprehension of the dashboard's overall usability. Payroll specialists will be able to use the system more effectively as a result, increasing productivity.

Predictive Analytics for Future Planning

Payroll dashboards use predictive analytics in addition to historical data. Organizations may anticipate changes in workforce size, compensation structures, and compliance requirements by proactively planning for them via trend and pattern analysis and payroll needs forecasting. The use of this prospective perspective improves strategic decision-making.

Leave and Absence Management

To ensure staff continuity, leave and absence management must be done effectively. Payroll dashboards monitor data pertaining to accumulated leave, utilization trends, and adherence to leave regulations. Organizations may use this data to manage personnel numbers, minimize interruptions, and make sure labor rules are followed.

Employee Demographics

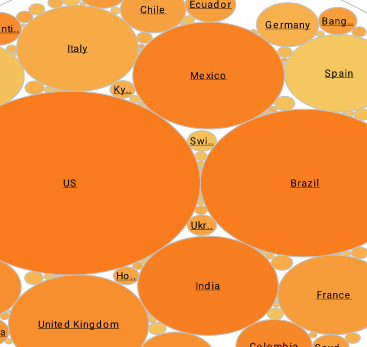

Comprehending the workforce's demographics is vital for devising focused pay tactics. Payroll dashboards examine the age, length of service, and job responsibilities of employees to provide information on fair pay, succession planning, and conformity to industry norms.

Garnishments and Deductions

The effect of garnishments and other deductions on net pay may be substantial. Payroll dashboards track data pertaining to deductions such as child support, garnishments, and other amounts. By ensuring correct accounting and adherence to legal regulations, this helps to avoid financial irregularities and legal problems.

Training and Certification Tracking

Payroll dashboards monitor certification indicators and staff training for companies with strict certification requirements. This guarantees that workers get fair compensation for earning and keeping certificates, coordinating payroll procedures with efforts to promote skill development.

Cost of Turnover

It's important to comprehend the financial effect of employee departures in addition to turnover rates. Payroll dashboards include in lost productivity, training costs, and recruiting costs when calculating the cost of turnover. This KPI aids businesses in estimating the real cost of staff churn and creating mitigation plans.

Employee Satisfaction Surveys

Retention and productivity are directly impacted by employee happiness. Payroll dashboards include data from polls of employee happiness, offering insights into the ways in which payroll procedures influence work satisfaction in general. The link between employers and employees is strengthened and payroll procedures are improved with the use of this information.

Time and Attendance Variance

Precise payroll processing depends on precise time and attendance recording. Dashboards compare planned and actual hours spent to track variations in time and attendance. This KPI aids in finding disparities, managing labor expenses, and improving workforce management techniques.

Bonus and Incentive Program Effectiveness

In order to inspire staff, several businesses run bonus and incentive schemes. Payroll dashboards analyze indicators like accomplishment rates, payment accuracy, and the influence on overall employee performance to assess how successful these programs are. The optimization of incentive structures for greatest effect is guided by this knowledge.